Analytici Barclays tento týden ve své zprávě zdůraznili, že počet nelegálních přistěhovalců v USA dosáhne v roce 2024 přibližně 17 milionů, což je nejvyšší hodnota od roku 2010. Analytici banky však uvádějí, že jsou „páteří klíčových odvětví“.

Barclays uvedla, že tito pracovníci tvoří pouze 7 % celkové pracovní síly, v klíčových odvětvích, jako je rostlinná výroba a stavebnictví, tvoří 20-30 %.

Banka odhaduje, že v letech 2021-2024 vstoupí do USA 8,4 milionu nových nelegálních přistěhovalců, což ekonomice přidá 5,2 milionu pracovníků, přičemž údaje vycházejí z kombinace údajů z průzkumu American Community Survey (ACS) a vlastního sledování imigrace společností Barclays.

Zpráva upozorňuje na odvětví, která jsou nejvíce závislá na práci nelegálních přistěhovalců, a uvádí, že „ačkoli nelegální přistěhovalci tvoří pouze 7 % pracovní síly v USA, naše analýza ukazuje, že v konkrétních odvětvích hrají významnou roli“.

Trade Breakdown and Trading Tips for the Japanese Yen

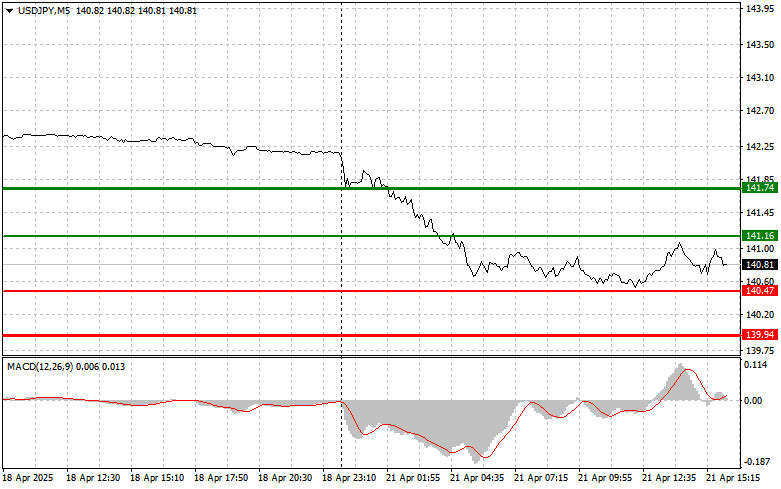

The first test of the 140.62 price level occurred when the MACD indicator had already fallen significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the dollar. The second test of 140.62 happened when MACD was recovering from the oversold zone, which activated Scenario #2 for buying and led to a more than 30-point rise in the pair.

Today's U.S. Leading Indicators data is unlikely to significantly alter the bearish market trend, so any upward move in USD/JPY can be viewed as a potential selling opportunity. Elevated volatility, driven by tensions over Trump's trade policy and uncertainty regarding the future path of interest rates, is causing investors to act cautiously and minimize risk. This adds further pressure to USD/JPY, which has historically been sensitive to changes in global risk sentiment. Technical analysis also confirms the prevailing bearish mood.

For the intraday strategy, I will focus on executing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today at the 141.16 entry point (green line on the chart) with a target at 141.74 (thicker green line). Around 141.74, I will exit long trades and open short positions in the opposite direction, aiming for a reversal of 30–35 points. A sustained rise in the pair is unlikely today. Important! Before entering a buy trade, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I will also consider buying USD/JPY if there are two consecutive tests of 140.47 while MACD is in the oversold zone. This will limit the pair's downward potential and trigger a bullish reversal. Expect growth toward the opposite levels of 141.16 and 141.74.

Sell Signal

Scenario #1: I plan to sell USD/JPY after a breakout below 140.47 (red line on the chart), which could lead to a swift drop in the pair. The key target for sellers will be 139.94, where I will exit short positions and immediately consider entering long trades (for a 20–25 point rebound). Pressure on the pair can return at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I will also consider selling USD/JPY if there are two consecutive tests of 141.16, while the MACD is in the overbought zone. This will cap the pair's upward potential and lead to a downward reversal. Expect a decline toward the opposite levels of 140.47 and 139.94.

Chart Legend:

Important Notes for Beginner Forex Traders

New traders should exercise extreme caution when entering the market. It's best to stay out of the market before major fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to limit potential losses. Trading without stop-loss orders can quickly wipe out your account, especially if you don't use proper money management and trade large volumes.

Remember, successful trading requires a solid trading plan, such as the one outlined above. Making spontaneous trading decisions based on current market noise is typically a losing strategy for intraday traders.

RÁPIDOS ENLACES