Trade Breakdown and Tips for Trading the British Pound

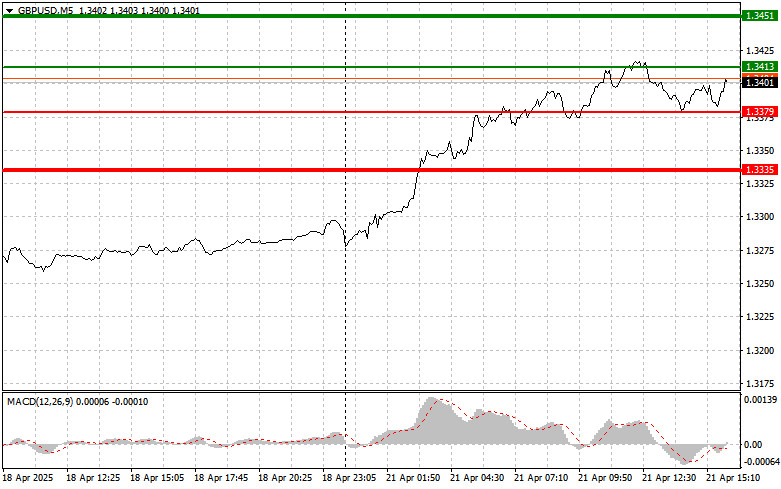

The price test at 1.3399 coincided with the MACD beginning to rise from the zero line, confirming a valid entry point. Considering how actively the pair climbed during Asian trading, the chances for further growth in GBP/USD were quite high. In the end, the move was limited to just 15 points before demand subsided.

The absence of news from the UK allowed the pound's growth to continue, which was expected in such a bullish market. However, it's important to remember that the absence of news is only a temporary factor. Once new economic data appear—whether on inflation, employment, or manufacturing—the market may react quickly and unpredictably. Investors should remain vigilant and avoid basing decisions solely on current momentum.

Perhaps today's speech by Chicago Federal Reserve President Austan Goolsbee will offer valuable insight into how FOMC members view the future path of interest rates. Traders will closely analyze any hints as to whether Goolsbee leans hawkish or dovish, and which factors he considers key in shaping monetary policy. The release of the Leading Indicators Index is traditionally seen as a forecast of future U.S. economic activity. A decrease may point to slowing growth, while an increase suggests potential acceleration.

As for intraday strategy, I will focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the entry point of 1.3413 (green line on the chart) with a target of rising to 1.3451 (thicker green line). Around 1.3451, I will exit long trades and consider shorting in the opposite direction, targeting a move of 30–35 points from the entry. Continued pound growth is expected today. Important! Before buying, make sure the MACD is above the zero line and just beginning to rise.

Scenario #2: I will also consider buying the pound today in case of two consecutive tests of 1.3379, when the MACD is in the oversold zone. This would limit the pair's downward potential and trigger a bullish reversal. Expect growth toward opposite levels of 1.3413 and 1.3451.

Sell Signal

Scenario #1: I plan to sell the pound after an update of the 1.3379 level (red line on the chart), which could lead to a quick decline. The primary target for sellers will be 1.3335, where I plan to exit short trades and immediately switch to long positions (targeting a 20–25 point reversal). Sellers are likely to show up, but probably not aggressively. Important! Before selling, make sure the MACD is below the zero line and just beginning to fall.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of 1.3413, while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a bearish reversal. Expect a decline toward opposite levels of 1.3379 and 1.3335.

Chart Legend:

Important for Beginner Forex Traders

Beginner traders must be extremely cautious when entering the market. Before important fundamental data releases, it's best to stay out of the market to avoid being caught in sharp price swings. If you choose to trade during news events, always place stop-loss orders to limit potential losses. Trading without stop-losses can quickly wipe out your entire deposit, especially if you don't practice sound money management and trade large positions.

And remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decisions based on current price action are typically a losing strategy for intraday traders.

RÁPIDOS ENLACES