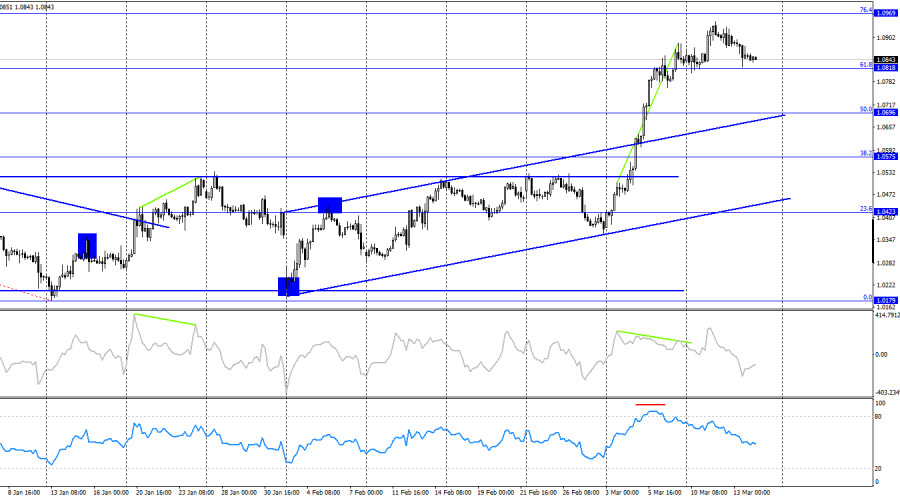

On Thursday, the EUR/USD pair continued its decline and consolidated below the 200.0% corrective level at 1.0857. This suggests that the downward movement could extend toward the next support zone at 1.0781–1.0797, as well as the 161.8% Fibonacci level at 1.0734. A break above 1.0857 would indicate a potential reversal in favor of the euro, leading to a renewed uptrend toward 1.0944.

The wave structure on the hourly chart has changed. The last completed downward wave broke below the previous low, while the last upward wave broke above the previous peak, indicating that a bullish trend is forming. However, the current impulsive growth is largely driven by concerns over a U.S. economic slowdown due to Donald Trump's policy measures. This appears to be the primary reason for the recent weakness of the U.S. dollar.

Thursday's fundamental background was mixed, as was traders' reaction. The market is currently paying little attention to economic data, focusing instead on the broader outlook for the U.S. and global economy. While a rise in Eurozone industrial production is a positive factor, it is not enough to sustain further euro growth at this time. Similarly, a decline in the U.S. Producer Price Index (PPI) is also favorable, but the dollar requires stronger, more significant economic data to regain momentum.

The key market driver remains U.S. President Donald Trump, who yesterday suggested the possibility of taking Greenland by military force. He also claimed that the entire world is exploiting America and that it is time to change that. As a result, we can expect many major geopolitical events in the near future—but unlike economic reports, these developments do not appear on the calendar. News could emerge unexpectedly, and traders' reactions may be just as unpredictable.

On the four-hour chart, the bullish trend continues, with the pair maintaining an uptrend after breaking out of a horizontal channel. The ascending trend corridor confirms this bullish sentiment. A break above the 61.8% Fibonacci level at 1.0818 could lead to further gains toward the 76.4% Fibonacci level at 1.0969.

At the same time, a bearish divergence on the CCI indicator and overbought conditions on the RSI signal that the pair may be ready for a correction, though bears have been attacking very weakly. A break below 1.0818 would indicate a possible decline toward 1.0696.

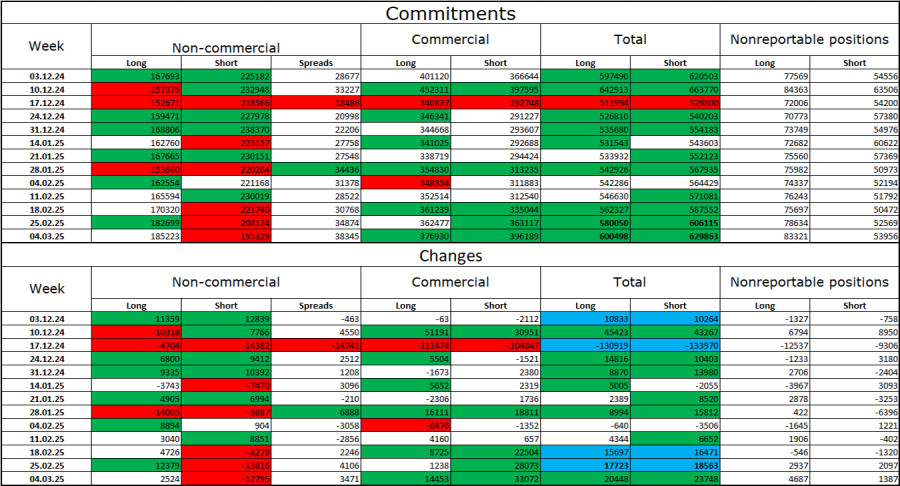

During the latest reporting week, professional traders opened 2,524 long positions and closed 12,795 short positions. The sentiment among Non-commercial traders remains bearish, but it has been weakening recently.

The total number of long positions among speculators now stands at 185,000, while short positions amount to 195,000.

For twenty consecutive weeks, large investors were selling the euro, confirming a bearish trend with no signs of reversal. The divergence in monetary policy between the ECB and the Federal Reserve still favors the U.S. dollar, as the interest rate differential remains in the dollar's favor. While the bearish advantage is starting to erode, it is too early to declare the downtrend over.

Interestingly, the number of long positions has been increasing for five consecutive weeks, coinciding with Donald Trump's presidency—a development worth noting.

On March 14, the economic calendar includes two events, but both are low-impact. The overall market sentiment on Friday is likely to be minimally influenced by fundamental data.

Selling the pair is possible if EUR/USD consolidates below 1.0857 on the hourly chart, with targets at 1.0797 and 1.0734.

Buying opportunities exist, but the strong and uninterrupted rally remains concerning. I remain cautious about such one-sided movements, as they often signal potential market reversals or corrections.

Fibonacci levels are drawn from 1.0529–1.0213 on the hourly chart and from 1.1214–1.0179 on the four-hour chart.

RÁPIDOS ENLACES