There will be no lifeline. The S&P 500 continues to send distress signals, but Donald Trump is not paying attention or at least pretends not to. In one of his speeches, the US president stated that he did not care about what was happening in the American stock market because, in the long run, the economy would strengthen, so investors had nothing to worry about. On another occasion, the Republican claimed that globalists were behind the stock market sell-off, accusing them of being envious of the United States.

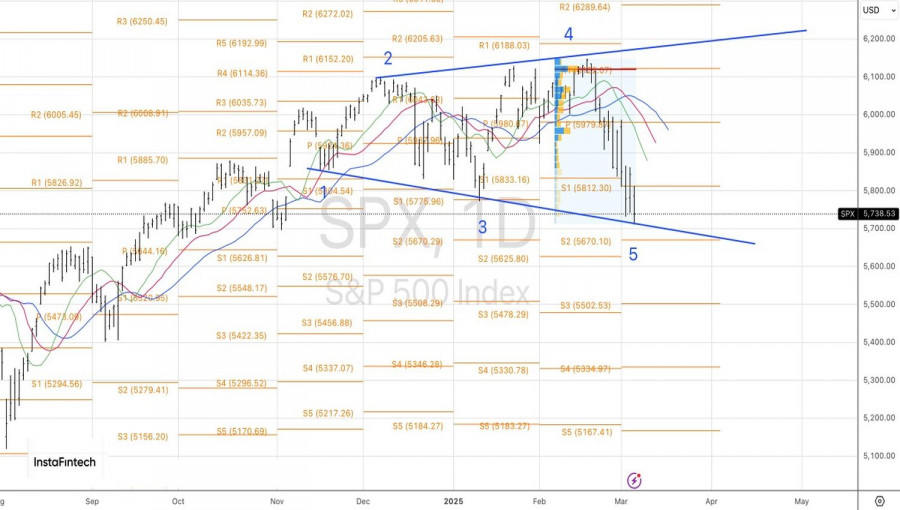

US Stock Market Trends

A scapegoat can always be found. For Donald Trump, it is once again China. Beijing was blamed for the COVID-19 pandemic, and now it is accused of triggering the US stock market's decline. The story of China's DeepSeek was the catalyst for investors fleeing American tech stocks. It is no surprise that the Magnificent Seven were the first to enter correction territory, followed by the Nasdaq 100. Now, a 10% drop in the S&P 500 from its February highs seems inevitable.

Trump's theory about globalists deserves attention. However, the record highs in stock indexes after the US presidential election were driven by hopes for economic acceleration and the assumption that the White House would act as a safety net for the S&P 500 in case of a steep decline. Neither of these expectations is materializing.

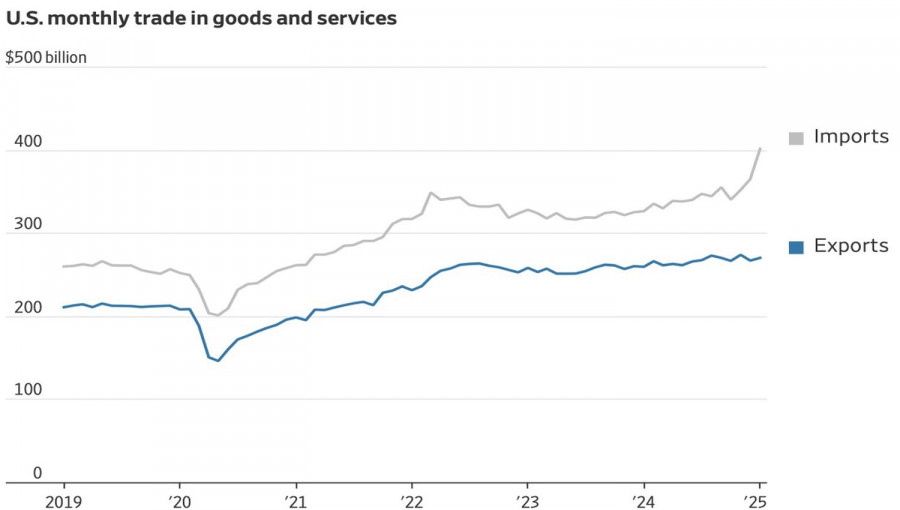

The more economic data comes in, the more concerns grow about the US economy. The disappointing February ADP employment report was followed by bleak trade balance figures. The front-loading of imports ahead of Trump's tariff hikes led to a record US trade deficit in January—34% higher than in December.

US Trade Balance

Net exports may drag down GDP growth, making the Atlanta Fed's forecast of a US economic contraction in the first quarter increasingly realistic. The urge to offload toxic US assets is rising, leaving the S&P 500 with little choice but to fall.

News that the White House exempted some goods from the 25% tariffs under the North American Free Trade Agreement (NAFTA) did not provide lasting relief. The exemption covers 50% of imports from Mexico and 38% from Canada. The S&P 500 briefly rebounded but quickly resumed its decline. Without White House support, whether against globalists' alleged manipulations or fears of an approaching recession, the US stock market has little chance of recovery.

Technically, on the S&P 500 daily chart, the Broadening Wedge pattern has been activated based on the Three Indians pattern. Point 5 could be located significantly lower. As long as the broad-market index trades below 5,800, selling remains the preferred strategy.

RÁPIDOS ENLACES