The designated levels I set yesterday were not tested in the second half of the day.

The recent sharp decline in the dollar, triggered by weak U.S. housing market data and a strengthening yen, was to be expected. Lower American economic figures are likely to prompt Federal Reserve officials to discuss the need for additional interest rate cuts more frequently. In contrast, the Bank of Japan is pursuing a completely different approach by seeking to tighten monetary conditions.

In this environment, investors are reassessing their positions and favoring the yen, which appears increasingly attractive due to anticipated rate hikes. Conversely, demand for U.S. assets is waning, putting further pressure on the dollar. However, the long-term outlook for the dollar remains complex. Despite indicators of a slowdown, the U.S. economy is still relatively strong, and the Federal Reserve is expected to proceed cautiously to avoid triggering a recession. Furthermore, any rate hikes in Japan may end up being less significant and occur more slowly than currently anticipated, which could dampen enthusiasm for the yen.

As a result, we will likely see continued volatility in the currency markets soon, with the dollar-yen dynamics driven by expectations of monetary policy changes from both central banks and the overall state of the global economy. Traders should closely monitor economic data and statements from Fed and BOJ officials to react quickly to changes in market conditions.

Regarding intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

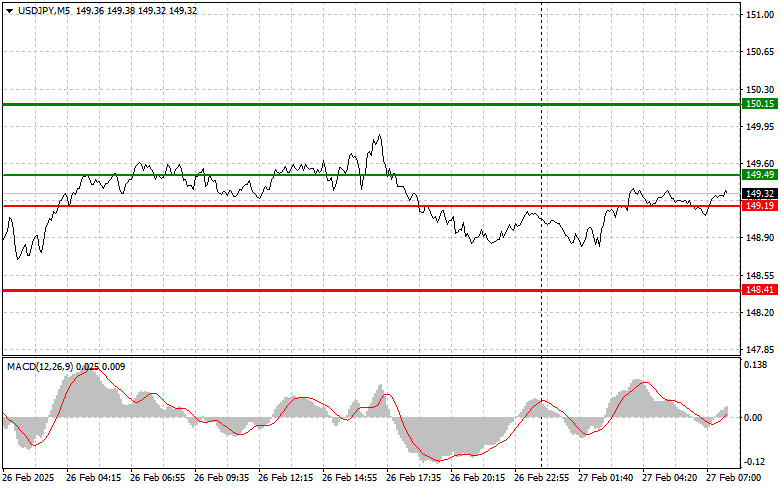

Scenario #1: I plan to buy USD/JPY today if the entry point reaches around 149.49 (green line on the chart), with a target of 150.15 (a thicker green line on the chart). Around 150.15, I plan to exit purchases and open short positions in the opposite direction, expecting a move of 30-35 pips downward. It is best to return to buying the pair during pullbacks and significant declines in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 149.19 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Growth can be expected towards the opposite levels of 149.49 and 150.15.

Scenario #1: I plan to sell USD/JPY today only after breaking below the 149.19 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 148.41, where I plan to exit short positions and immediately open long positions in the opposite direction, expecting a move of 20-25 pips upward. Pressure on the pair can return at any moment. Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 149.49 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 149.19 and 148.41.

RÁPIDOS ENLACES