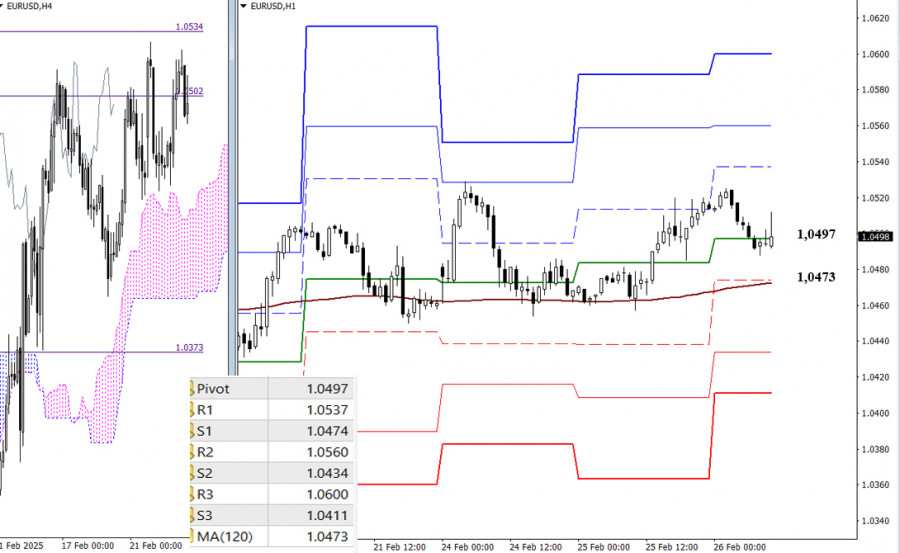

At the start of the workweek, bullish players strive to achieve new results but clearly lack strength. Today, the daily cloud boundary has shifted, attempting to move out of the bulls' way, clearing a path toward the cluster of resistances from the highest timeframes in the 1.0575 – 1.0598 range. If the bulls fail to hold their gains and continue the upward movement, their opponents will regain their positions, with the nearest support being the daily short-term trend at 1.0465.

The pair is in a corrective zone on the lower timeframes, but the overall advantage remains on the bulls' side. A few hours ago, they began testing the strength of the daily central Pivot level support at 1.0497, with the next challenge being the weekly long-term trend at 1.0473. A breakout of these key levels would shift the balance of power in favor of strengthening bearish sentiment. Additional intraday movement targets include supports at 1.0434 – 1.0411 and resistances at 1.0537 – 1.0560 – 1.0600, based on classic Pivot levels.

***

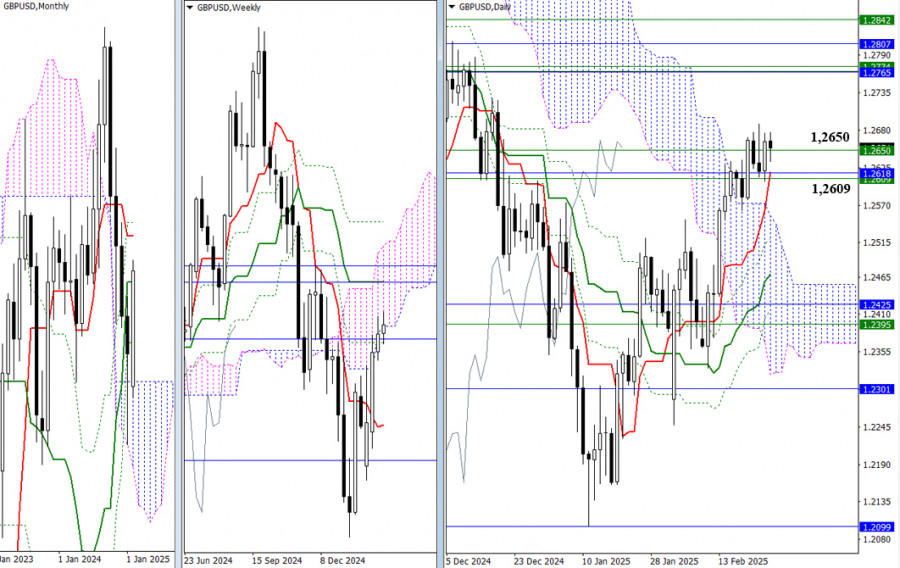

Currently, the daily timeframe is forming a consolidation. The market is struggling against the pull and influence of several strong Ichimoku levels, which have converged around 1.2650 – 1.2609. To shift the sentiment, the pound must exit this zone and consolidate above or below it. If the bears take control, they can slide down through the daily cloud, starting from 1.2553 (the upper cloud boundary today). Conversely, the bulls will aim for the resistance zone with a lower boundary around 1.2765.

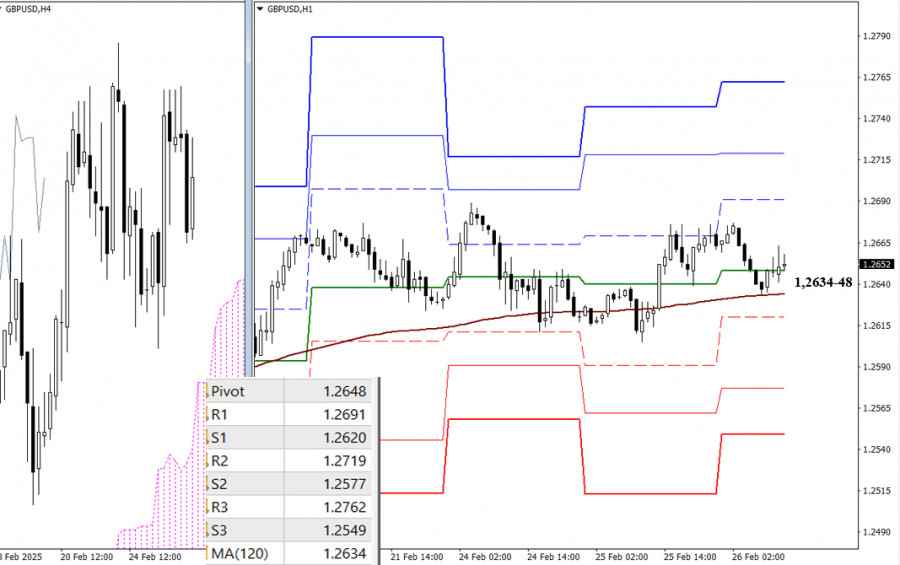

In the lower timeframes, the bulls maintain an advantage, but it is evident that they are struggling, repeatedly relying on key-level support. Today's key levels are 1.2648 (the daily central Pivot level) and 1.2634 (the weekly long-term trend). The prevailing condition is uncertainty. A breakout from this indecisive range and the development of a directional movement will shift focus to other targets on the lower timeframes. For the bears, these targets will be the classic Pivot level supports at 1.2620 – 1.2577 – 1.2549, while for the bulls, they will be the resistances at 1.2691 – 1.2719 – 1.2762.

***

RÁPIDOS ENLACES