The test of 150.25 earlier in the day occurred when the MACD indicator had already moved significantly below the zero level, limiting the pair's downward potential. As a result, I did not sell the dollar at that moment.

Given the recent statements by the Bank of Japan Governor that bond yields should not experience significant fluctuations and the market's reaction to these remarks, betting on a weaker USD/JPY toward the end of the week is not the best approach. Additionally, upcoming positive U.S. data on the Manufacturing PMI and Services PMI could further support the dollar, reinforcing the correction that started during today's Asian session. Furthermore, data on existing home sales and the University of Michigan Consumer Sentiment Index should not be overlooked.

For today's trading session, I will primarily rely on Scenario #1 and Scenario #2.

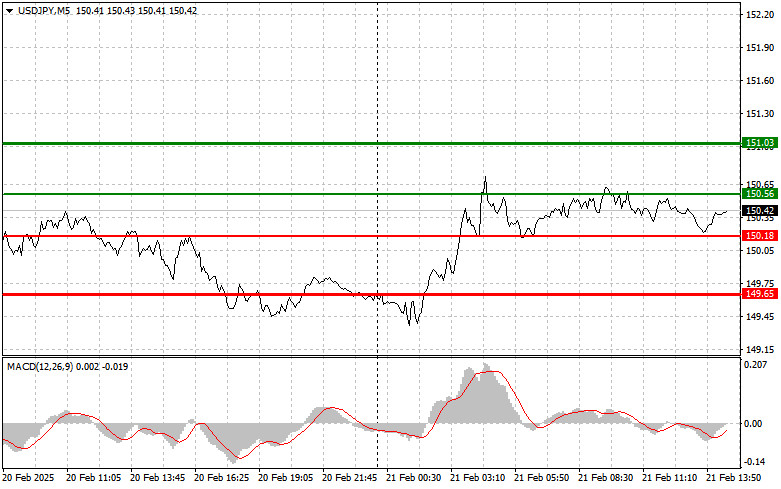

Scenario #1: Buy USD/JPY at 150.56 (green line on the chart) with a target of 151.03. At 151.03, I plan to exit long positions and sell the pair, expecting a 30-35 point pullback.The pair's rise will depend on strong U.S. economic data.Important! Before buying, ensure the MACD indicator is above the zero level and just starting to rise.

Scenario #2: Another buying opportunity arises if USD/JPY tests 150.18 twice, with MACD in the oversold zone. This will limit downward potential and trigger a reversal toward 150.56 and 151.03.

Scenario #1: Sell USD/JPY if it breaks below 150.18 (red line on the chart), targeting 149.65, where I will exit short positions and immediately buy in the opposite direction, expecting a 20-25 point rebound.Sellers will gain momentum if U.S. data disappoints.Important! Before selling, ensure the MACD indicator is below the zero level and just starting to decline.

Scenario #2: Another selling opportunity arises if USD/JPY tests 150.56 twice, with MACD in the overbought zone. This will limit the pair's upward potential and trigger a reversal toward 150.18 and 149.65.

Chart Explanation

RÁPIDOS ENLACES