The euro, pound, and other risk assets have resumed growth, while the U.S. dollar has lost all its strength. The U.S.'s active efforts to resolve the Russia-Ukraine conflict and reduce geopolitical tensions are only fueling risk appetite.

The U.S. labor market report was mixed, but positive news regarding the resolution of the Russia-Ukraine conflict led to increased purchases of the euro, pound, and Australian dollar yesterday. The euro also showed resilience due to ongoing concerns about rising inflation in the eurozone, which may force the European Central Bank to postpone its interest rate-cutting policy in the long term. However, short-term currency fluctuations will rely on new economic data and geopolitical developments.

Today, several PMI indices for eurozone countries are expected to be released. These indices, especially the composite PMI, are important leading indicators of the eurozone's economic health. Readings above 50 indicate economic expansion, while readings below 50 suggest contraction. Strong PMI values, which reflect economic growth, typically enhance the euro's attractiveness to investors. Conversely, weak PMI values may lead to euro depreciation due to concerns about economic slowdown and potential monetary easing by the ECB. Additionally, it's important to consider the difference between actual PMI readings and market expectations.

Regarding the pound, there is considerable potential for further bullish momentum, especially if today's PMI data suggests a relatively stable state for the UK economy. If the data aligns with economists' expectations, it's advisable to follow a Mean Reversion strategy. However, if the data significantly surpasses or falls short of these expectations, a Momentum strategy would be more appropriate.

Buying on a breakout above 1.0512 may lead to euro growth toward 1.0554 and 1.0593.

Selling on a breakout below 1.0475 may push the euro down to 1.0441 and 1.0404.

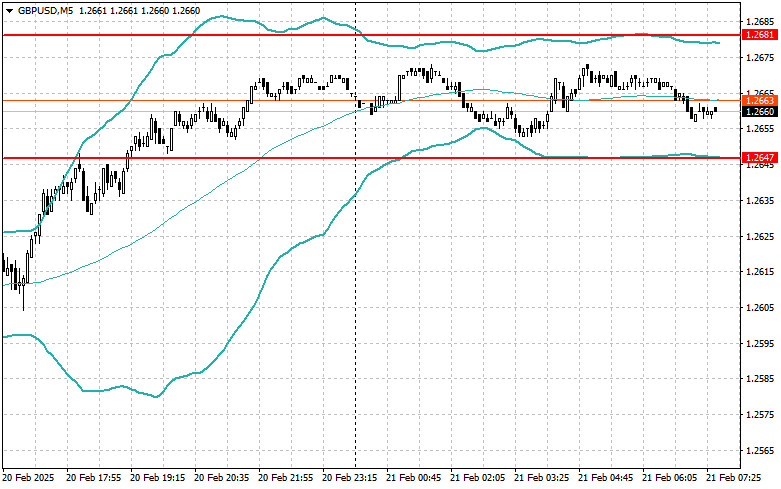

Buying on a breakout above 1.2683 may drive the pound up to 1.2718 and 1.2761.

Selling on a breakout below 1.2640 may lead to a decline toward 1.2600 and 1.2563.

Buying on a breakout above 150.40 may result in dollar growth toward 150.70 and 151.05.

Selling on a breakout below 150.10 may trigger a sell-off toward 149.80 and 149.60.

I will look for sell opportunities after an unsuccessful breakout above 1.0515, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.0480, upon a return to this level.

I will look for sell opportunities after an unsuccessful breakout above 1.2681, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.2647, upon a return to this level.

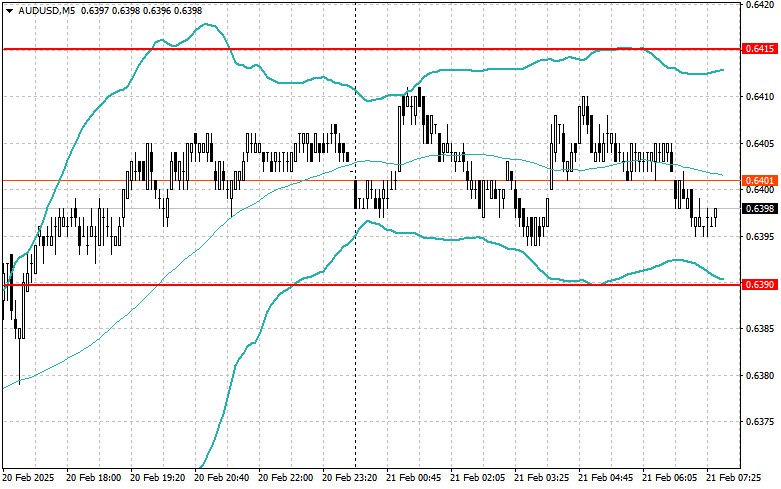

I will look for sell opportunities after an unsuccessful breakout above 0.6415, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 0.6390, upon a return to this level.

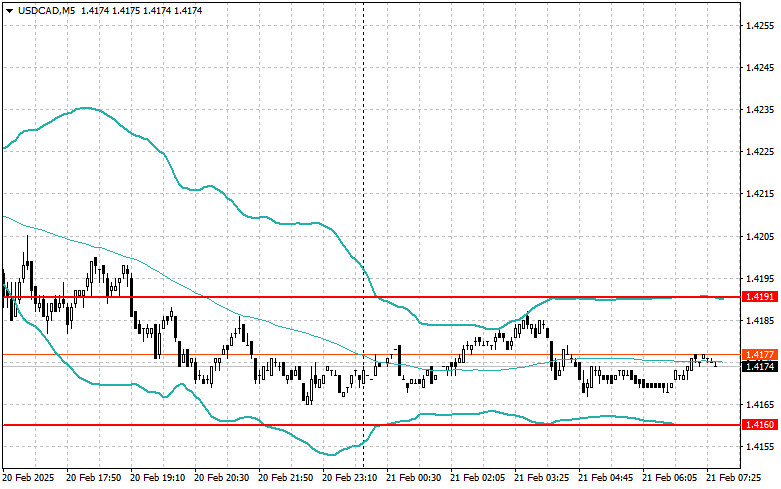

I will look for sell opportunities after an unsuccessful breakout above 1.4191, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.4160, upon a return to this level.

RÁPIDOS ENLACES