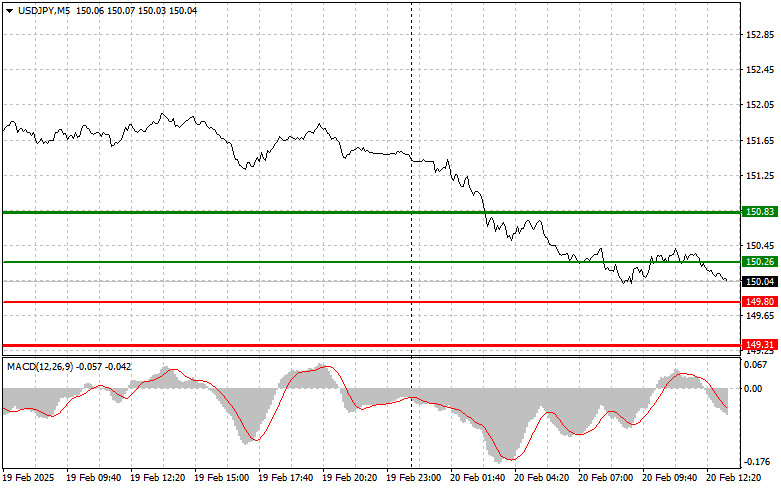

The first test of 150.03 occurred when the MACD indicator had already moved significantly downward from the zero mark, limiting the pair's downward potential. For this reason, I did not sell the dollar. The second test of 150.03 coincided with MACD entering the oversold zone, allowing Scenario #2 (buying) to materialize, resulting in a 40+ point gain.

Given the ongoing pressure on the dollar since the Asian session, it is unlikely that today's U.S. data will change the current market direction, but it's best not to rush to conclusions. The upcoming reports on U.S. jobless claims and the Philadelphia Fed Manufacturing Index will likely not trigger major market moves, particularly if they align with economists' forecasts.

Additionally, speeches by FOMC members Austan D. Goolsbee and Michael S. Barr are unlikely to offer any surprises beyond what was already revealed in yesterday's FOMC minutes. Thus, the market is not expected to react significantly to their comments.

Instead, their statements will likely reinforce the Fed's established stance—a wait-and-see approach, dependent on macroeconomic data. Particular attention will be given to their assessment of inflation and labor market conditions. Investors will likely focus on any hints regarding the future path of interest rates. Any signals suggesting a slower pace of rate cuts or a more aggressive policy stance could trigger short-term volatility.

For intraday trading, I will primarily focus on Scenarios #1 and #2.

Buy Signal

Scenario #1: Buying USD/JPY is possible at 150.26 (green line on the chart), targeting 150.83. At 150.83, I plan to exit long positions and sell USD/JPY in anticipation of a 30-35 point correction. A further rise in the pair is only likely after positive U.S. data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if the pair tests 149.80 twice, while the MACD is in oversold territory. This should limit the pair's downward potential and trigger a market reversal upward. The expected targets will be 150.26 and 150.83.

Scenario #1: Selling USD/JPY is advisable after the price drops below 149.80 (red line on the chart), which could lead to a rapid decline. The key target for sellers will be 149.31, where I plan to exit short positions and buy the dollar in anticipation of a 20-25 point correction. Sustained bearish pressure is only likely if FOMC members adopt a dovish tone. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY if the pair tests 150.26 twice, while the MACD is in overbought territory. This will limit the upward potential and lead to a reversal downward. Expected targets will be 149.80 and 149.31.

Chart Key:

Important Note for Beginner Traders

Beginner traders in the Forex market should be cautious when making trade entry decisions. Before major economic reports, it is best to stay out of the market to avoid sharp price fluctuations.

If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-loss protection, you risk losing your entire deposit quickly, especially if you trade large volumes without risk management.

For successful trading, it is essential to follow a structured trading plan, like the one outlined above. Random trade decisions based on current market sentiment often result in losses, making it an ineffective strategy for intraday traders.

RÁPIDOS ENLACES