The test of the 1.2591 price level occurred when the MACD indicator was beginning to rise from the zero mark, confirming an optimal entry point for buying the pound. As a result, the currency pair increased by approximately 30 pips.

Weak U.S. data, particularly the sharp decline in retail sales in January, negatively impacted the U.S. dollar. This trend is likely to continue in the short term unless upcoming U.S. economic data shows significant improvement. Investors, concerned about a potential slowdown in U.S. economic growth, are gradually reallocating their assets towards riskier instruments, including the British pound. However, further growth of the GBP/USD pair will depend on the stability of UK economic data and a generally positive geopolitical environment.

Since there are no significant fundamental reports from the UK today, it will be challenging for the overbought pound to surpass last week's high. Therefore, caution is advised when considering long positions, as a consolidation within the current range seems more likely.

From a technical perspective, if the pound attempts a breakout, the key level to monitor is last week's high. A strong breakout above this level could lead to further growth; however, I remain skeptical about this scenario for now.

I will focus primarily on Scenario #1 and Scenario #2 for today's intraday strategy.

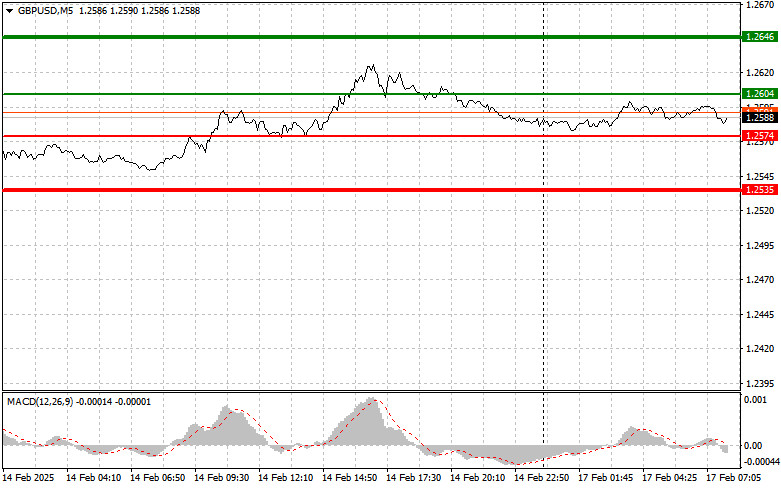

Scenario #1: I plan to buy the pound today if the price reaches 1.2604 (green line), with a target of 1.2646 (thicker green line). At 1.2646, I plan to exit long positions and immediately open short positions, expecting a 30-35 pip pullback from this level. The pound's growth may continue as part of the ongoing uptrend. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2574 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Growth towards 1.2604 and 1.2646 can be expected.

Scenario #1: I plan to sell the pound today after breaking below 1.2574 (red line on the chart), which should trigger a quick decline in the pair. The key target for sellers will be 1.2535, where I will exit short positions and immediately buy in the opposite direction, expecting a 20-25 pip rebound. Selling the pound is best from the highest possible levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today if two consecutive tests of the 1.2604 level occur while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a market reversal downward. A decline towards 1.2574 and 1.2535 is expected.

RÁPIDOS ENLACES