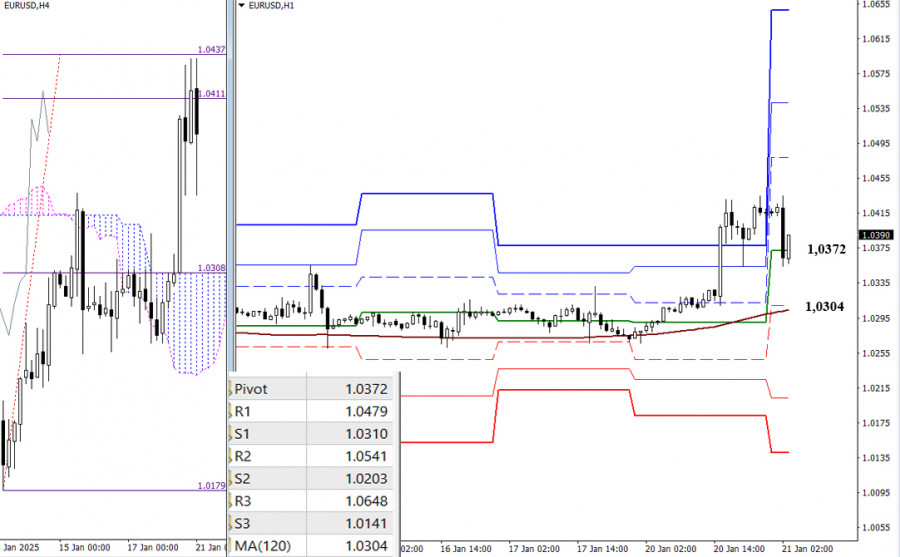

The week started on a highly optimistic note. The pair managed to test its nearest key benchmarks at 1.0399 - 1.0404, which corresponds to the final level of the Ichimoku daily dead cross and the weekly short-term trend. As a result, the euro is now at a crucial decision point: will the bulls be able to eliminate the daily Ichimoku dead cross and turn the weekly Tenkan into support? If this scenario unfolds, new opportunities will arise. The levels of the daily cross that were breached yesterday now act as supports, so the pair may interact with them during a pullback (1.0357 - 1.0315 - 1.0307).

On lower timeframes, the bulls currently have the upper hand. Yesterday, they managed to form and almost fully achieve the target for breaking through the H4 Ichimoku cloud (1.0411 - 1.0437). Thanks to this success, the classic Pivot levels have expanded today. After surpassing the H4 target of 1.0437, the pair is likely to move toward the resistance levels of the classic Pivot system (1.0479 - 1.0541 - 1.0648). However, if the bears can establish a correction by breaking below the support at the central Pivot level (1.0372), the pair could head toward the weekly long-term trend at 1.0304. This trend dictates the current balance of power, and breaking it could shift the advantage to the bears. Additional intraday targets for a downward move are the support levels at the classic Pivot levels (1.0203 - 1.0141).

***

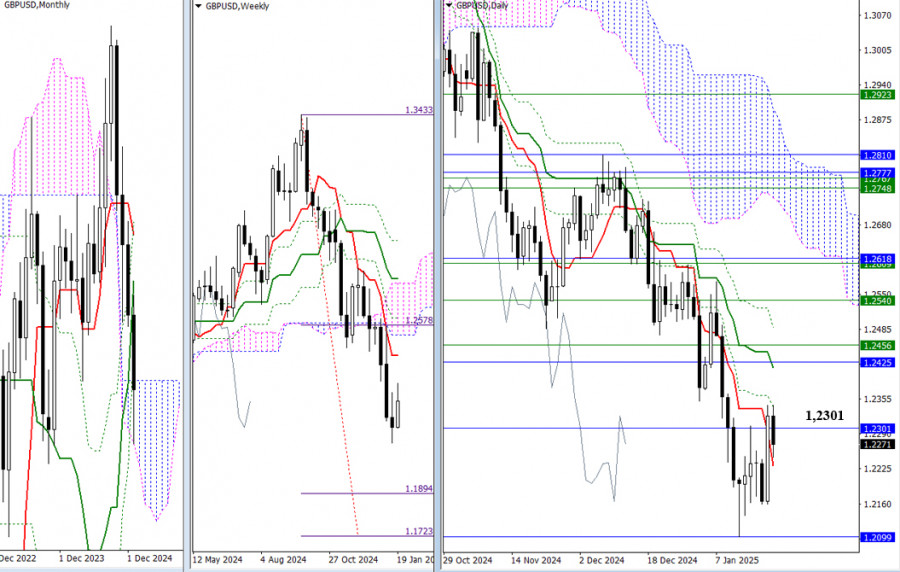

Yesterday, the bulls successfully pushed the currency pair back to the area near the upper boundary of the monthly Ichimoku cloud at 1.2301. If they can secure a position in the bullish zone relative to the cloud, it could drive the pair toward the next targets around 1.2425 to 1.2456, which coincide with the weekly Tenkan, the monthly Fibonacci Kijun, and the daily medium-term trend levels. However, a bounce from the upper boundary at 1.2301 could see the pair retreat back to the monthly cloud, with the target being the lower boundary at 1.2099. Along this path, the daily short-term trend at 1.2231 may serve as intermediate support.

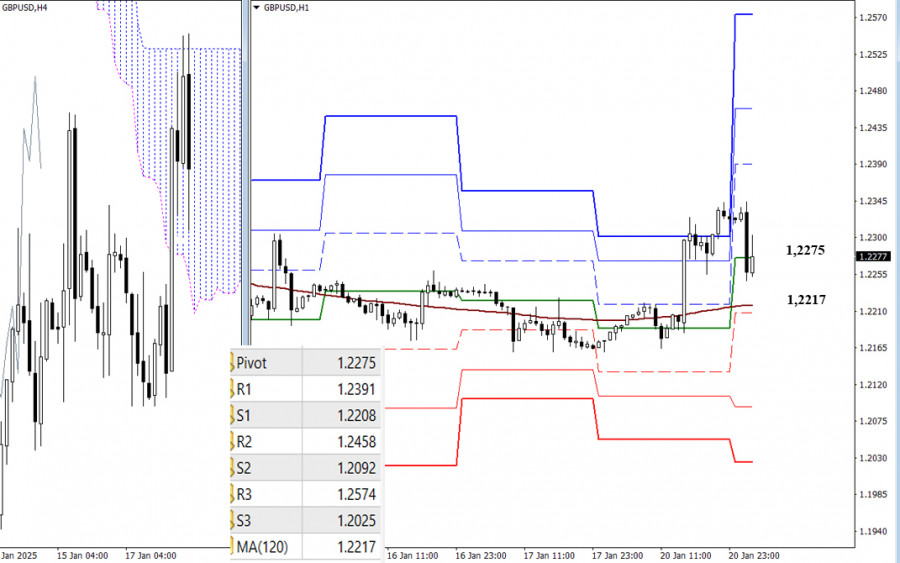

On the lower timeframes, bulls remain in control. Currently, they are testing the key level at 1.2275, which is the central pivot level of the day. Just below this level lies the weekly long-term trend at 1.2317, and maintaining this trend is crucial for the bulls to retain their advantage. Additional intraday targets include classic pivot levels. For further declines, key support levels are found at 1.2208, 1.2092, and 1.2025. Conversely, for upward movements, resistance levels are positioned at 1.2391, 1.2458, and 1.2574.

***

RÁPIDOS ENLACES