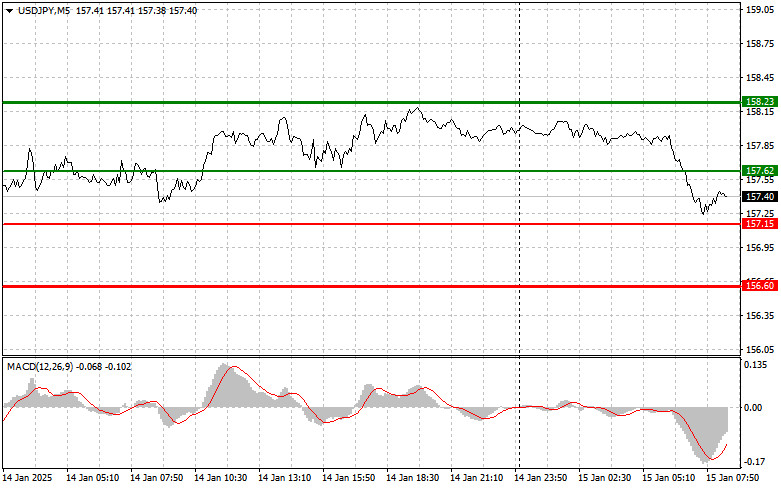

The test of the 158.10 level occurred when the MACD indicator had already risen significantly above the zero line, which limited the dollar's upside potential. For this reason, I chose not to buy.

Today's data on the change in Japan's monetary aggregate showed significant growth, providing a positive signal for investors. The increase in the money supply indicates that the Bank of Japan is actively taking measures to stimulate the economy, which could, in turn, strengthen the domestic currency. Combined with the growth in machinery orders, this information has bolstered confidence in the recovery of the Japanese economy. As a result, the yen appreciated, reflecting increased demand among traders for the Japanese currency. The current exchange rate dynamics illustrate the connection between economic data and financial market reactions. Japanese indicators are strengthening the yen, while uncertainty surrounding U.S. monetary policy is putting additional pressure on the dollar.

For today's intraday strategy, I will primarily rely on the implementation of Scenario #1 and Scenario #2.

Scenario #1: Plan to buy USD/JPY today at the entry point around 157.62 (green line on the chart) with a target of 158.23 (thicker green line). At 158.23, I plan to exit the long position and open short positions, expecting a pullback of 30–35 pips. It is best to bet on further growth of the pair and buy on corrections. Important: Before buying, ensure that the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy USD/JPY today if the MACD indicator is in the oversold area and the pair tests the 157.15 level twice consecutively. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 157.62 and 158.23.

Scenario #1: Plan to sell USD/JPY today only after breaking below the 157.15 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 156.60, where I plan to exit the short position and immediately open long positions, expecting a pullback of 20–25 pips. Pressure on the pair is likely to persist until U.S. economic data is released. Important: Before selling, ensure that the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 157.62 level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. Declines can be expected toward the opposite levels of 157.15 and 156.60.

RÁPIDOS ENLACES