What is acceptable for Jupiter may not be acceptable for the bull. The U.S. economy is strong enough to withstand the Federal Reserve's high interest rates. Unsurprisingly, the futures market indicates that the next rate cut in the U.S. is not expected until May. However, European economies are not as robust and cannot sustain such high rates. Those who doubt this need only look at the financial crisis unfolding in Britain, which is causing the EUR/USD exchange rate to decline.

The yield on 30-year UK bonds has surged to its highest level since the 1980s, leading to an increase in the cost of servicing government debt by approximately £10 billion. This situation has prompted investors to question the viability of the budget. As a result, the Labour Party faces a tough decision: either raise taxes or cut public spending. Both options carry the risk of triggering a recession. It is no wonder that the pound is sinking.

The Bank of England's tendency to follow the Fed is partly to blame for the current economic pressures. As the leader among central banks, the Fed's actions are often emulated. The Fed's forecast predicting two rate cuts in 2025 has caused other central banks to slow their monetary policies. As a result, when U.S. bond yields rise, UK yields also increase. Unfortunately, the UK economy may struggle to endure these pressures.

It's often wiser to learn from the mistakes of others rather than from our own. Observing developments in London, Frankfurt has little reason to hesitate. According to Bank of France Governor Francois Villeroy de Galhau, the recent rise in eurozone inflation in December should not be a cause for concern. The overall trend for the Consumer Price Index (CPI) remains downward; therefore, there is no reason to slow the easing of monetary policy. It is crucial to bring interest rates to a neutral level—one that neither stimulates nor restricts the economy—as quickly as possible. This neutral level is estimated to be around 2%.

Market pricing indicates that a 100 basis point rate cut by the European Central Bank in 2025 is likely. In contrast, derivatives markets suggest that the Fed will implement fewer than two acts of monetary easing. This widening interest rate differential is a significant factor driving the EUR/USD pair toward parity, or potentially even lower.

For the EUR/USD pair to continue its downtrend, strong U.S. labor market data will be essential. Bloomberg experts forecast an increase of 162,000 jobs, with the unemployment rate remaining at 4.2%. Bank of America anticipates even higher job growth of 175,000, which would bolster long positions in the U.S. dollar.

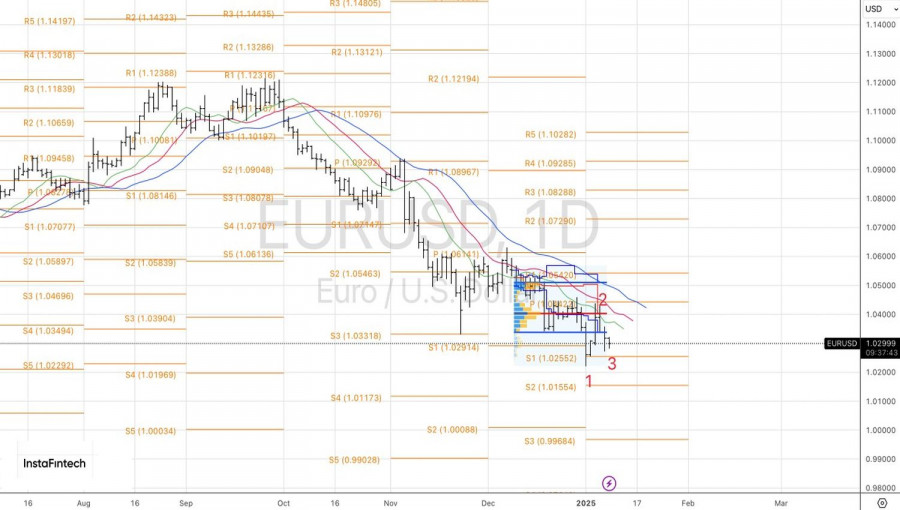

From a technical perspective, there is potential for a 1-2-3 reversal pattern to form on the daily EUR/USD chart. However, for this pattern to activate, prices must rise above 1.040, which currently appears unlikely. As long as the euro remains below this level, the focus should be on selling, with targets set at $1.012 and $1.000.

RÁPIDOS ENLACES