Analysis of Trades and Tips for Trading the Euro

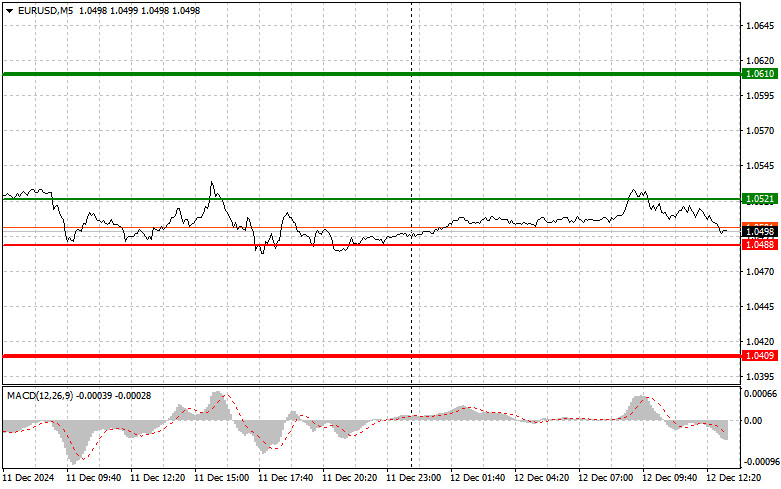

The first test of the 1.0515 price level occurred when the MACD indicator had already risen significantly above the zero mark, which, in my opinion, limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.0515 coincided with the MACD returning downward from overbought territory, which led to the implementation of Scenario #2 for selling and resulted in about 20 points of profit.

In the second half of the day, aside from the ECB decision, U.S. labor market data is also expected. A decrease in the number of initial jobless claims will indicate improvements in the labor market, which could significantly boost investor confidence in the economy, strengthening the U.S. dollar. The more people gain employment, the higher consumer confidence rises, increasing demand for goods and services. This could lead to higher production levels and even wage growth, further supporting economic activity.

Additionally, data on the Producer Price Index (PPI) will be released. An increase in this index would indicate rising prices for raw materials and services at the production level. If core prices also continue to rise, this could heighten inflationary pressure, making investors question whether the Fed should reduce interest rates now. The combination of these two factors—declining unemployment and rising producer prices—will likely strengthen the dollar against the euro.

Regarding the intraday strategy, I will focus primarily on Scenario #1, disregarding MACD signals, as I anticipate strong and directional pair movements following the ECB meeting.

Scenario #1:Buy the euro today at around 1.0521 (green line on the chart), targeting an increase to 1.0610. At 1.0610, I plan to exit the market and also sell the euro in the opposite direction, aiming for a correction of 30-35 points from the entry point. Expect strong euro growth today only if news indicates a rejection of interest rate cuts in the eurozone.Important: Before buying, ensure that the MACD is above the zero mark and just beginning to rise.

Scenario #2:I also plan to buy the euro if there are two consecutive tests of 1.0488, with the MACD in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Expect growth to the opposite levels of 1.0521 and 1.0610.

Scenario #1:Sell the euro after reaching 1.0488 (red line on the chart). The target will be 1.0409, where I plan to exit the market and immediately buy in the opposite direction (targeting a movement of 20-25 points upward). Pressure on the pair will return if there is a sharp decline in interest rates.Important: Before selling, ensure that the MACD is below the zero mark and just beginning to decline.

Scenario #2:I also plan to sell the euro if there are two consecutive tests of 1.0521, with the MACD in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Expect a decline to the opposite levels of 1.0488 and 1.0409.

Beginner Forex traders must make market entry decisions cautiously. Before major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on current market conditions are inherently a losing strategy for intraday traders.

RÁPIDOS ENLACES