The GBP/USD currency pair continued to trade within a narrow range on Wednesday. Despite expectations for either a continuation of the pair's upward movement or the start of a new decline, the U.S. inflation report turned out to be so lackluster that it's hardly worth mentioning. While the Federal Reserve might have celebrated the modest inflation increase to 2.7%, traders were left yearning for stronger market movements instead of watching prices stagnate for three consecutive days.

Indeed, the pair spent Monday, Tuesday, and Wednesday oscillating within a tight range. While the lack of significant events in the U.K. and the U.S. during the first two days of the week justified the absence of significant movements, Wednesday held the potential for a trend-defining move. However, no such development materialized. The technical picture remains unchanged, with the price hovering just above the moving average line, suggesting the potential for a sustained upward correction. However, even in the 4-hour timeframe, it's evident that this movement is a correction. The British pound lacks any fundamental basis for medium-term growth, leaving room to anticipate only further declines.

The frequent repetition of certain points is not due to a lack of insights but rather because of the global factors that evolve at a glacial pace. Over the past two years, the British pound has climbed steadily—a correction within a 16-year-long downtrend. This upward correction was driven primarily by the anticipation of future Federal Reserve monetary policy easing, a factor priced in by the market as early as 2022 when U.S. inflation began decelerating.

The dollar's recovery appears inevitable since this factor has been mostly or entirely priced in. However, considering the pair's two-year rise, expecting a return to target levels within a couple of months is unrealistic. With target levels near 1.18, the pound still has approximately 1,600 pips to decline from its recent high—a process that could take up to a year. But traders should clearly understand two things. First, the market mostly moves in corrections, consolidations, or flats. Second, every correction allows one to align positions with the prevailing trend, anticipating a return to directional movement. At least, this is how major players work.

For intraday traders, the global trend is less relevant. Local levels and technical patterns suffice for short-term gains. However, these opportunities have been sparse this week due to a weak fundamental and macroeconomic backdrop.

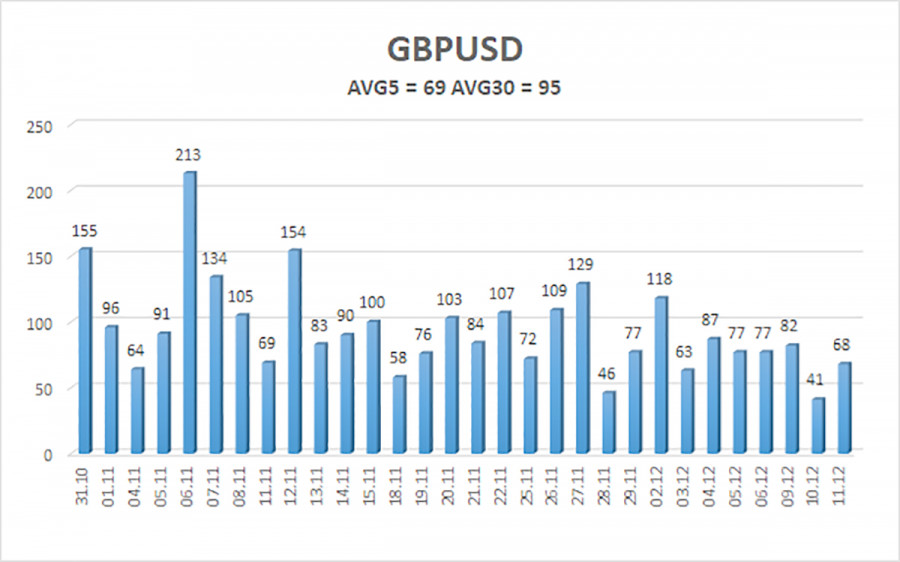

The average volatility of the GBP/USD pair over the past five trading days is 69 pips, considered "average" for this pair. On Thursday, December 12, we expect the pair to move within the range of 1.2677–1.2815. The higher linear regression channel points downward, signaling a continuation of the bearish trend. The CCI indicator has formed multiple bullish divergences and entered the oversold area several times. The correction is ongoing, but its strength remains difficult to predict.

The GBP/USD pair remains in a bearish trend but continues to correct upward. We still do not recommend long positions, as we believe the factors supporting the British currency have been priced into the market several times. For those trading using pure technical analysis, long positions are possible with targets at 1.2817 and 1.2939 if the price moves above the moving average line. However, short positions are more relevant now, targeting 1.2573 if the price consolidates below the moving average.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

RÁPIDOS ENLACES