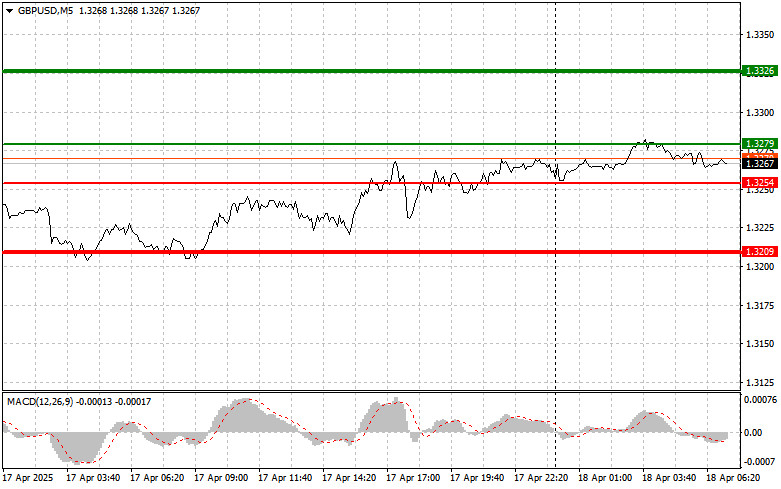

The test of the 1.3249 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the pound. After a long period, another test of 1.3249 took place. At that moment, the MACD had just started moving up from the zero mark, which confirmed a valid entry point for buying the pound and led to a 20-pip increase in the pair.

A slower-than-expected rise in initial jobless claims in the U.S. and solid figures for building permits were insufficient to put pressure back on GBP/USD. The pair continued to rise, returning to the monthly high. This indicates a prevailing bullish market sentiment favoring the British currency. Investors may view the pound as a more attractive asset amid economic uncertainty and geopolitical risks stemming from U.S. trade tariffs.

No UK reports are scheduled for release today, so pound buyers may have a chance to update the weekly high. And while the technical picture supports this, resistance at the weekly high will likely be strong enough to hold back further growth. Breaking through this level would require a strong driver, which is currently absent.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.3279 (green line on the chart), targeting a rise toward 1.3326 (thicker green line). Around 1.3326, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pips pullback from that level). A continued upward trend can be expected if data support the pound.

Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound today if the price level 1.3254 is tested twice consecutively while the MACD is in the oversold area. This would limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.3279 and 1.3326 can be expected.

Scenario #1: I plan to sell the pound today after a breakout below the 1.3254 level (red line on the chart), which would trigger a rapid drop in the pair. The key target for sellers will be 1.3209, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a pullback of 20–25 pips).

Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3279 level while the MACD is in the overbought zone. This would limit the pair's upside potential and lead to a downward market reversal. A drop to the opposite levels of 1.3254 and 1.3209 can be expected.

LINKS RÁPIDOS