The GBP/USD currency pair continues to rise gradually, even though there is no substantial reason for this movement this week. While the British pound has not experienced significant appreciation during this time, it has also avoided any notable decline. For instance, a drop in the pair could have been anticipated yesterday when Trump announced a 25% tariff on all imports from the EU.

What do these tariffs have to do with the UK? Quite a lot. Britain's economy is closely linked to Europe's, so sanctions against Europe effectively act as sanctions against Britain. It's also possible that Trump may be considering a separate set of "personal tariffs" aimed specifically at London.

Despite this, we did not observe a significant rise in the dollar. In fact, it seems the market is simply weary of Trump's unpredictable behavior and protectionist policies. The US President appears to believe that he alone should dictate how the world functions, issuing directives to any country that grabs his attention. He feels that others are taking advantage of America and treating it unfairly. However, it seems the market is no longer concerned with Trump's opinions. It recognizes that his policies may only yield short-term benefits for the US, but ultimately, they could lead to a global shift away from America—few want to engage with such a leader.

And now, despite maintaining long-term growth prospects, the dollar continues to decline. The monetary policies of the Bank of England and the Federal Reserve are the key factors for its future strength. However, there is a real risk that the market could lose interest in the dollar entirely—and Trump would be to blame. We still hope that market participants will prioritize economic factors, but the first five weeks of his policies have only made enemies for America. These opponents may not be strong enough to openly challenge the US, as they fear its power. But which is worse: an open adversary, like North Korea or Iran, or a hidden one?

At the moment, we still expect the US currency to continue its growth. However, if developments continue in this direction, forecasts may have to be revised. Right now, we see the euro as the main indicator of market sentiment toward the dollar. Since the euro has not shown growth for the past month and a half, we believe that medium-term and long-term downtrends could resume. If the euro declines, the pound will likely follow suit—by at least 90%. Perhaps not as sharply, since Trump's tariffs are not directly aimed at the UK or because the BoE is not planning to cut interest rates as aggressively as the European Central Bank. However, imagining a scenario where the euro falls while the pound rises is difficult.

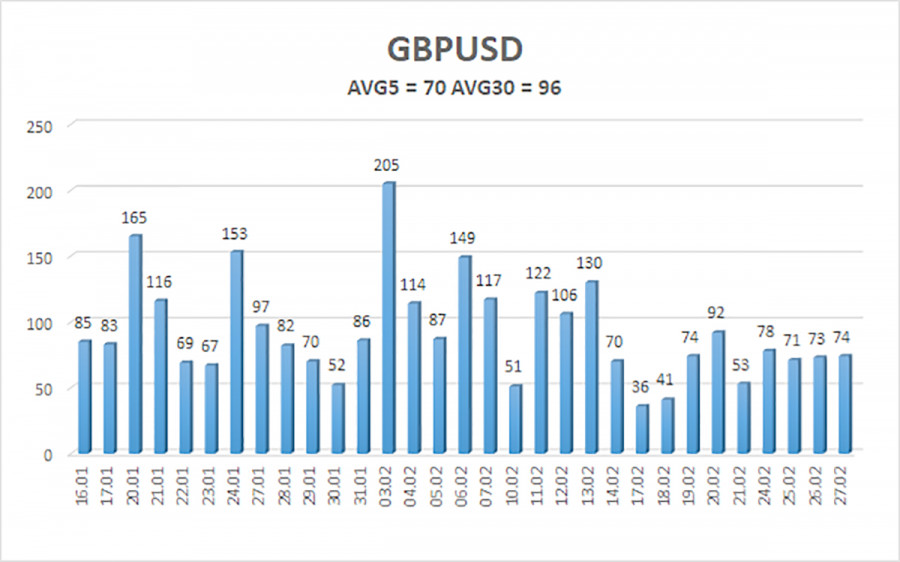

The average volatility of the GBP/USD pair over the last five trading days is 70 pips, which is considered "average" for this currency pair. On Friday, February 28, we expect the pair to move between 1.2555 and 1.2695. The long-term regression channel remains downward, signaling a bearish trend. The CCI indicator entered the overbought zone on Friday, warning of a potential decline. A bearish divergence may also be forming.

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

The GBP/USD currency pair maintains a medium-term downtrend. We still do not consider long positions, as we believe the current upward movement is just a correction. If you trade purely on technical analysis, long positions are possible, with targets at 1.2695 and 1.2756 if the price is above the moving average. However, sell orders remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will inevitably end. The British pound currently appears locally overbought, but it has not yet been able to begin a decline.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

LINKS RÁPIDOS