The test of the 1.2659 price level occurred when the MACD indicator had just started to move upward from the zero mark, confirming a suitable entry point for buying the pound. Consequently, the pair rose toward the target level of 1.2689.

Unfavorable data from the US real estate sector caused the dollar to decline. Investors, concerned about a potential slowdown in US economic growth, began to sell dollar assets aggressively, which significantly impacted the dollar's exchange rate against the British pound. However, statements from Trump and the threat of tariffs against the EU quickly brought buyers back to reality. Experts believe that the US president may soon focus on the UK as well, so caution is advisable when buying the pound today.

Unfortunately, there is no economic data from the UK today, nor are there any scheduled speeches or interviews from Bank of England representatives. As a result, the pound may experience a significant correction. Investors are likely to pay close attention to general market sentiment and the dynamics of the US dollar, as the lack of domestic drivers makes the pound particularly vulnerable to external factors. Technical analysis will also be crucial, as breaking through key support levels could intensify downward pressure.

In the short term, traders should closely monitor US macroeconomic data and overall risk asset trends. If the dollar strengthens and market sentiment worsens, the pound could face additional challenges. Conversely, some stabilization or a moderate rebound may occur if the external background improves.

Regarding intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

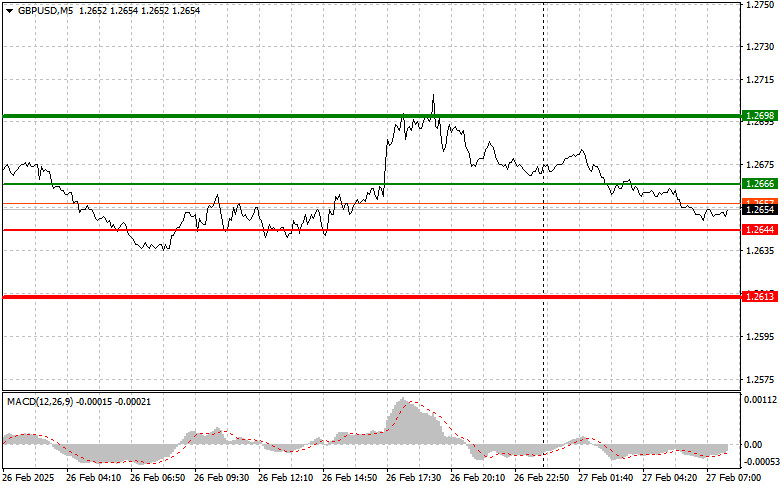

Scenario #1: I plan to buy the pound today at the 1.2666 entry point (green line on the chart), targeting a rise to 1.2698 (thicker green line on the chart). Around 1.2698, I plan to exit the buy trades and open sell trades in the opposite direction (expecting a 30-35 pips movement back). Betting on the pound's growth is reasonable only within the upward trend. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2644 price level when the MACD is in the oversold zone. This will limit the pair's downward potential and trigger an upward market reversal. Growth can be expected toward the opposite levels of 1.2666 and 1.2698.

Scenario #1: I plan to sell the pound today after breaking the 1.2644 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 1.2613, where I plan to exit the sell trades and immediately open buy trades in the opposite direction (expecting a 20-25 pips movement back). It's best to sell the pound as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2666 price level when the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposite levels of 1.2644 and 1.2613 can be expected.

LINKS RÁPIDOS