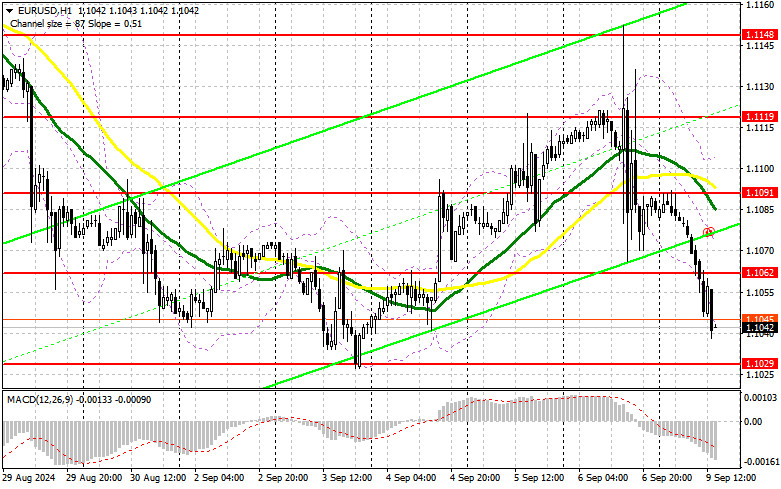

In my morning forecast, I focused on the 1.1068 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see what happened. The breakout at 1.1068 happened, but the price fell just short of a proper retest by a few points, so I couldn't identify a suitable entry point for selling the euro. The technical picture was slightly revised for the second half of the day.

To enter long positions on EUR/USD:

The euro is losing ground as expected, and this trend will likely continue until the previous week's low is updated, so it's better not to rush into long positions. No data releases are expected in the second half of the day that could alter the market balance. The figures for wholesale trade inventories and consumer credit in the U.S. are unlikely to significantly influence traders. Therefore, I plan to enter long positions only after a decline and a false breakout around 1.1029, the previous week's low, aiming for a correction and recovery to the 1.1062 level, which has become new resistance following the European session. A breakout and retest of this range to the upside could lead to further growth and a potential test of 1.1091, where the moving averages are positioned. The farthest target will be the 1.1119 maximum, where I plan to take profits. If EUR/USD declines and activity around 1.1029 remains absent in the afternoon, sellers will regain full control of the market, potentially leading to a larger sell-off. In this case, I will only enter long positions following a false breakout near the next support level at 1.1008. I plan to buy on a rebound from 1.0984 for a 30-35 point intraday upward correction.

To open short positions on EUR/USD:

Sellers are capitalizing on market sentiment after Friday's labor market data from the U.S. If the euro rises after the U.S. data, a false breakout around 1.1062 will be the only suitable condition for opening short positions, targeting the new support level of 1.1029—the weekly low. A breakout and consolidation below this range, followed by an upward retest, will provide another selling point with a target toward 1.1008. The farthest target will be the 1.0984 level, which would completely negate buyers' plans for a short-term euro rise. I will take profits there. If EUR/USD moves up and there are no bears at 1.1062, buyers will have a chance for a correction and a move to retest 1.1091 resistance. I will also consider selling there, but only after a failed consolidation attempt. I plan to open short positions on a rebound from 1.1119, targeting a 30-35 point downward correction.

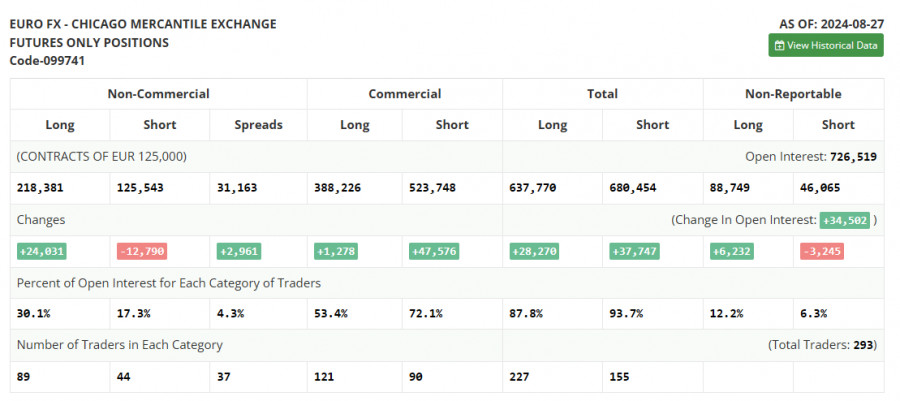

In the COT (Commitment of Traders) report for August 27, we saw an increase in long positions and a significant reduction in short positions. This indicates sustained bullish sentiment among risk asset buyers, which was reinforced after Fed Chair Jerome Powell's speech at Jackson Hole, where he clearly indicated that U.S. interest rates would be cut in September. The current report reflects the market's full reaction to these statements. The future direction of the dollar will depend entirely on upcoming data related to the labor market and inflation, so I recommend paying particular attention to these indicators. The COT report shows that long non-commercial positions rose by 24,031 to 218,381, while short non-commercial positions fell by 12,790 to 125,543. As a result, the gap between long and short positions increased by 2,961.

Indicator signals:

Moving Averages:

Trading is below the 30- and 50-day moving averages, indicating further euro decline.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart, differing from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator, near 1.1045, will serve as support.

Indicator descriptions:

LINKS RÁPIDOS