As it has been for the past week, the EUR/USD currency pair continued its impressive growth on Friday. Therefore, no significant price changes have taken place. The illustration below shows that last week's volatility was not low, but the lack of trend movement gives the impression that the pair barely moved from its position. The European Union only experienced a few noteworthy events. In reality, the market received no new information from Christine Lagarde's two speeches, and the second assessment's report on inflation rarely caused a market reaction. Since we have stopped expecting to see a flat on the 4-hour TF in recent months, it took time to understand last week why the pair was neither rising nor falling.

Regarding the other fundamental background, traders were not particularly interested in the results of the US congressional elections because nothing else was more interesting. Remember that the pair haven't grown reasonably over the past few weeks; as a result, we anticipated a strong correction last week. In any case, there is no reason for the euro to keep rising. As a result, if the correction did not occur last week, it should occur this week. At least temporarily, a downward trend will be announced if the price is fixed below the moving average line.

A new week without any events in the EU.

There won't be much to highlight from this week's significant events in the European Union. Speaking engagements by ECB officials, including Vice-Chairman Luis de Guindos, will take place on Monday, Wednesday, Thursday, and Friday. Even Christine Lagarde was unable to persuade the market of the significance of her speeches last week, which may be why this is interesting. Less significant ECB monetary committee members are also likely to be unsuccessful. The market is now aware that the ECB will keep raising the key rate, and it is unlikely that their members' public statements will suddenly change dramatically. As a result, we don't have high expectations for these performances.

There is nothing noteworthy to highlight other than the performances. The November manufacturing and business activity indices will be released on Wednesday, and it is anticipated that all three indices will remain below the critical level of 50.0. There will only be a response to these reports if there is a significant departure from the previous month's values. Christine Lagarde acknowledged that economic and commercial activity would need to be sacrificed to lower inflation. Therefore, it won't surprise us if these indicators continue to decline. There is a chance that Europe will experience a recession, but it is unlikely that it will be severe. The market is no longer motivated to predict the EU economy's decline because it is a well-known and well-established fact. Geopolitics and central bank rates continue to be the most significant factors.

Everything is more or less clear when looking at the rates. The Fed will gradually tighten monetary policy to raise the rate to 5%. The European Central Bank must aim for 5%, but it is highly unlikely that the economies of many nations can withstand such a tightening of monetary policy. We continue to think that the ECB rate will weaken and lengthen, which will not be in the European currency's favor.

Everything is more challenging in geopolitics because it is virtually impossible to predict how events will unfold over the next month, two months, or three months. Numerous experts predicted that the situation would deescalate in November following the G-20 summit in Bali. We can see that this did not occur. There were simply no discussions about the "Ukrainian issue" at the summit because neither Vladimir Putin nor Vladimir Zelensky attended. Since Kyiv rejects peace talks with Russia and Moscow thinks negotiations can only take place on its terms, the military conflict will only intensify. We are still determining how things might start to get better.

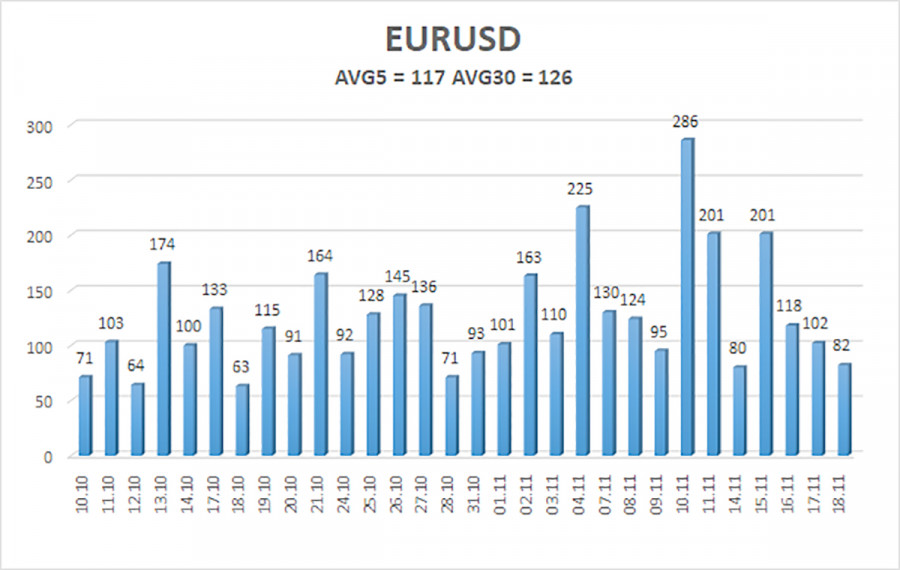

As of November 21, the euro/dollar currency pair's average volatility over the previous five trading days was 117 points, which is considered "high." So, on Friday, we anticipate the pair to fluctuate between levels of 1.0208 and 1.0441. An upward turn of the Heiken Ashi indicator will indicate a potential continuation of the upward movement.

Nearest levels of support

S1 – 1.0254

S2 – 1.0132

S3 – 1.0010

Nearest levels of resistance:

R1 – 1.0376

R2 – 1.0498

R3 – 1.0620

Trading Advice:

The EUR/USD pair is still fluctuating. In light of this, we should consider opening new long positions with targets of 1.0441 and 1.0498 if the Heiken Ashi indicator reverses its upward trend. Only after fixing the price below the moving average line with targets of 1.0208 and 1.0132 will sales become significant.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

ĐƯỜNG DẪN NHANH