Bitcoin (BTC) dosáhl nejvyšší hodnoty 65 250 USD, což je nejvyšší hodnota od srpna. Rostoucí cena upoutala pozornost širšího kryptotrhu, protože se blíží ke klíčovému milníku ziskovosti. Podle analytické platformy IntoTheBlock on-chain bude v případě, že BTC překoná hranici 65 000 USD, více než 90 % držitelů v zisku, což je úroveň, která nebyla zaznamenána od července. To vyvolává otázku, zda se tentokrát bude situace lišit od předchozích případů, kdy se Bitcoinu nepodařilo dosáhnout nových maxim. Cena Bitcoinu zaznamenala koncem července pokles poté, co se jí nepodařilo překonat hranici 70 000 USD, ale od té doby se odrazila ode dna. Za posledních 24 hodin cena BTC vzrostla o 0,92 % na 64 536 USD. Kromě toho několik kryptoměn, včetně Shiba Inu (SHIB), Dogwifhat (WIF) a Worldcoin (WLD), zažilo výrazné rally poháněné býčí náladou. Trh také čeká na signály z Federálního rezervního systému ohledně snížení úrokových sazeb a ekonomických údajů. Nedávné potvrzení předsedy Komise pro cenné papíry Garyho Genslera, že Bitcoin není cenný papír, dále posílilo náladu na trhu.

Analysis of transactions and tips for trading EUR/USD

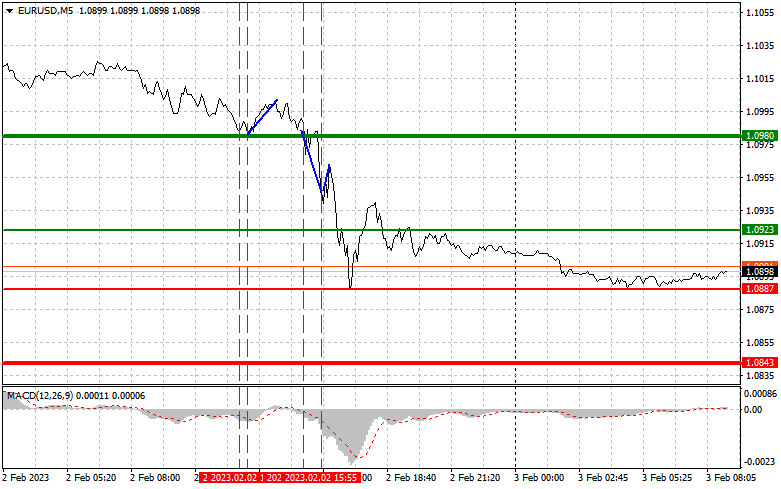

When euro first tested 1.0982, the MACD line was already far from zero, so the downside potential was limited. But a short time later, on the second test, the MACD line was already exiting the oversold area, so a signal to buy emerged. This led to a price jump of around 20 pips. Meanwhile, the third test of 1.0982 prompted a sell signal, which resulted in a decline of as much as 40 pips. There was a 15-pip rebound in the afternoon due to long positions around 1.0947.

The ECB's decision of raising its rate by 0.5% was so expected that markets reacted with a decline despite Christine Lagarde's tough statements on further increases. But euro could make a comeback today as PMI reports are due out, and the PPI data, albeit showing a decline, will not have much impact on the market. The speech of ECB Board member Frank Elderson will also be of little interest.

In the afternoon, there is a report on US non-farm payrolls for January, in which a sharp slowdown in new job growth is expected. This could lead to a further fall in dollar and another rise in euro. Service and composite PMI data will be of little interest.

For long positions:

Buy euro when the quote reaches 1.0923 (green line on the chart) and take profit at the price of 1.0980. Growth could occur if the Euro area releases strong PMI data. However, make sure that when buying, the MACD line is above zero or is starting to rise from it. Euro can also be bought at 1.0887, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0923 and 1.0980.

For short positions:

Sell euro when the quote reaches 1.0887 (red line on the chart) and take profit at the price of 1.0843. Pressure will increase if there is no bullish activity at yesterday's low. However, make sure that when selling, the MACD line is below zero or is starting to move down from it. Euro can also be sold at 1.0923, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0887 and 1.0843.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

ลิงก์ด่วน