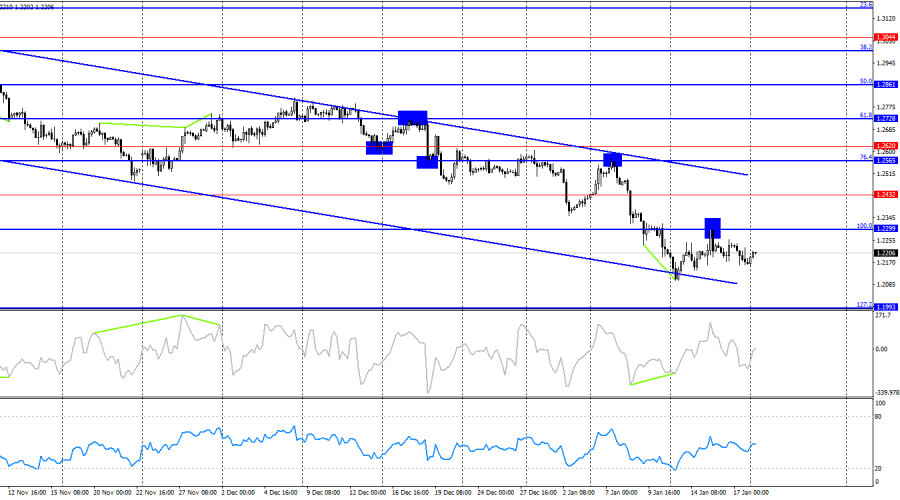

On Friday, the GBP/USD pair continued to trade sideways on the hourly chart, completely ignoring the 1.2191 level. As this is a classic range-bound movement, it's best to wait for the range to end. Since the range lacks clear boundary lines, trading based on rebounds from them is also not feasible.

The wave situation is straightforward. The last completed downward wave broke below the previous low, while the last upward wave failed to approach the previous high. This indicates the ongoing formation of a bearish trend, with no signs of its completion. For this trend to end, GBP/USD must rise to at least 1.2569 and close confidently above it. Such a development is unlikely in the near term.

On Friday, another disappointing report was released in the UK, adding to a string of negative data from last week. To be precise, every piece of data from the UK last week created new problems for the pound. Sterling was fortunate that the market shifted its focus to Donald Trump's inauguration and essentially paused trading, opting to wait and see. Without this shift in focus, the pound likely would have continued falling throughout the week.

Retail sales volumes in December dropped by 0.3% m/m, despite positive forecasts. Today, Trump's inauguration will take place, an event that has been heavily discussed for three weeks due to Trump's ambitious promises. However, it remains unclear what actions he will actually take, how strict his tariffs against the EU, China, and Canada will be, or whether he will truly pursue ambitions like taking Greenland or the Panama Canal. Personally, I approach Trump's statements with caution, as many appear surreal. Alternatively, the US could implement Trump's ambitions through military aggression or open trade wars. The impact on the currency market in such scenarios is extremely hard to predict.

On the 4-hour chart, the pair rebounded from the 100.0% retracement level at 1.2299, allowing for continued decline toward the 127.2% retracement level at 1.1993. The downward trend channel signals the dominance of bearish traders, who do not intend to lose control soon. Only a close above the channel would signal potential for a strong recovery in GBP.

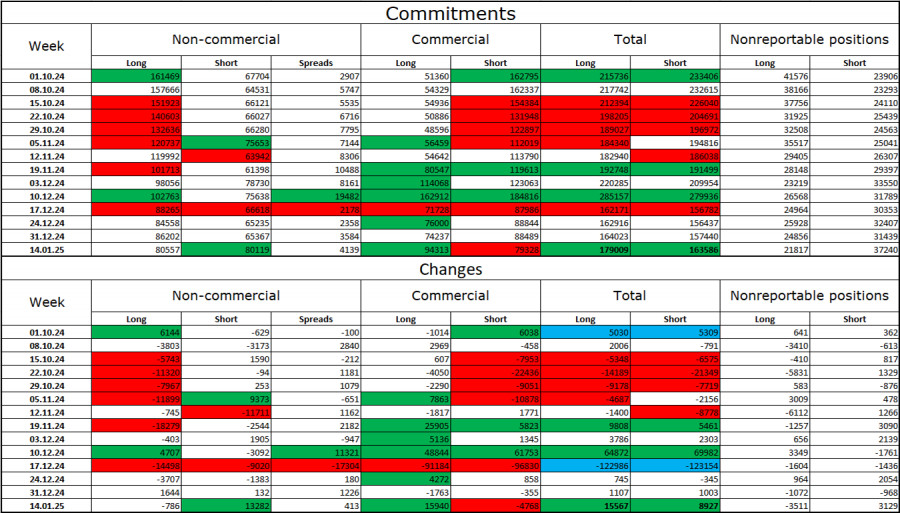

The sentiment among Non-commercial traders turned significantly more bearish over the last reporting week. The number of long positions held by speculators decreased by 786, while short positions increased by 13,282. Bulls have lost all their previous market advantage, a process that unfolded over several months. There is now parity between long and short positions, with 80,000 each.

In my view, GBP/USD retains a bearish outlook, with COT reports signaling strengthened bearish positions nearly every week. Over the past three months, long positions have decreased from 161,000 to 80,000, while short positions have risen from 67,000 to 80,000. I expect professional players to continue reducing long positions or increasing short positions, as all potential bullish factors for the pound have been exhausted. Graphical analysis also supports a bearish outlook for sterling.

On Monday, the economic events calendar features a single entry, but it could have a significant impact on the US dollar. The information background could strongly influence trader sentiment for the remainder of the day.

Short positions were viable after a rebound from 1.2303 on the hourly chart, with targets at 1.2191 and 1.2036. The first target has been reached. I would not hold shorts further, as the upcoming week may prove "stormy," and the 1.2191 level is being ignored by traders. I still do not recommend considering long positions today.

Fibonacci levels are drawn from 1.3000–1.3432 on the hourly chart and 1.2299–1.3432 on the 4-hour chart.

RÁPIDOS ENLACES