Strong corporate profits can make up for many sins. Neither Donald Trump's policy uncertainty, nor the largest tariffs since the 1930s, nor the split within the Federal Reserve prevented the S&P 500 from posting a third consecutive double-digit annual gain — this time 17%. Credit goes to impressive corporate results; their undervaluation allowed the broad index to prosper. It's no surprise that Wall Street analysts are raising earnings forecasts for 2026.

The past year was marked by the fading glory of the Magnificent Seven. Because of high market concentration, those companies continued to move the S&P 500, but their influence gradually diminished. NVIDIA's 40% share gain is impressive at first glance, but it ranks only 71st. Data-storage stocks outpaced it by a wide margin.

Performance of the top S&P 500 companies

At the year's end, there was active rotation. Investors trimmed positions in tech giants and bought banks and other firms poised to benefit from sustained economic growth and slowing inflation. The main drivers were inflated fundamental valuations and doubts about AI's ability to generate returns commensurate with the investments.

That is not to say the Magnificent Seven's dominance is entirely over. For example, cuts to Tesla's fourth-quarter vehicle-sales forecasts weighed on both the company's shares and the S&P 500. Sales are expected to fall 8% in 2025, from 1.79 million to 1.64 million — the second consecutive annual decline.

Negative news from Tesla, coupled with the Fed split, prevented the broad index from resuming a Christmas rally. History shows that after such a rally, the S&P 500 rises in January by an average of 1.4% and by an average of 10.4% over the following 12 months.

Market expectations for the federal funds rate

According to the minutes of the December FOMC meeting, 6 of the Committee's 19 members disagreed with the decision to cut the federal funds rate by 25 basis points to 3.75%. Some of those who supported the Fed's decision had doubts and might not have backed it otherwise. It was suggested that easing monetary policy sent the wrong signal — namely, that the central bank was no longer putting inflation control first.

The split within the Federal Reserve increases the likelihood of a prolonged pause in the cycle of monetary easing. Not great news for stocks. Their reluctance to move decisively in either direction is driven by low trader activity: trading volumes in recent days are 40–44% below 20-day averages.

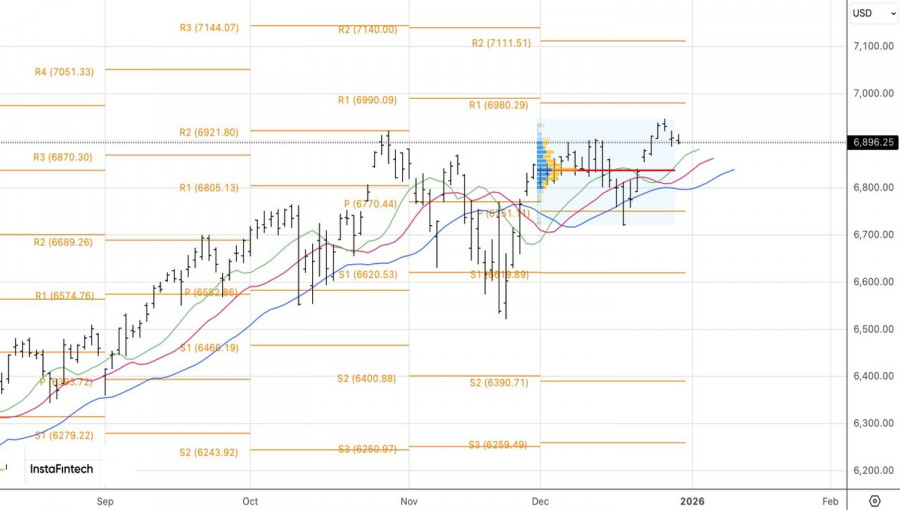

Technically, the S&P 500 shows a combination of a doji bar and an inside bar on the daily chart. Traders should consider a strategy of placing pending buy orders for the broad index at 6,925 and sell orders at 6,885.

LINKS RÁPIDOS