Společnost Stifel zůstává před zveřejněním výsledků společnosti NVIDIA Corporation (NASDAQ:NVDA) za první čtvrtletí fiskálního roku pozitivní a popisuje akcie jako „atraktivně oceněné“ navzdory přetrvávajícím nepříznivým vlivům souvisejícím s omezeními v Číně a smíšeným makroekonomickým podmínkám. Společnost Nvidia zveřejní výsledky 28. května.

Broker očekává, že výsledky a výhled budou převážně v souladu s očekáváními, ale uznává, že nedávná omezení vývozu čipů H20 AI společnosti Nvidia do Číny měla negativní dopad na tržby. Stifel přesto vidí silnou dynamiku pro druhou polovinu roku.

In 2025, the strategies of "Buy America" and "Sell America" alternated. In 2026, these may be replaced by the slogan "anything but America." The slowing economic growth in the United States, ongoing uncertainty surrounding Donald Trump's policies, decreasing confidence in US-issued assets, and challenges related to artificial intelligence are prompting investors to fill their portfolios with what they previously lacked. Will the S&P 500 withstand such capital outflow pressure?

Dynamics of US and Global Stock Index Ratio

2025 is set to be the best year for the global stock market since 2009. The global MSCI ex USA has risen by more than 29%, significantly outpacing the S&P 500, which gained only 17%. Emerging market indices increased by 30%, while the Chinese MSCI jumped by 29%, and Hong Kong's Hang Seng rose by 28%. The whole world appeared stronger than the US. However, due to advances in artificial intelligence and a loosening of the Fed's monetary policy, capital that had turned toward Europe and Asia has managed to flow back into the United States.

Can the S&P 500 gain support from these factors in 2026? The outcome will depend on the pace of federal funds rate cuts and the ability of technology companies to generate adequate profits from their significant investments. The futures market anticipates two acts of monetary expansion from the Fed. However, if Donald Trump can fill the FOMC with dovish members, that number could increase.

Technology companies are transitioning from a race to train artificial intelligence to promoting it to the masses. NVIDIA is facing serious competition from other giants, including Alphabet and Amazon. It is not surprising that NVIDIA seeks to strike a $20 billion deal with the startup Groq, which develops chips and software for AI deployment.

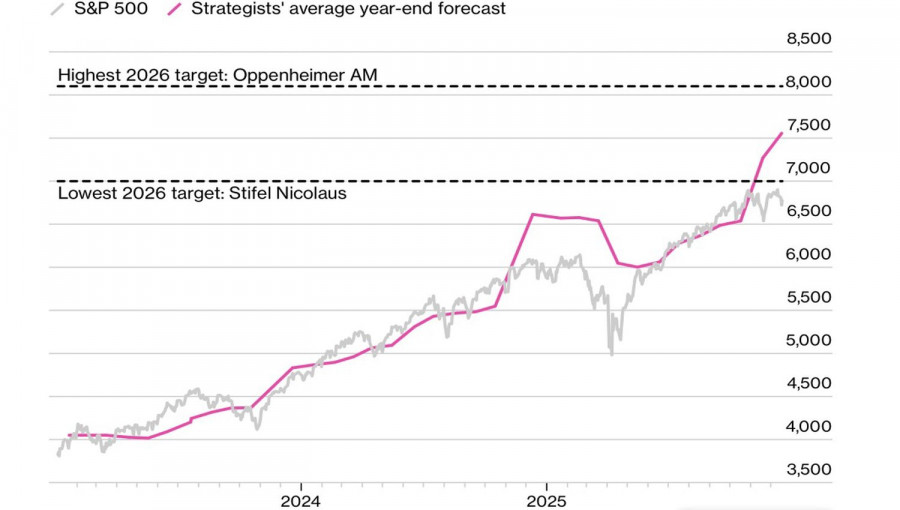

The potential slowing of US GDP, Trump's eccentricities, and waning interest in artificial intelligence technology do not deter Wall Street experts. Major banks predict a 9% growth for the S&P 500 in 2026, with none of the respondents anticipating a decline in the broad market index.

Wall Street's S&P 500 Predictions

Thus, Wall Street experts believe that the broad market index will be able to withstand numerous headwinds.

From a technical perspective, the daily chart of the S&P 500 showed a market pullback with a downward gap. Typically, gap filling in a bullish market serves as a basis for buying. Therefore, a return of the broad market index to the 6,922 level would provide an opportunity to increase previously opened long positions.

LINKS RÁPIDOS