After the sharp rally of the S&P 500 index from its April lows, investors' desire to lock in profits is so strong that it is driving the broad market index lower. Moreover, there are tangible catalysts for this move. Key US labor market data will shed light on the Fed's stance regarding potential rate cuts, while disappointing earnings from tech companies are adding fuel to portfolio rotation.

Over the past three trading sessions, Broadcom shares have declined by 18%, translating to a $300 billion market capitalization loss, roughly equivalent to that of its competitor AMD. This marks Broadcom's worst period since 2020, pushing its market value below that of Meta Platforms, resulting in a swap of their rankings from 6th to 7th place.

Investors are spooked by parallels to the 1990s dot-com crisis, questioning tech companies' ability to generate profits commensurate with their massive investments and worrying about inflated fundamental valuations. Consequently, there is a rotation in favor of small-cap stocks, which explains why the Russell 2000 is outperforming the broader market index.

S&P 500 and Russell 2000 Dynamics

Smaller issuers are capitalizing on the combination of a surprisingly strong economy and the Fed that continues to signal interest rate cuts. US GDP is growing despite tariff headwinds. White House protectionist measures are being offset by gains in productivity from artificial intelligence technologies and a surge in consumer spending, enriched by the S&P 500 rally. Will this momentum persist into 2026?

Doubts about the effectiveness of investing in tech companies, coupled with a gradual slowing of the Fed's monetary expansion cycle, could negatively impact the US economy, especially as the labor market continues to cool. According to Jerome Powell, actual monthly employment is running 60,000 below previously reported BLS figures.

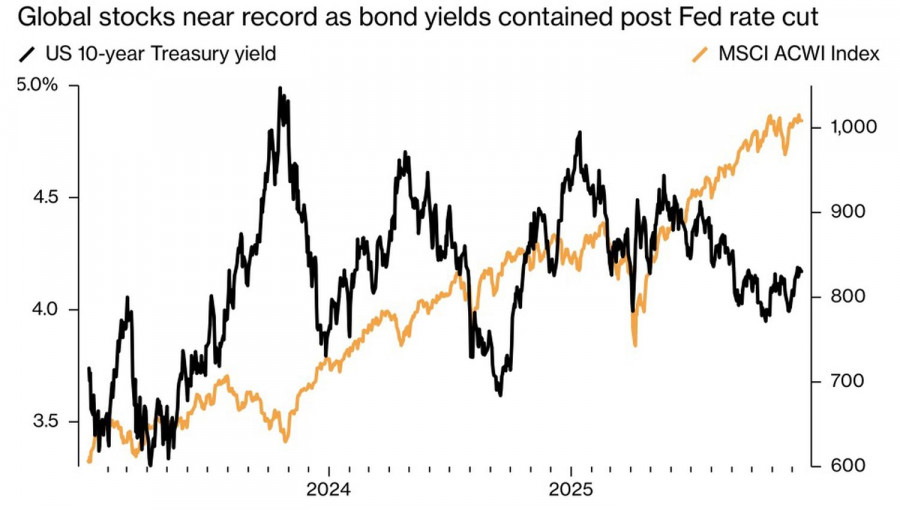

MSCI and Bond Yields Dynamics

Morgan Stanley, however, believes the equity market has entered a "bad or good news is good for the S&P 500" regime. In this context, even a slight miss in US nonfarm payrolls versus Bloomberg consensus estimates could lift the broad index on expectations of a renewed Fed easing cycle. This scenario would likely push bond yields lower while supporting equity prices.

Derivatives currently imply a 53% probability of a Fed funds rate cut in March. If this probability continues to rise, the US dollar could weaken, and the S&P 500 may have an opportunity to resume its upward trend and hit new record highs.

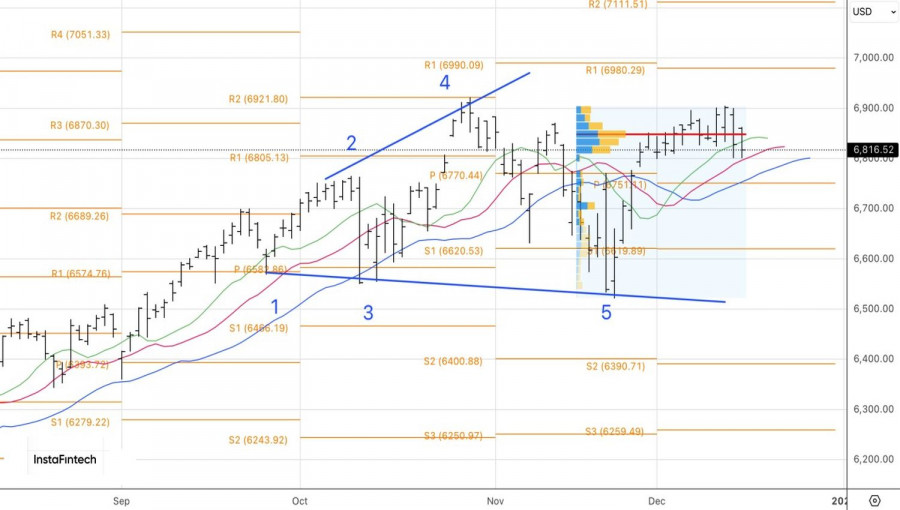

From a technical point of view, the daily charts shows that bears have managed to push the S&P 500 below its fair value. Nevertheless, a rebound from the 6,750–6,770 convergence zone could offer traders a favorable setup for long positions.

LINKS RÁPIDOS