Trade Analysis and Advice for Trading the British Pound

The price test at 1.3211 occurred when the MACD indicator had already moved significantly downward from the zero line, limiting the pair's downward potential. For this reason, I did not sell the pound.

The UK Manufacturing PMI matched economists' forecasts, remaining above 50 points. This paints a picture of a fragile but still steady recovery, with the manufacturing sector stabilizing. Exceeding expectations in UK lending also provides a positive signal, indicating continued demand in the real estate market.

Later today, the U.S. ISM Manufacturing Index data is expected. Only exceptionally strong numbers—which are unlikely—would boost dollar demand. Otherwise, even neutral data could trigger another wave of U.S. dollar selling, especially against the British pound. Most likely, the market has already priced in weak ISM results, so reversing the current trend will require something truly impressive. Traders are currently very bearish on the dollar, and restoring confidence will need not just good, but extremely strong macroeconomic signals. Particular attention will be paid to the employment component in the manufacturing sector; a decline there would further support expectations of slower U.S. economic growth.

For intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

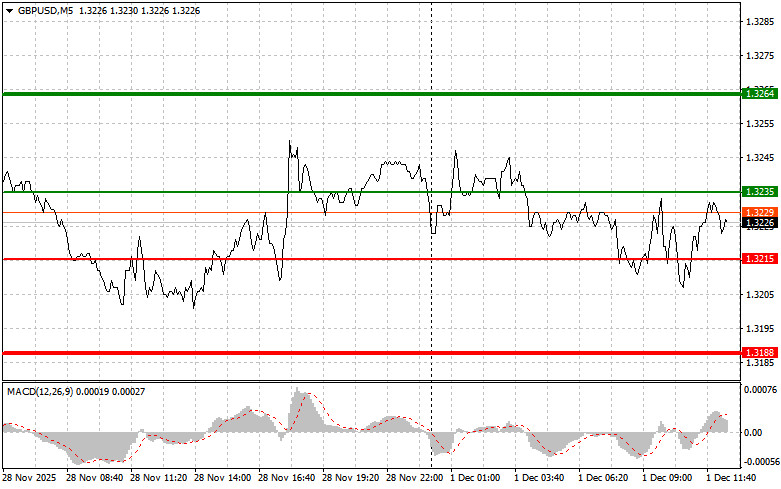

Scenario #1: Buy pounds today around the entry point at 1.3235 (green line on the chart) targeting a rise to 1.3264 (thicker green line). Around 1.3264, I plan to exit the buy position and open a sell in the opposite direction, expecting a 30–35 point move back from that level. Strong pound growth is possible today. Important: Before buying, ensure the MACD is above zero and just starting to rise.

Scenario #2: Buy pounds if the price tests 1.3215 twice while the MACD is in the oversold zone. This limits the pair's downward potential and may trigger a market reversal upward, with expected growth toward 1.3235 and 1.3264.

Sell Signal

Scenario #1: Sell pounds after breaking the 1.3215 level (red line), which would trigger a quick decline. The key target for sellers is 1.3188, where I plan to exit the sell and immediately buy in the opposite direction, expecting a 20–25 point reversal. Pressure on the pound is unlikely to return today. Important: Before selling, ensure the MACD is below zero and just starting to fall.

Scenario #2: Sell pounds if the price tests 1.3235 twice while the MACD is in the overbought zone. This limits upward potential and may trigger a market reversal downward, with expected decline toward 1.3215 and 1.3188.

Chart Notes

Important Notes for Beginners:

Forex beginners should be very cautious when entering the market. It's best to stay out before major fundamental reports to avoid sharp price fluctuations. If trading during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if trading large volumes without money management.

Remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on current market conditions is inherently a losing strategy for intraday traders.

LINKS RÁPIDOS