Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

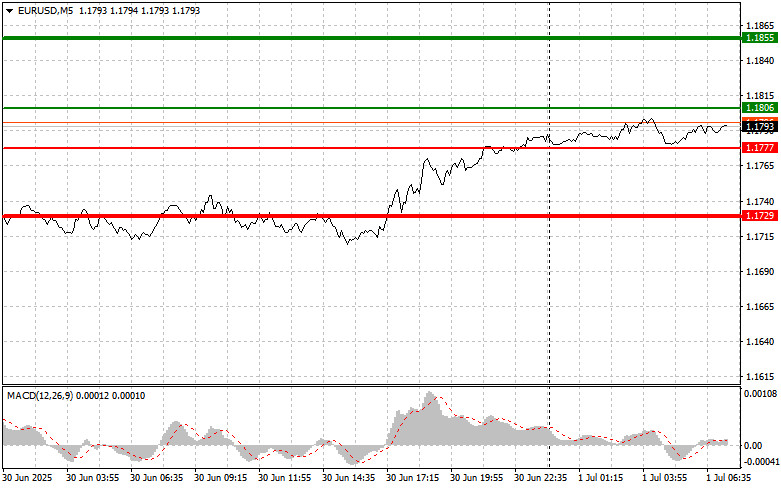

The price test of 1.1746 coincided with the MACD indicator having moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of this level occurred when the MACD was in the overbought zone, which enabled scenario #2 (sell) to play out, but a full-fledged decline in the pair still did not materialize.

News of the European Union's willingness to sign a trade pact with the United States triggered a rise in the euro. At the same time, the U.S. dollar significantly weakened. Market participants are likely concerned about deeper issues in the U.S. economy than previously assumed, which weakened the dollar's position. The long-term impact of the agreement remains to be seen, and experts are divided: some fear a new inflation spike due to tariff policies, while others view this as an opportunity to reform international trade and establish fairer conditions.

Today marks the release of key economic indicators for the Eurozone. Special attention will be paid to the manufacturing PMI. Additionally, data on the unemployment rate and the Consumer Price Index (CPI) will be published. The manufacturing PMI serves as an important leading indicator of economic growth. A value above 50 signals expansion in manufacturing, while a value below 50 points to contraction, which could weaken the euro. The unemployment data is also relevant—its decline signals labor market improvement, which may boost consumer spending and overall economic growth.

The most important indicator will be the CPI, which reflects inflation. Rising CPI could prompt the European Central Bank to refrain from further monetary easing, potentially supporting the euro.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Buy the euro today if the price reaches the area around 1.1806 (green line on the chart), targeting a rise toward 1.1855. At 1.1855, I plan to exit the market and open a reverse sell position, expecting a move of 30–35 pips from the entry point. Expect euro growth today if strong data is released.

Important! Before buying, ensure the MACD is above the zero line and is just beginning to rise from it.

Scenario #2: I will also consider buying the euro today after two consecutive tests of the 1.1777 level while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to an upward reversal. A rise toward the opposite level, at 1.1806 and 1.1855, can be expected.

Scenario #1: I plan to sell the euro once the price reaches 1.1777 (indicated by the red line on the chart). The target will be 1.1729, where I plan to exit the market and open a reverse buy position (expecting a 20–25 pip move in the opposite direction). Pressure on the pair may return today if data is weak.

Important! Before selling, ensure the MACD is below the zero line and is just beginning to move downward from it.

Scenario #2: I will also consider selling the euro today after two consecutive tests of the 1.1806 level while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels, 1.1777 and 1.1729, can be expected.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

LINKS RÁPIDOS