Yesterday's news that the European Union is ready to sign a trade agreement with the U.S., which includes a 10% universal tariff, led to the strengthening of the euro, the pound, and other risk assets while significantly weakening the U.S. dollar. Interestingly, the dollar used to react with buying to such news in the past. Traders now expect significantly larger problems in the American economy than they did before. The long-term consequences of the new agreements remain to be assessed. Some experts believe that tariff policies could spark a new wave of inflation, while others see them as an opportunity to reboot global trade and establish fairer conditions. It is essential to note that the agreement's details are still under discussion, and the final terms may differ from the announced ones, particularly since the EU is not willing to make concessions on key sectors, including pharmaceuticals, alcohol, semiconductors, and commercial aircraft.

Today, figures for the Eurozone manufacturing PMI are expected, which could put significant pressure on the euro, along with positive data on the Eurozone unemployment rate and consumer price index (CPI). Economists are closely monitoring these indicators as they provide insight into the health of the European economy amid global uncertainty. In particular, the manufacturing PMI is viewed as a leading indicator of economic growth. If it exceeds the 50-point threshold, this will indicate expansion in the manufacturing sector, which typically has a positive effect on the euro.

The unemployment data are also significant. A decrease in the unemployment rate could indicate an improvement in the labor market, which in turn may lead to increased consumer spending and economic growth. The CPI, reflecting the level of inflation, will also be closely analyzed. An increase in inflation is expected, which could prompt the European Central Bank (ECB) to adopt a more cautious, wait-and-see stance—thus supporting the euro.

It is also important to listen to what ECB President Christine Lagarde will say during her speech. Her comments on inflation, interest rates, and the outlook for Eurozone economic growth may become key market-moving catalysts.

If the data aligns with economists' expectations, it is advisable to rely on the Mean Reversion strategy. If the data turns out to be significantly above or below forecasts, the Momentum strategy would be more effective.

Buying on a breakout above 1.1805 may lead to a rise toward 1.1844 and 1.1875

Selling on a breakout below 1.1780 may lead to a fall toward 1.1745 and 1.1690

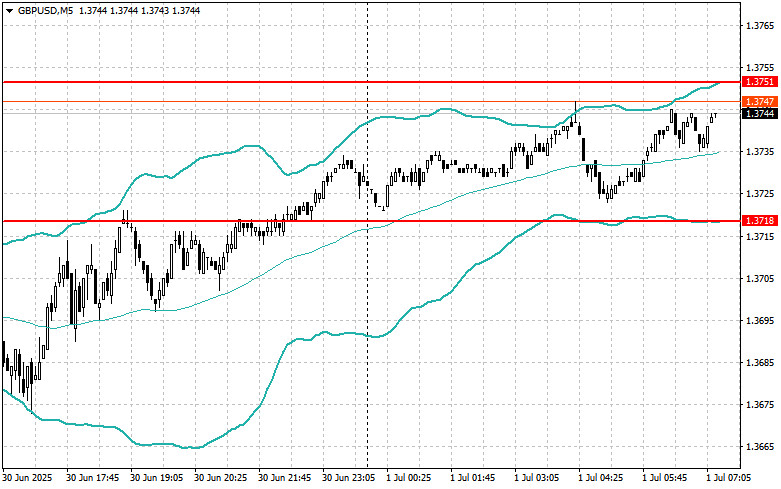

Buying on a breakout above 1.3760 may lead to a rise toward 1.3810 and 1.3860

Selling on a breakout below 1.3720 may lead to a fall toward 1.3675 and 1.3630

Buying on a breakout above 144.00 may lead to a rise toward 144.45 and 144.90

Selling on a breakout below 143.65 may lead to a drop toward 143.25 and 142.79

I will look to sell after a failed breakout above 1.1805, upon a return below this level

I will look to buy after a failed breakout below 1.1772, upon a return above this level

I will look to sell after a failed breakout above 1.3751, upon a return below this level

I will look to buy after a failed breakout below 1.3718, upon a return above this level

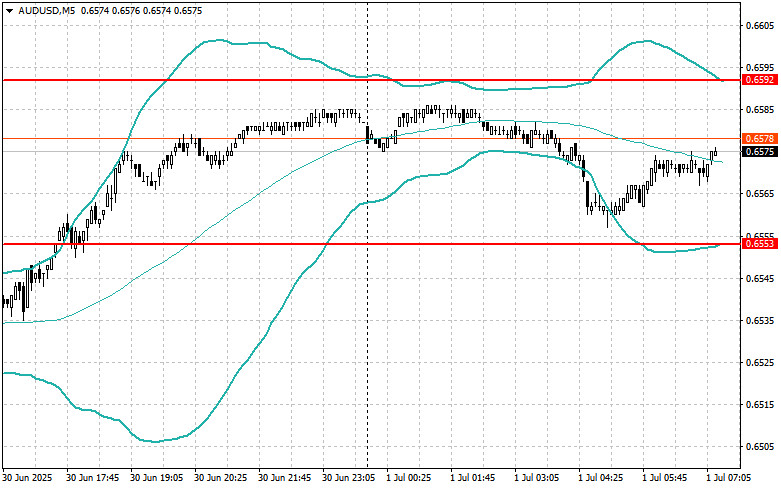

I will look to sell after a failed breakout above 0.6592, upon a return below this level

I will look to buy after a failed breakout below 0.6553, upon a return above this level

I will look to sell after a failed breakout above 1.3635, upon a return below this level

I will look to buy after a failed breakout below 1.3585, upon a return above this level

LINKS RÁPIDOS