Americké společnosti si v dubnu půjčily o 4,4 % méně na financování investic do vybavení ve srovnání se stejným obdobím loňského roku, uvedla ve středu Asociace pro leasing a financování vybavení (ELFA).

„Poptávka po novém vybavení mírně poklesla, ale zůstala zdravá, zejména s ohledem na všechny dubnové výkyvy,“ uvedl prezident a generální ředitel Leigh Lytle.

Nové úvěry, leasingy a úvěrové linky sjednané společnostmi v dubnu se snížily na 10 miliard dolarů z 10,2 miliardy dolarů v předchozím roce.

Obchodní asociace se sídlem ve Washingtonu, která sleduje ekonomickou aktivitu v sektoru financování vybavení v hodnotě více než 1 bilion dolarů, rovněž uvedla, že míra schvalování úvěrů v dubnu vyskočila na 77,4 % a dosáhla nejvyšší úrovně za více než dva roky.

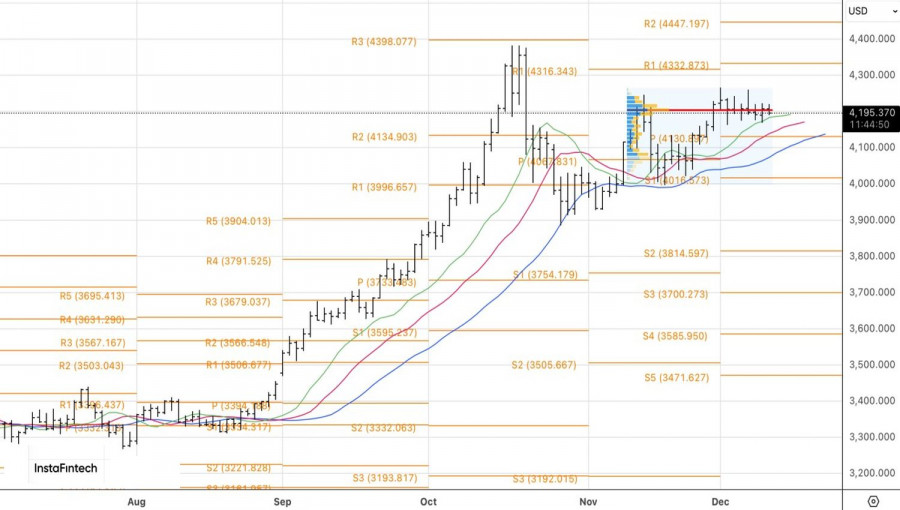

The bubble in the gold market was discussed at the end of October when XAU/USD prices plummeted off a cliff after reaching a record high. This conversation is still going on. The Bank for International Settlements warns investors not to get carried away with buying the precious metal, which increasingly resembles a risky asset.

Since the beginning of 2025, the S&P 500 has set 20 record highs, while gold has achieved 50. According to the BIS, for the first time in 50 years, a situation has emerged where both stock indices and the precious metal are in a bubble. The first sign is the activity of retail investors. Typically, FOMO, or the fear of missing out, manifests itself towards risky assets, but this year it has spread to XAU/USD as well.

Retail investors or the crowd have joined the gold rally and provided it with new momentum. Retail investors often act differently from institutional players. Large investors withdraw money from the stock market and are neutral towards precious metals. Meanwhile, smaller players are buying up anything they can, expecting the continuation of monetary expansion cycles and the associated cheap liquidity. However, it's not guaranteed that this will actually happen.

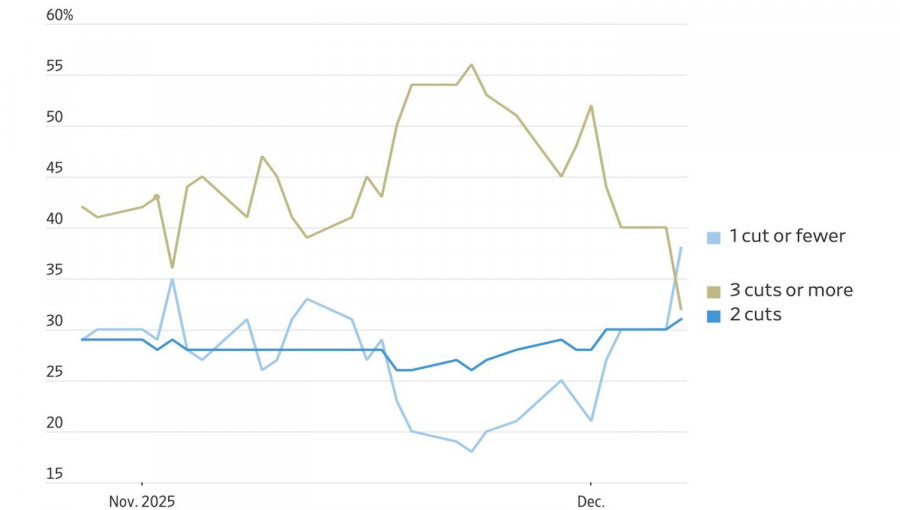

Dynamics of central bank rate expectations

Just a week ago, the futures market was confident that the Federal Reserve will cut the key interest rate to 3% in 2026. Now, there are doubts about two acts of monetary expansion by the Fed next year. Derivatives from Japan, Australia, New Zealand, and Sweden even expect tightening of monetary policy. "Hawkish" turns could lead to a weakening of the US dollar against major world currencies. However, Treasury yields are unlikely to fall significantly due to events unfolding in the global economy. Gold will lose important support and risks dropping below $4,000 per ounce if the Federal Reserve takes into account the views of other central banks. This opinion was expressed by Fitch Solutions.

On the contrary, RBC Capital Markets raised its forecasts for the precious metal to $4,600 in 2026 and to $5,100 in 2027, citing geopolitical risks, a persistent budget deficit, and the easing of monetary policy by the US central bank.

Market expectations for the federal funds rate

Heraeus believes the XAU/USD rally will be postponed until the second half of 2026. Since July, high investment demand, concerns over fiscal dominance, and purchases of bullion by central banks will lead to a recovery in the upward trend for gold.

In the short term, its fate will depend on the Fed's verdict and the forecasts of FOMC members regarding the federal funds rate. Jerome Powell's hawkish rhetoric could put the bulls in XAU/USD in their place.

Technically, on the daily chart, gold is experiencing short-term consolidation in the range of $4,165–4,265 per ounce. Only a breakout from this range will allow the precious metal to determine its further direction—upward or downward. In this situation, it makes sense to set pending orders to buy from $4,265 and sell from $4,165.

SZYBKIE LINKI