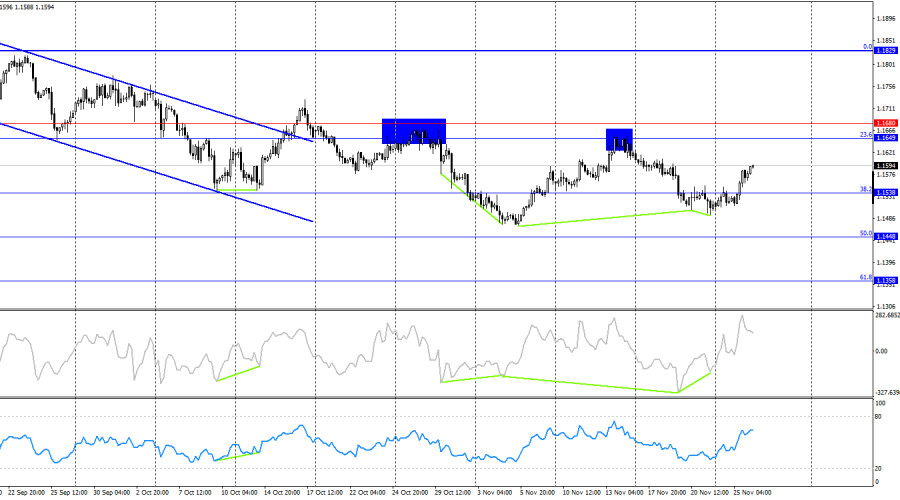

On Tuesday, the EUR/USD pair formed a clear rebound from the 76.4% corrective level at 1.1517, reversed in favor of the euro, and rose toward the 61.8% corrective level at 1.1594. A rebound from the 61.8% level will work in favor of the US dollar and lead to a new decline toward 1.1517. Consolidation above 1.1594 will increase the likelihood of continued growth toward the resistance level of 1.1645–1.1656.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave did not break the peak of the previous one, and the last completed downward wave did not break the previous low. Thus, the trend remains bearish for now. The bulls have launched an offensive, but their efforts are still not enough to form a trend. To consider the bearish trend complete, the pair needs to rise above 1.1656.

On Tuesday, the US news background significantly helped the bullish traders, and the bulls finally did not miss their chance to attack. Three reports on the US economy were released yesterday, and two of them came in worse than expected. If the Producer Price Index can be considered conditionally neutral, retail sales volumes fell short of forecasts, and the ADP report showed a decline of 13.5 thousand jobs. Thus, the bulls had the opportunity to go on the offensive—and they did. In my view, the overall fundamental backdrop remains negative specifically for the dollar, as no disappointing news has recently come from the Eurozone. The ECB is not planning to cut interest rates, while the Federal Reserve is very likely (over 80%) to deliver its third monetary easing this year in December. Traders still have no new labor market data, so at the beginning of December, the dollar may face a new threat of a serious decline. If the labor market once again shows weakness, this will be an additional reason to sell the US dollar.

On the 4-hour chart, the pair reversed in favor of the euro after two bullish divergences formed on the CCI indicator. The pair consolidated above the 38.2% corrective level at 1.1538, allowing traders to count on continued growth toward the resistance level of 1.1649–1.1680. No new forming divergences are observed today on any indicator. A rebound from the 1.1649–1.1680 level will work in favor of the dollar and lead to some decline.

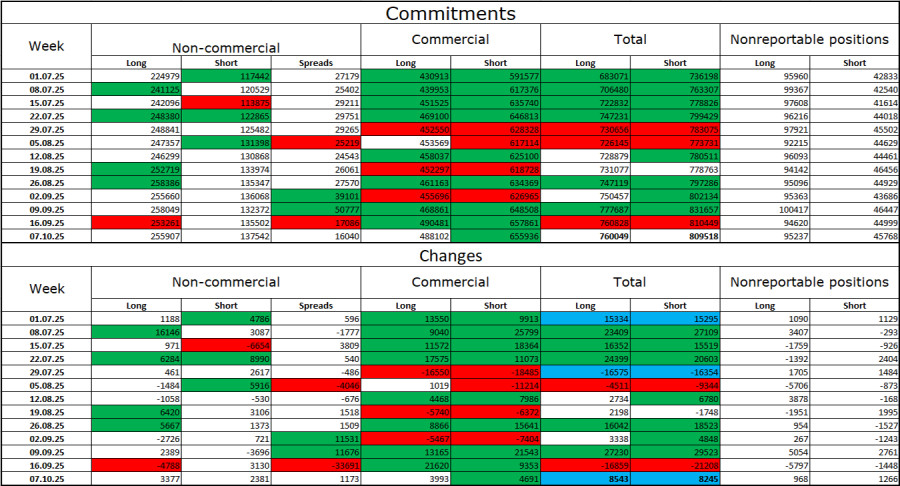

Commitments of Traders (COT) Report:

During the last reporting week, professional traders opened 3,377 long positions and 2,381 short positions. COT reports have resumed after the government shutdown, but the data is still outdated — from October. The sentiment of the "Non-commercial" group remains bullish, strengthened by economic and policy developments, and continues to grow over time. The total number of long positions held by speculators is now 255,000, while short positions number 137,000.

For thirty-three consecutive weeks, large players have been reducing short positions and increasing long ones. Political developments remain a major factor for traders, as they may lead to long-term structural challenges for the US economy. Despite the signing of several trade agreements, many key economic indicators are falling, and the dollar is losing its status as a "global reserve currency."

News Calendar for the US and the Eurozone:

On November 26, the economic calendar contains three entries, but only one can be considered significant. The impact of the news background on market sentiment will appear in the second half of the day.

EUR/USD Forecast and Trading Tips:

Selling the pair today will be possible after a rebound from the 1.1594 level on the hourly chart, with a target of 1.1517. However, I expect new growth. Buying opportunities were available after the rebound from 1.1517 on the hourly chart, with a target of 1.1594. That target has been reached. New long positions may be opened after a close above 1.1594, with a target of 1.1645–1.1656.

Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.

SZYBKIE LINKI