The GBP/USD currency pair traded more actively on Thursday following macroeconomic data from across the Atlantic. In our discussions about the Non-Farm Payrolls and unemployment reports, we emphasize that the local macroeconomic events impact how the market reacts. However, in this article, we'll focus on more global factors.

The data on unemployment and Non-Farm Payrolls, which the market had awaited for a month and a half, was released yesterday. However, we must immediately ask ourselves: what does it really change? It doesn't matter whether Non-Farm Payrolls increased or decreased, or if they exceeded forecasts— the Federal Reserve will not make monetary policy decisions in December based on three-month-old data. Data for October and November are needed, but the Bureau of Labor Statistics has already stated that the October report will not be published on time. The Bureau simply cannot gather reliable and relevant information for a month when neither it nor most government agencies were operational.

Thus, the September data has become outdated, and there will simply be no October data. The straightforward conclusion is that we have to wait until early December when the November Non-Farm Payrolls and unemployment data are released. Even those reports will be overshadowed by the inflation report. The Fed lowered the key rate twice, and in the past three weeks, nearly all members of the Monetary Committee (except, of course, Stephen Miran) have indicated that further rate cuts without a pause and without relevant data could be dangerous, risking an acceleration of consumer price growth.

Therefore, the Fed needs a pause in December to gather the entire set of current statistics and analyze it. The next meeting is scheduled for January 28, and by that time, the central bank will receive another batch of data on the labor market, unemployment, and inflation. This will allow a decision on rates to be made based on the trend that has been forming since September, when the Fed resumed easing monetary policy.

Meanwhile, the British pound has once again not shown the expected growth based on global factors, but it should be acknowledged that the British currency has had legitimate reasons for its decline in recent weeks. The UK's macroeconomic information package has been disappointing, and inflation has decreased, practically guaranteeing a rate cut by the Bank of England at its next meeting. This potential rate cut may not have been necessary at all. The failure of statistics, the rise of "dovish" expectations, and ongoing statements from Rachel Reeves (who cannot decide whether to raise taxes in the UK) lead to the pound's depreciation. Thus, the recent decline in the British pound appears logically consistent, though it had been falling for a month and a half for other reasons. The pound should have remained within its sideways channel, just like the euro, but instead, it broke out of it. Nonetheless, we still anticipate a new wave of global upward trend.

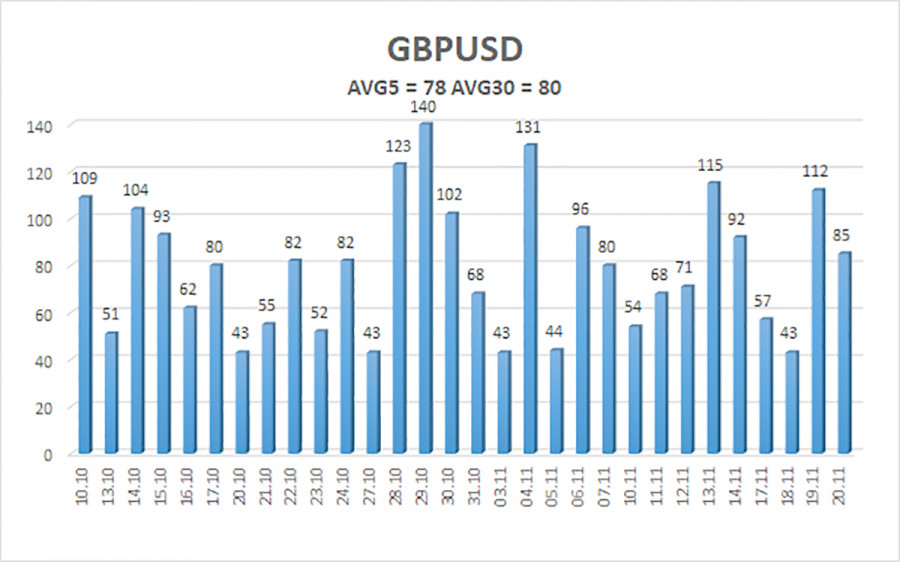

The average volatility of the GBP/USD pair over the last five trading days is 78 pips and continues to decline. Therefore, on Friday, November 21, we expect movement within a range limited by the levels of 1.3003 and 1.3159. The upper channel of the linear regression is directed downward, but this is only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area for the sixth time in recent months, forming another bullish divergence.

The GBP/USD currency pair is attempting to resume its upward trend for 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to pressure the dollar, so we do not expect the U.S. currency to grow. Thus, long positions targeting 1.3306 and 1.3428 remain relevant for the near term when the price is above the moving average. If the price is below the moving average, small shorts can be considered targeting 1.3000 on technical grounds. From time to time, the U.S. currency exhibits corrections on a global scale, but real signs of the end of the trade war or other positive global factors are needed for sustained strengthening.

SZYBKIE LINKI