Global markets remain in turmoil: gold is hitting an all-time high amid the escalating US-China trade war, while Bitcoin and major altcoins are experiencing a massive sell-off.

At the same time, institutional players aren't standing idle — whales are buying up Ethereum worth hundreds of millions during the dip. Meanwhile, in the tech sector, Apple has made a strategic acquisition of startup Prompt AI to bring cutting-edge innovations into the smart home space. Read a detailed breakdown of these events and get recommendations on how to navigate the current wave of high volatility.

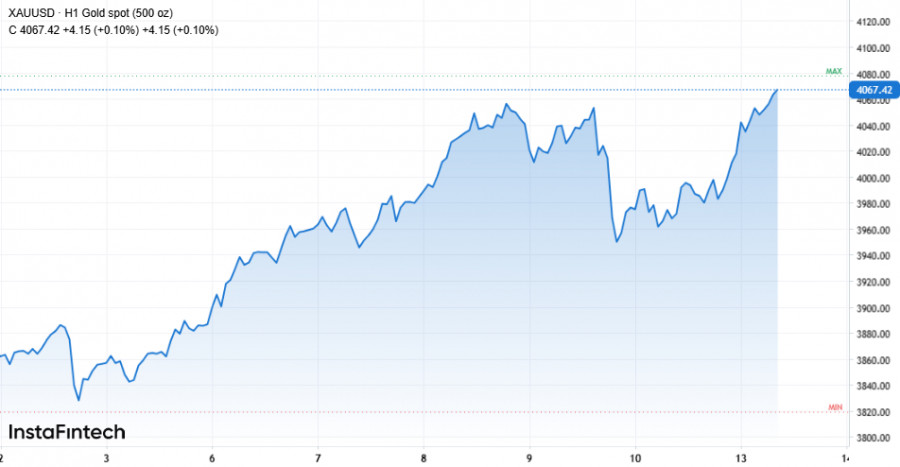

Gold sets new records: why markets are on edge and how traders can profit

On October 13, global financial markets were stunned as gold surged to a new all-time high of $4,059.30 per ounce. It was hard to imagine the precious metal would rise to such heights so quickly — but as often happens in times of global turmoil, reality has once again exceeded all forecasts. In this article, we'll explore what's driving the rapid rise in gold prices, what consequences may follow, and why this situation offers promising opportunities for traders and investors.

At the start of the week, gold climbed 0.7%, testing a new historic peak at $4,059.30. Silver wasn't far behind, jumping 2% to a record $51.52. These sharp moves were a direct result of the intensified trade war between the US and China. Donald Trump once again rattled markets by promising 100% tariffs on Chinese imports along with new restrictions on the export of critical technologies. China opted not to respond with mirror tariffs but rather with "strategically justified" countermeasures — which did little to calm investor nerves.

Experts agree: geopolitical tensions in the Middle East have taken a backseat this time — the spotlight is on the escalating trade confrontation between global superpowers. Investors are flocking to gold, the ultimate "safe-haven" asset, as uncertainty and chaos continue to dominate the headlines.

The market is also being fueled by expectations of further action from the Fed: nearly 100% of market participants anticipate a 25 basis point rate cut in October, with another cut expected by December. This only increases interest in gold, as looser monetary policy typically boosts its appeal. It's no surprise that demand for the metal has surged by 54% year-over-year, driven by massive central bank purchases, strong inflows into ETFs, and rising anxiety over global debt and tariffs.

Silver is also in the spotlight. According to Goldman Sachs, silver is expected to see medium-term growth, fueled by inflows from retail investors, though with significantly more volatility than gold. For thrill-seeking traders, these conditions are ideal.

Meanwhile, political instability is adding fuel to the fire. The US government shutdown drags on, the release of key economic data is delayed, and Trump is blaming Democrats for mass layoffs of federal workers. In short, there are plenty of reasons for investors to be nervous — and gold is clearly leading as the preferred safe-haven for capital preservation.

Bottom line: gold is now the ultimate indicator of global anxiety. Its rally is just beginning, and even all-time highs don't seem like a ceiling. Expectations of further Fed easing, trade wars, and a weakening macroeconomic backdrop in developed countries could push prices even higher.

For traders, this is a golden opportunity — literally. Volatility and demand are creating ideal conditions for both short- and medium-term speculation. It's wise to consider long positions on pullbacks and breakouts of new highs. Don't forget about well-placed stop-losses and profit-taking: the moves are sharp, and the market is jittery.

For long-term investors, cautiously increasing gold exposure can be a strong defensive strategy as the world braces for potential new crises. Now it all comes down to your trading discipline — and your ability to act decisively in a world full of instability.

Bitcoin crashes below $105,000: new trade war escalation turns crypto market into a panic arena

Last week was truly intense for the crypto market: news of a sharp escalation in the US-China trade conflict sent Bitcoin plunging below $105,000. Donald Trump, ever the architect of economic shocks, announced new 100%-130% tariffs on Chinese imports and tighter controls on the export of strategic software. In this piece, we'll break down why these measures triggered a sell-off, what's currently happening in the crypto market, and how traders can capitalize on the chaos.

The situation escalated after China imposed export restrictions on rare earth metals, provoking a storm of retaliation — first on Truth Social, then with real tariffs from the White House. Trump did not hold back, accusing Beijing of "aggressive policy" and "resource monopolization." The result? Bitcoin, which had recently been approaching $120,000, lost over 10% in a matter of hours, dropping to $105,000. Other crypto assets followed: Ethereum fell 16%, Solana dropped 20–30%, and XRP plunged 32%. The total crypto market cap shrank by a quarter trillion dollars, falling from $4.27 trillion to below $4 trillion — the biggest collapse since August.

The crash was further intensified by a liquidation avalanche: leveraged positions worth $7 billion were wiped out within hours, with over 80% of those being long positions. Exchanges struggled to handle the load, and liquidation tracking services even went offline due to overwhelming traffic — a clear sign of how widespread the panic was.

Ironically, cryptocurrencies — often considered a hedge against traditional finance — turned out to be highly vulnerable to classical geopolitics. A breakdown in diplomacy (Trump even canceled a meeting with Xi Jinping at the APEC summit) only deepened the unease. Traditional markets were hit too: S&P 500 fell 2.7%, Nasdaq dropped 3.5% — hardly good news for long-term investors.

What's the bottom line?

This phenomenal volatility once again proves that the crypto market is not just driven by technology, but by news flow and global uncertainty. But those who profit aren't the ones who panic — it's those who thrive in turbulence. Sharp collapses often lead to technical rebounds. In the midst of the noise, traders can capitalize on support levels and short-term strategies.

Widening spreads between platforms create room for arbitrage, while solid risk management becomes a matter of survival:

Experienced traders can use the current situation to find short entries or take advantage of highly volatile altcoins. Most importantly, closely monitor new statements from the US and China — any signal of de-escalation or fresh tariff threats could instantly reshape the price landscape.

If you're looking for a platform to implement these strategies and stay one step ahead of the market, open an account with InstaForex. You'll gain access to tools for fast, flexible trading, real-time news response, and market insights through our mobile app.

$182M in Ethereum: whales are buying while the market panics

On October 11, 2025, the crypto market once again fell hostage to chaos: in the wake of Washington's hardline economic stance — following Trump's promise of 100% tariffs on Chinese imports — Ethereum crashed from $4,300 to $3,400 in mere hours.

While most retail investors scrambled to dump their digital assets, whales — major funds and institutional players — took advantage of the panic, buying up a whopping $182 million worth of ETH. Let's break down what's happening, who's behind it, and what opportunities this creates for traders — without the fear-mongering.

As usual, panic among small investors turned into a shopping spree for the big players. Mass liquidations of leveraged positions worth $19 billion turned the market into a discount sale — one that seasoned investors couldn't ignore.

According to Lookonchain, just two newly created wallets — reportedly linked to BitMine — withdrew 33,323 ETH ($126.4 million) from major exchanges. Add to that an OTC player who bought 14,165 ETH (around $56 million), and you have just the visible part of a massive accumulation.

One standout example: BitMine Immersion Technologies, led by Thomas Lee of Fundstrat. The company has already accumulated 2.83 million ETH (about $13.4 billion), representing over 2% of the total ETH supply. Lee even announced an ambition to acquire 5% of all circulating ETH — an aggressive move that hasn't gone unnoticed.

In the midst of the chaos, institutional investors are doing the opposite of the crowd: when others sell, they buy. No wonder that after the crash, over 230,000 ETH ($900+ million) was moved from centralized exchanges to cold wallets.

As a result, ETH exchange reserves have hit their lowest levels since 2016, now standing at just 14.8 million ETH — a 52% drop in available supply over the years. For long-term holders, this represents a golden opportunity: the lower the supply, the higher the growth potential, assuming demand holds — a principle proven across all commodity markets.

The ETH shortage has been amplified by surging institutional demand. Since April alone, 68 institutions have purchased over 5.2 million ETH ($21.7 billion). Add to that Ethereum ETFs, which hold 6.75 million tokens, and nearly 10% of the total ETH supply is now under whale control. The market is quietly tilting toward a potential rally, awaiting the next positive catalyst.

Takeaway:

When the crowd panics, the smart money buys strong assets. Those who follow the professionals — not the herd — tend to win.

For traders, the current conditions are ripe: speculators can profit from rebounds and quick price reversals. Long-term investors may use the dip to increase ETH exposure and prepare for the next growth wave.

Our advice is simple:

The professionals are already building positions — perhaps now is your time to join them and turn this global turbulence into your perfect entry point.

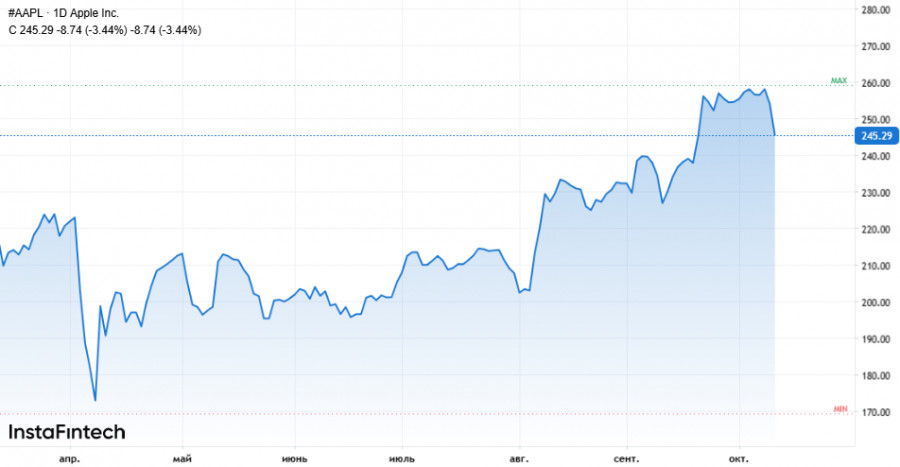

Apple strengthens HomeKit: another quiet acquisition promises a big leap for the Smart Home

Apple is preparing for a new strategic acquisition — a targeted buyout of Prompt AI, a computer vision startup. This small team of 11 has spent the past two years building Seemour, a service for home security cameras that can recognize people, animals, and vehicles, send real-time alerts, and most notably, generate text-based descriptions of what's happening on video. In this article, we'll explore what Apple gains from this deal, why it could reshape the smart home market, and how traders and investors should react.

Apple is structuring the deal as an acquihire — meaning part of the Prompt AI team will join Apple, and the technology will be integrated into Apple's products. Some employees will be offered new roles in Cupertino, while others may see pay cuts or be encouraged to seek opportunities elsewhere. According to reports, investors will receive a partial return on their funding. Apple's interest is less about the finished product and more about the talent and innovation behind it.

The Seemour technology has the potential to make smart home cameras truly smart. AI-powered cameras will be able to identify people, track vehicle movement, distinguish pets, and send detailed and user-friendly alerts. The ultimate goal is to integrate these features into HomeKit, boosting Apple's competitiveness in the smart home device market. Notably, competitors like Elon Musk's xAI and Neuralink also showed interest in Prompt AI, but the startup ultimately chose to go with Apple.

Prompt AI's business model couldn't withstand the pressure from larger players. The startup's management has already announced that the Seemour app will shut down, all user data will be deleted for security reasons, and the entire team will move to Apple.

This move is a clear example of how Apple builds technological leadership not by acquiring huge companies, but by quietly bringing in small but talented teams. Before launching new products with advanced features, Apple strategically absorbs top talent and neural network solutions — allowing for rapid innovation across its ecosystem. This approach proved highly effective during the development of Vision Pro and object recognition technologies in iPhones.

While there's no official confirmation of the deal yet, if the transition of staff and integration of technology happens in the coming weeks, Seemour users will receive notifications about the app's shutdown and data deletion.

For Apple fans, the key question will be: how soon will Prompt AI's innovations appear in HomeKit, and how much will they improve smart home devices?

Key takeaway:

Apple's small, niche startup acquisitions have long been a hallmark of its digital strategy. For traders, this is a signal: don't overlook such deals. They may not instantly affect stock prices, but they often become powerful catalysts for long-term value growth.

Recommendation for investors and traders:

Keep a close eye on news about HomeKit feature integration and monitor Apple's moves in the fields of AI and computer vision. Stories like these often lay the groundwork for future tech rallies, even if they seem subtle at first.

And remember — big companies know how to turn low-profile acquisitions into massive competitive advantages.

Don't miss your chance to capitalize on these trends: open an account with InstaForex to gain access to advanced tools for trading the biggest tech stocks. Track the market in real-time with our mobile app and make informed decisions anytime, anywhere!

SZYBKIE LINKI