The GBP/USD currency pair has been falling actively for the past few weeks, without any solid or objective reasons. Or to be more precise, the number of compelling GBP-selling factors has been even fewer than those for the euro. However, switching to the daily timeframe immediately shows that the British pound has been trading sideways for months.

Therefore, the current decline holds little significance. In fact, the lower the pair drops now, the higher it is likely to rise later. We fully expect the decline to continue toward the last local low near 1.3140, from which the next bullish wave for the pound may begin.

Let us recall once again that the U.S. government shutdown has been in effect since October 1. Macroeconomic data is not being released, which means the market has nothing new to react to.

Reports such as final inflation numbers from Germany and the Eurozone. These are secondary indicators for several reasons. First, second estimates rarely differ from the initial release. Second, inflation is not an immediate threat to the European Central Bank, which has already made that clear. Third, ECB President Christine Lagarde has stated outright that there is no need to change the key rate in the near term—the current inflationary level suits the central bank just fine.

What else? Economic sentiment indexes? Industrial production data? More speeches from Powell and Lagarde that provide meaningful insights once in ten appearances? Both Powell and Lagarde spoke last week, and neither offered anything new.

Lagarde remains neutral, and Powell won't have a reason to shift his tone until the shutdown ends and the Fed has access to fresh data on jobs, inflation, and economic growth. So there are no notable updates expected from him in the near term.

In fact, the key U.S. inflation report originally scheduled for this week will not be published. The same applies to unemployment claims, producer prices, and retail sales—all of which are delayed. As a result, the most "meaningful" report releases this week will come from the U.K. But expectations remain low.

The following indicators will be published in the U.K.:

If any of these surprise significantly, the market may react, but the broader sentiment is dictated by global events—not by British macroeconomic data. More likely, the market will continue pricing in Trump's escalating trade war with China starting Monday.

Even if the downward correction persists, it's highly probable that this is merely setting the stage for bulls to re-enter at more favorable levels ahead of the next upward wave of the 2025 bullish trend. So one way or another, we continue to expect upward movement in the long term. The British reports are interesting, but global geopolitical developments are clearly shaping current market sentiment—and there are plenty of them right now.

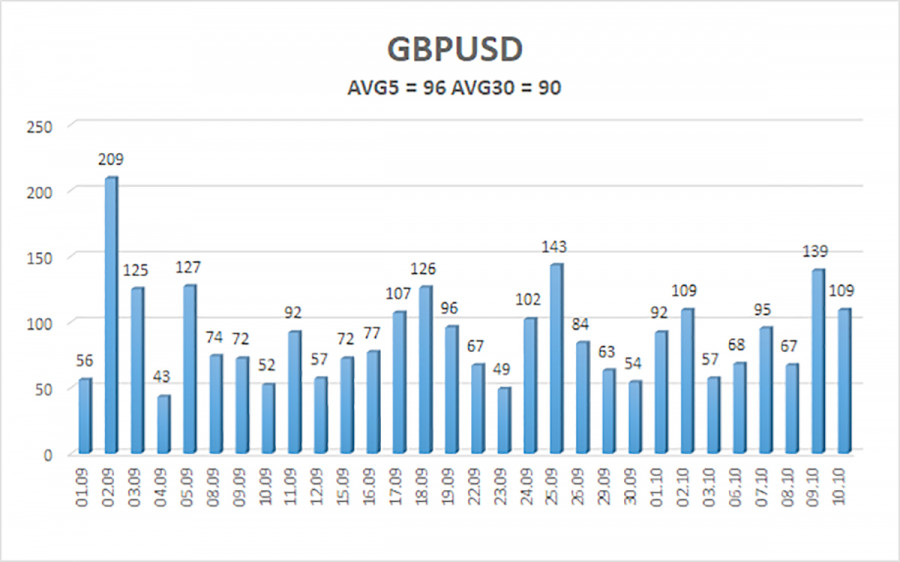

The average volatility of the GBP/USD pair over the past five trading sessions is 96 pips, which is considered "average." Thus, for Monday, October 13, we expect the pair to trade between 1.3259 and 1.3451.

The higher linear regression channel is still pointing upward, confirming the longer-term bullish trend. The CCI indicator entered oversold territory for a third time—another signal warning of a likely resumption of the upward trend.

The GBP/USD pair is undergoing a technical correction, but its long-term outlook remains bullish. The policies of Donald Trump will likely continue pressuring the U.S. dollar, and we do not expect substantive strengthening from the greenback in the current environment.

Therefore, long positions with targets at 1.3672 and 1.3733 remain highly relevant as long as the price is trading above the moving average.

When the price is below the moving average, short-term short positions can be considered with targets at 1.3259 and 1.3245, based solely on technical signals.

From time to time, the dollar makes corrections—as it is now—but it will require resolution of the trade war or some other global-positive catalyst to turn the trend durable in its favor.

SZYBKIE LINKI