Šéf společnosti Primark George Weston potvrdil, že značka pokračuje v expanzi v USA, přestože hrozí nejistota kolem celní politiky prezidenta Trumpa.

Primark aktuálně provozuje 29 prodejen a plánuje dosáhnout 60 poboček do roku 2026.

Weston uvedl, že firma je připravena čelit případným celním zásahům a zároveň věří, že konec výjimky „de minimis“ by mohl podpořit zájem amerických zákazníků o nákupy v kamenných obchodech. Jeho komentáře následovaly po zveřejnění pololetních výsledků mateřské skupiny AB Foods.

The fresh US consumer inflation data released Thursday showed an increase, with the month-on-month number coming in above forecasts. What's next? Will this stop the Federal Reserve from cutting rates?

Yesterday's inflation report showed an annual CPI increase from 2.7% to 2.9%, in line with expectations. But the August month-on-month figure jumped to 0.4% (from 0.2% in July), versus a forecast of 0.3%.

Let's look at how markets reacted yesterday and what's likely from the Fed next week.

As I suspected earlier, markets have fully priced in a 100% probability of a 0.25% rate cut—basically, no one doubts this any longer. Stock markets unambiguously moved higher on the CPI news. Now, investors are focused on the odds of a 0.50% cut—a scenario with just an 8% probability. Meanwhile, the dollar's decline against a currency basket on Forex was minor and, in my opinion, justified.

Even back in summer, I suggested that dollar weakness from lower ICE index rates would be limited—mainly due to the pressure (economic and political) the US (especially under Trump) has put on the economies whose currencies are in the ICE Dollar Index basket, through tariffs and financial obligations that effectively amount to the US extracting rents from these countries. Following earlier rate cuts by these central banks, don't expect much strength or growth in their currencies against the US dollar now.

Considering the impact of the inflation report, I do not think it will stop the Fed from lowering the key rate by 0.25% on September 17. There are currently no real economic grounds for a 0.50% cut if you look just at the CPI. If it happens, it would be more for political reasons, under pressure from D. Trump and Treasury Secretary S. Bessent.

What should we expect on the markets today? I believe there is a high probability of a correction in equity markets, especially in the US, in anticipation of the Fed's final rate decision. On this correction, the dollar may get a bit of support, which could also result in local gold price weakness. A minor correction of major currencies against the dollar can also be expected on Forex.

Starting today, investors may already take a wait-and-see approach in the run-up to the Fed meeting on September 16–17.

The S&P 500 CFD, after setting a new all-time high, is trading above support at 6577.00. Before the Fed meeting, expect a correction that could pull the contract down to 6528.75 if support is broken. The 6572.25 level can be used as a sell trigger.

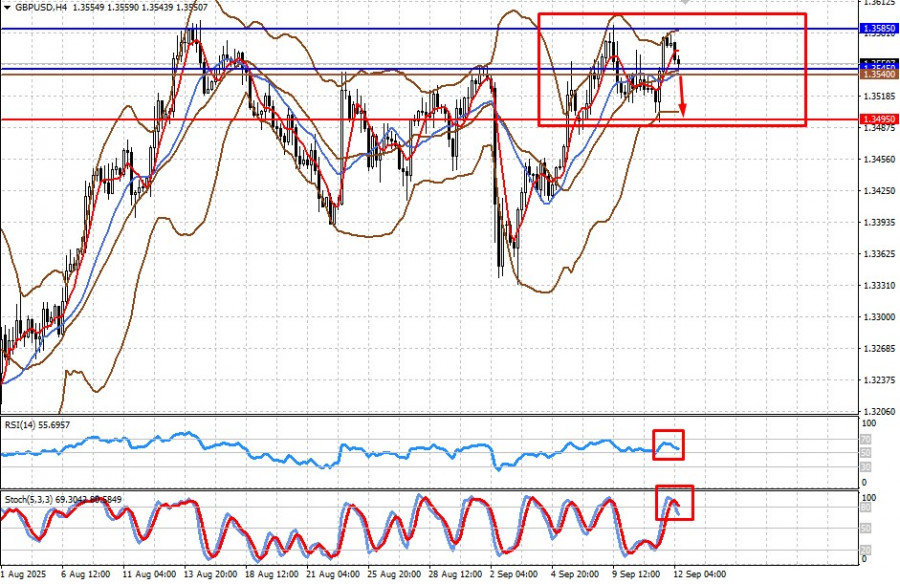

The pair remains in a deep sideways trend and is correcting lower ahead of the Fed's rate decision. If it drops below 1.3545, a move down to 1.3495 becomes likely. The 1.3540 mark serves as a viable sell trigger.

SZYBKIE LINKI