On Tuesday, the EUR/USD currency pair nearly fully recovered from Monday's decline. As reality has shown, strong reasons are required for the U.S. dollar to strengthen, such as progress in trade negotiations with major countries, tariff reductions, or the signing of trade agreements. Routine economic reports or even Federal Reserve meetings have almost no effect on market sentiment. On the other hand, it takes very little to trigger a dollar decline: a basic inflation report, market expectations of an upcoming Fed rate cut, or even no trigger at all. Yesterday, the U.S. dollar started weakening overnight. In the afternoon, the U.S. inflation report showed a slowdown, and the market immediately began anticipating that the Fed might lower rates as early as the next meeting. Official statements from Jerome Powell about keeping monetary policy unchanged through the end of the year appear irrelevant—the market decides for itself when the Fed will ease.

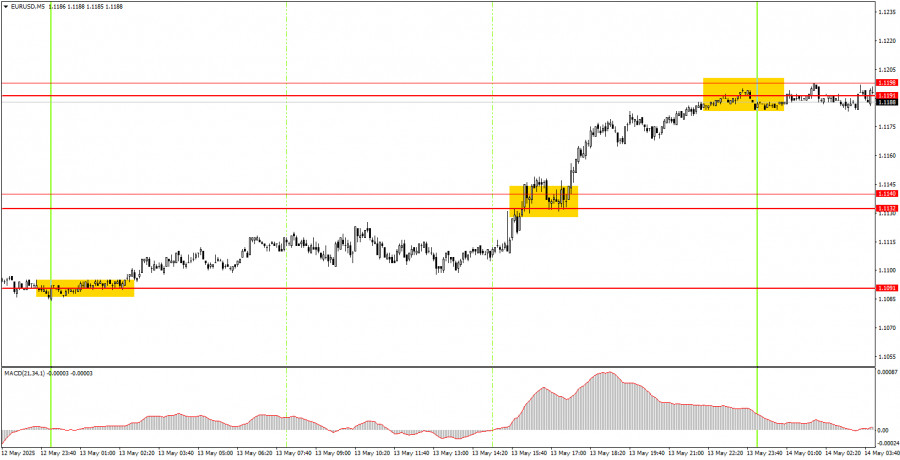

On Tuesday, at least two strong trading signals were formed on the 5-minute timeframe. First, the price rebounded from the 1.1091 level, and then it broke through the 1.1132–1.1140 area. In both cases, long positions were possible. By the end of the day, the pair reached the 1.1191–1.1198 area, so both trades closed in profit.

In the hourly time frame, EUR/USD has finally started a semblance of a downward trend. Overall, market sentiment remains strongly negative toward the U.S. dollar. However, since Trump has embarked on de-escalating the trade conflict he initiated, the dollar could improve its position in the near term. The extent of the dollar's rise will depend on how many agreements are successfully signed.

On Wednesday, the EUR/USD pair is expected to trade based on technical factors. Yesterday indicated that the market is still reluctant to buy the dollar. If the decline persists today, it would not be surprising.

On the 5-minute TF, we should consider the levels of 1.0940-1.0952, 1.1011, 1.1091, 1.1132-1.1140, 1.1191-1.1198, 1.1275-1.1292, 1.1413-1.1424, 1.1474-1.1481, 1.1513, 1.1548, 1.1571, and 1.1607-1.1622. In the European Union, only one event is scheduled for Wednesday—the German inflation report. In the United States, there is no scheduled news for today. Therefore, if Trump does not take the spotlight again, today may experience low volatility and minimal movements.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

SZYBKIE LINKI