U.S. stock index futures plunged again following NVIDIA's earnings report, but after testing the weekly low, risk appetite returned, helping the American stock market recover. During today's Asian trading session, S&P 500 futures rose 0.3%, while the tech-heavy NASDAQ added 0.5%.

Asian stocks declined on Thursday as investors analyzed the latest statements from U.S. President Donald Trump regarding tariffs. Chinese indices and tech stocks in Hong Kong dropped, while the 10-year U.S. Treasury yield edged higher. European stock index futures fell 0.9% after Trump announced 25% tariffs on all goods imported from the European Union. He also reiterated that the previously announced tariffs on Mexico and Canada will take effect on April 2.

Trump's comments were at times contradictory, causing market confusion. The tariffs on the U.S.'s neighboring countries were originally expected to take effect next month, and there had been no prior mention of tariffs on the EU.

NVIDIA shares fell after market close, as the chipmaker delivered good—but not exceptional—quarterly results, disappointing investors who have grown accustomed to explosive earnings beats. The report provided some reassurance that the company's growth remains on track, but it was not the strong upside catalyst investors were hoping for.

Many analysts believe that NVIDIA may no longer have the same market-driving impact it once did, and that U.S. stocks could continue to struggle with a lack of short-term catalysts. The company's current performance is not enough to fully ease concerns about geopolitical risks, tariffs, and the evolving AI landscape.

Additionally, NVIDIA warned that its gross margin will be lower than expected as it rushes to release its new Blackwell chip. There is also concern that U.S. tariffs could impact the company's future earnings.

This year, NVIDIA shares have already declined due to fears that data center operators may cut back on spending. The rise of Chinese AI startups, such as DeepSeek, has further fueled concerns that AI chatbots can be developed at lower costs, potentially reducing demand for NVIDIA's high-performance AI chips.

Traders have revised their expectations for two quarter-point rate cuts from the Federal Reserve this year. Morgan Stanley now forecasts more aggressive monetary easing, citing a series of disappointing U.S. economic reports in recent weeks.

The upcoming Personal Consumption Expenditures (PCE) Price Index—set for release on Friday—will be crucial in determining the Fed's next policy move. If the data signals slower price growth, it could strengthen the case for rate cuts, further influencing investor sentiment.

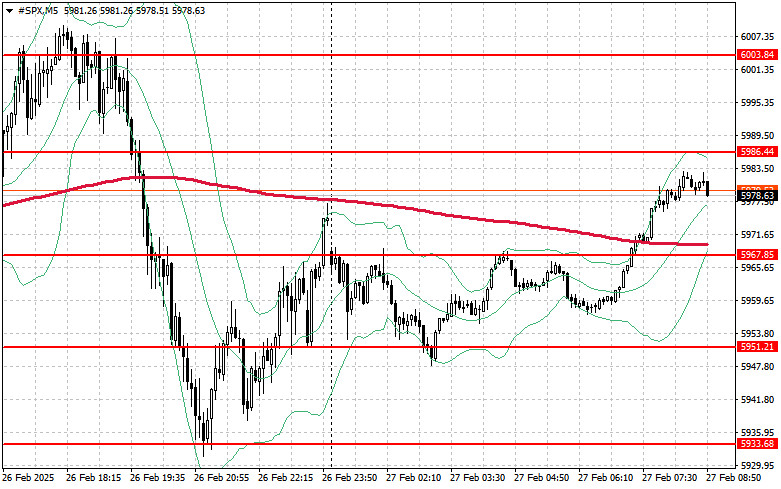

Demand for S&P 500 remains strong.

The key objective for buyers today is to break above the nearest resistance at $5,986, which would extend the rally and potentially lead to a test of $6,003. A further push above $6,024 would strengthen the bullish momentum.

However, if risk appetite declines, buyers must defend support at $5,967. A break below this level could push the index down to $5,951, with the next major support at $5,933.

SZYBKIE LINKI