The USD/JPY pair remains under pressure, extending its downward movement for the second consecutive session, with spot prices now hovering just above the psychological level of 150.00. This leaves the pair vulnerable to further downside, as the hawkish expectations surrounding the Bank of Japan (BoJ) continue to shape market sentiment.

Recent statements from BoJ Governor Kazuo Ueda and Deputy Governor Himino have reinforced expectations of a possible interest rate hike, contingent on economic and inflation trends aligning with the central bank's projections. BoJ board member Hajime Takata has also highlighted that real interest rates in Japan remain deeply negative, suggesting that the central bank may need to adjust its monetary policy stance should economic conditions evolve as expected.

The strong GDP report from Japan, coupled with rising inflationary pressures, further suggests that the BoJ could raise borrowing costs. According to a Reuters survey, the majority of economists anticipate that the Bank of Japan will increase interest rates to 0.75% in Q3 2025. This expectation has pushed Japanese government bond (JGB) yields to their highest levels since November 2009, strengthening the yen's appreciation trend.

Additionally, concerns about a potential global trade war—triggered by the U.S. President Donald Trump's threats of new tariffs—are weighing on investor risk appetite. This has further supported demand for the safe-haven yen.

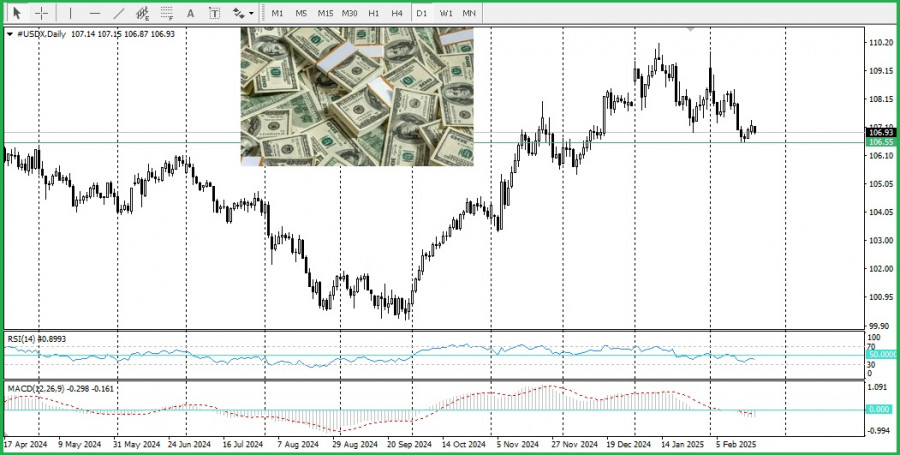

Meanwhile, the decline in U.S. Treasury yields has added pressure on the U.S. dollar, preventing it from staging a meaningful rebound from its two-month low. However, the hawkish FOMC meeting minutes released on Wednesday reinforced expectations that the Federal Reserve will maintain a prolonged pause on interest rate adjustments, which could limit the dollar's downward potential.

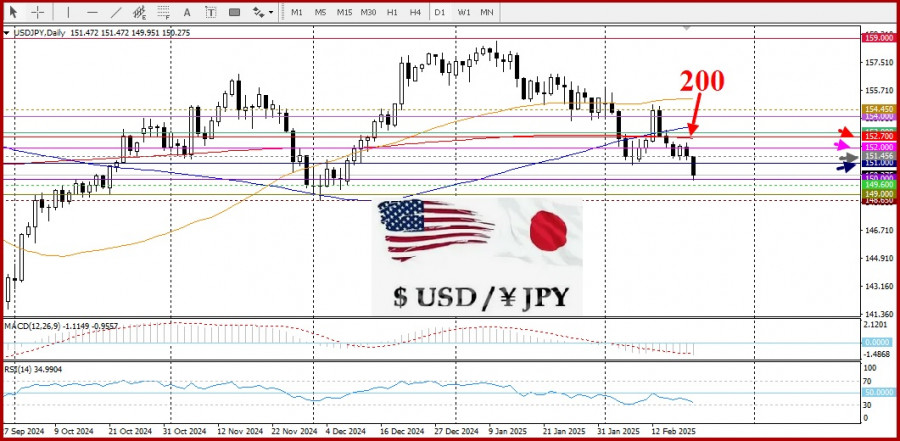

Technical Outlook for USD/JPY

A firm break below the 151.00 level acted as a trigger for bearish momentum in the pair. Oscillators on the daily chart remain in deeply negative territory, signaling that the downtrend is likely to persist. However, before initiating new short positions, traders should wait for a decisive break below the key psychological level of 150.00. A move below this threshold could accelerate the decline towards the 149.60–149.55 support zone, followed by a drop to 149.00 and potentially the December 2024 low at 148.65.

On the other hand, any significant recovery attempts may encounter resistance around the 150.90–151.00 zone. A break above this range could trigger short-covering, driving USD/JPY towards 151.45, followed by the 152.00 psychological barrier. However, any further gains may be seen as selling opportunities around the 200-day simple moving average (SMA), currently near 152.70. A break above 152.70 would shift the short-term bias in favor of the bulls.

SZYBKIE LINKI