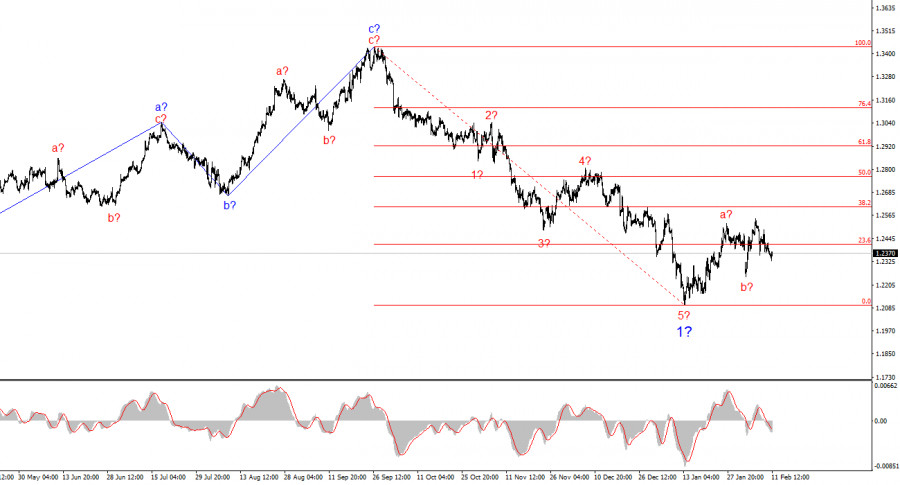

The wave structure of GBP/USD remains somewhat ambiguous but generally understandable. There is a high probability that a long-term bearish trend segment is still forming. However, the assumed Wave 2 in 1 appears weak, making the overall structure uncertain. Conversely, Wave 5 is well-formed, suggesting that the senior Wave 1 has been completed.

If this assumption is correct, we are now in a corrective phase, targeting the 1.2800 level. The first two waves of this corrective structure appear to be completed. Given that the euro is also undergoing a correction, I expect similar price action for the pound.

The Bank of England (BoE) is preparing for four rounds of monetary easing in 2025. The Fed does not plan rate cuts beyond 50 basis points. The UK economy continues to underperform, weakening investor confidence in GBP. The U.S. economy remains resilient, supporting USD strength. These factors suggest that traders are unlikely to engage in aggressive GBP buying while reducing USD positions.

GBP/USD remained unchanged on Tuesday, with minimal price movement over the past two days. Monday lacked significant global events, and Tuesday has yet to deliver any surprises. BoE Governor Andrew Bailey is set to speak soon, but the market may be overestimating the impact of this event.

The BoE's last policy meeting was less than a week ago. No major economic data has been released in the UK since then. Bailey previously highlighted slowing growth and the absence of urgency for further rate cuts. What are the chances that Bailey's stance has changed in just a few days? Very low. Bailey is not known for dramatic policy shifts or frequent speeches. His comments today are unlikely to change market sentiment. A bigger market mover could be Jerome Powell's speech—but even that comes with uncertainty.

Powell Does Not Answer to Congress

Neither the Fed nor Powell himself is obligated to Congress. While Congress members can ask Powell any questions, he is not required to provide direct answers. Trump failed to pressure the Fed in his first term, and Powell remains independent in policy decisions. As a result, Powell is unlikely to create problems for the U.S. dollar.

Wave structure confirms that the bearish trend is continuing, with the first wave completed. Traders should wait for a convincing corrective wave before seeking new short positions. Minimal corrective targets - 1.2600. More optimistic correction targets - 1.2800. The assumed Wave b in 2 is complete. GBP and EUR wave structures are similar but not identical.

At the larger wave structure, the previous upward three-wave correction has likely ended. If this assumption is correct, the market should prepare for corrective Wave 2 or b, followed by an impulse wave 3 or c (resuming the downtrend).

Key Trading Principles from My Analysis

1) Wave structures should be simple and clear. Complex formations are difficult to trade and are more prone to structural changes.

2) If the market outlook is uncertain, it is best to stay out.

3) There is never 100% certainty in market direction. Always use Stop Loss orders for risk management.

4) Wave analysis should be combined with other trading strategies. Integrating multiple forms of analysis improves overall accuracy.

SZYBKIE LINKI