The EUR/USD pair continued its gradual decline on Friday. We have consistently pointed out that the euro has no reasons to rise, and this remains true. Our scenario and forecast are continuing to unfold as expected. So, what has changed over the past week? The fundamental and macroeconomic conditions for the euro have only worsened. It's important to note that the Federal Reserve has no plans to lower the key interest rate before summer and may only consider one reduction throughout all of 2025.

Just a week ago, the market was anticipating two rate cuts; however, the realistic scenario now seems to involve only one. The issue at hand is that inflation in the U.S. is on the rise, and with Donald Trump yet to be inaugurated, there are no plans in place to implement his proposals aimed at restoring "fairness" in global trade. As a result, in the early months of Trump's new administration, trade tariffs are likely, even if they aren't severe. This could lead to a further increase in global inflation, prompting the Fed to adopt a more hawkish stance. All of these factors favor the U.S. dollar.

The European Central Bank (ECB) indicated last week that it is open to continuing to ease monetary policy, with the possibility of lowering the interest rate to a "neutral" level of 2% by summer. It is possible that the rate could fall even further below this level. Informal discussions about more substantial rate cuts have already occurred, and as the saying goes, "where there's smoke, there's fire." This approach by the ECB is in stark contrast to the stance of the Fed. Despite rising inflation in the Eurozone, members of the ECB's monetary policy committee have expressed confidence in their ability to "defeat" high inflation rates by summer. The ECB appears optimistic, or nearly so, that inflation will soon stabilize at around 2% and remain there for several years. If this expectation holds true, there may be no need to keep interest rates high.

In our opinion, the real issue is not inflation but the state of the EU economy. The Eurozone economy has essentially stagnated for the past two years, which should prompt the ECB to focus on stimulating growth rather than worrying about inflation. We have previously stated that an inflation rate of 2.4%—instead of the target 2%—would not be a significant problem. The ECB struggled for years to raise inflation to 2%, yet during that time, the Eurozone economy managed to grow. Now, however, with no economic growth and a consistent decline in industrial production, the ECB should prioritize addressing these challenges. As a result, the ECB is likely to continue its easing policies, while the Fed will likely not make similar moves since the U.S. economy does not face any significant issues.

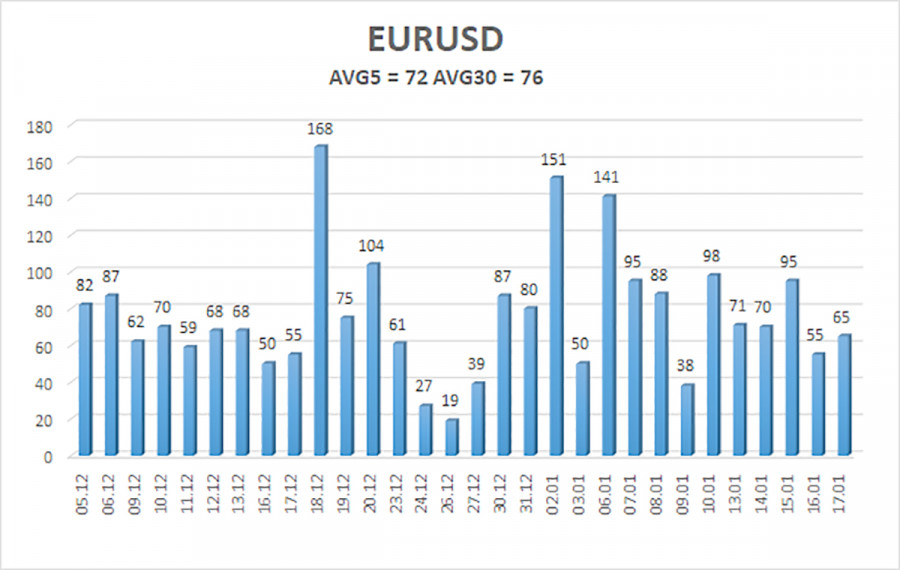

The average volatility of the EUR/USD currency pair over the last five trading days, as of January 20, is 72 pips, which is categorized as "average." We anticipate that the pair will move between the levels of 1.0199 and 1.0343 on Monday. The higher linear regression channel is directed downward, indicating the continuation of the global bearish trend. Recently, the CCI indicator entered the oversold zone twice, forming two bullish divergences. However, these signals again suggest only a correction, which may already be complete.

It is likely that the EUR/USD pair will continue its downward trend. For months, we have consistently predicted a decline in the euro over the medium term. We fully support the overall bearish direction and believe it is far from complete. The Fed has paused its monetary policy easing, while the ECB is accelerating its easing. As a result, the dollar currently has no medium-term reasons to decline, apart from purely technical corrections.

Short positions remain relevant, with targets at 1.0199 and 1.0193. If you trade based purely on technical signals, long positions can be considered when the price is above the moving average, targeting 1.0437. However, any growth at this point is classified as a correction.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

SZYBKIE LINKI