Today, the Japanese yen attempts to attract new sellers following reports that the Bank of Japan, during its upcoming meeting next week, will maintain interest rates at current levels.

Investors remain skeptical about the Bank of Japan's intention to further tighten its monetary policy, limiting yen purchases. Meanwhile, rising U.S. Treasury yields, supported by expectations that the Federal Reserve will adopt a cautious stance on rate cuts, are driving funds away from the Far Eastern currency.

Additionally, the generally positive sentiment in equity markets is another factor undermining the safe-haven Japanese yen. However, yen bears are also hesitant to open new positions, awaiting the pivotal monetary policy meeting of the Bank of Japan next week. Coupled with today's moderate dollar weakness, this has prevented the USD/JPY pair from staging a notable intraday rebound.

Traders should focus on the U.S. Producer Price Index (PPI) and the weekly Initial Jobless Claims to identify potential trading opportunities.

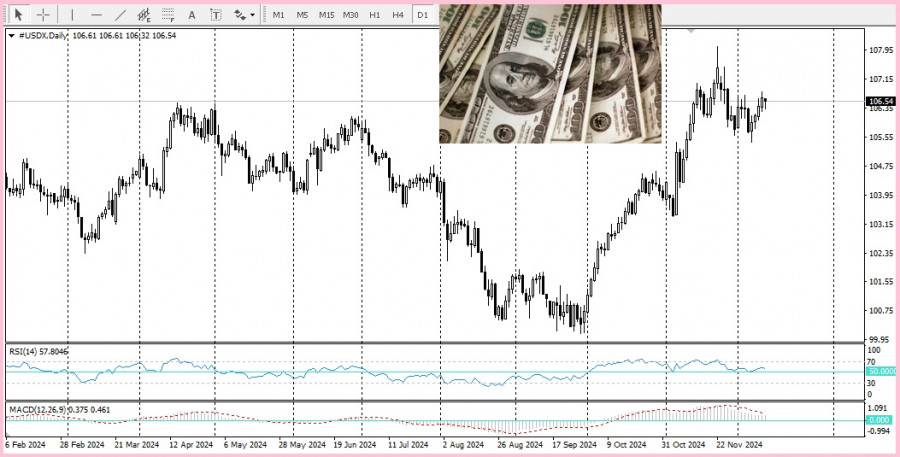

The breakout through the 200-day Simple Moving Average (SMA) near the round figure of 152.00 has been perceived as a bullish trigger.

However, daily chart oscillators present mixed signals, reflecting caution among both bulls and bears. The Relative Strength Index (RSI), though, is leaning towards a more positive outlook, suggesting that the path of least resistance may favor the bulls.

In summary, the USD/JPY pair remains in a cautious stance as traders await decisive signals from upcoming data and central bank meetings. While technical indicators favor the bulls, downward risks persist, especially below the critical 152.00 threshold.

SZYBKIE LINKI