Německé akcie se po uzavření středečního obchodování snížily, když ztráty v sektorech stavebnictví, softwaru a technologií vedly k poklesu akcií.

V závěru obchodování ve Frankfurtu ztratil index DAX 0,18 %, index MDAX 0,06 % a index TecDAX 0,30 %.

V rámci indexu DAX si nejlépe vedla společnost Vonovia SE (ETR:VNAn), která vzrostla o 2,93 %, resp. 0,89 bodu, a v závěru se obchodovala na úrovni 31,22 bodu. Mezitím společnost Henkel & Co KGaA AG Pref (ETR:HNKG_p) přidala 2,45 %, resp. 1,94 bodu, a skončila na 81,06 bodu a společnost Brenntag AG (ETR:BNRGn) v závěru obchodování vzrostla o 2,14 %, resp. 1,30 bodu, na 62,04 bodu.

Nejhůře si během seance vedla společnost Zalando SE (ETR:ZALG), která klesla o 2,05 % neboli 0,60 bodu a v závěru obchodování se obchodovala na úrovni 28,65 bodu. Společnost MTU Aero Engines NA O.N. (ETR:MTXGn) klesla o 1,58 % neboli 5,00 bodu a uzavřela na 311,80 bodu a Infineon Technologies AG NA O.N. (ETR:IFXGn) se propadla o 1,41 % neboli 0,43 bodu na 30,06 bodu.

The market takes everything into account. However, there comes a time when many factors are already reflected in the quotes of a particular pair. In November, U.S. Treasury bonds posted their best performance in decades, resulting in a significant drop in yields. Global stock indices grew at the fastest pace in three years. All this indicates an improvement in global risk appetite and creates a tailwind for GBP/USD or, to be precise—created. Is it time to say that the pound needs a new driver to continue the rally?

Alongside the growing risk appetite, an important advantage for the pound is the Bank of England's sluggishness. The short-term market expects a repo rate cut of only 75 basis points by 2025. According to investor forecasts, the monetary expansion process will start in August. For the Federal Reserve and the ECB, a different scenario is in place. Both central banks will cut their key interest rates by 125 basis points and start in March-April. As a result, due to the divergence in monetary policy, the pound looks better against both the U.S. dollar and the euro.

The reasons for the Bank of England's slowness can be found in higher wage growth in Britain than in other developed countries. Brexit has become a barrier to cheap labor, and the English will not work for pennies. According to recent surveys, 47.4% of wage workers are optimistic about their prospects in the next five years. At the same time, 58.4% of respondents predict a recession.

Dynamics of Inflation and Average Wages in the UK

A robust labor market is a restraining factor for the Bank of England's monetary expansion. According to Andrew Bailey, the central bank will do everything possible to return inflation to the 2% target, but any discussions about lowering the repo rate at this stage are inappropriate. New Monetary Policy Committee member Megan Greene echoes him. In her opinion, borrowing costs should remain at a plateau for a long period, as the risks of inflation returning are currently higher than fears of a recession.

Indeed, the final reading showed that business activity in the manufacturing sector grew from 44.8 to 47.2 in November, higher than the initial estimate. Despite the indicator remaining below the critical 50-mark for the 16th consecutive month, Britain has so far managed to avoid a downturn. Will it succeed in the near future? The story of a soft landing will be excellent news for GBP/USD.

Thus, the Bank of England's deliberateness plays into the hands of the pound, but some deterioration in global risk appetite due to expectations of strong U.S. labor market statistics for November may lead to a correction in the analyzed pair.

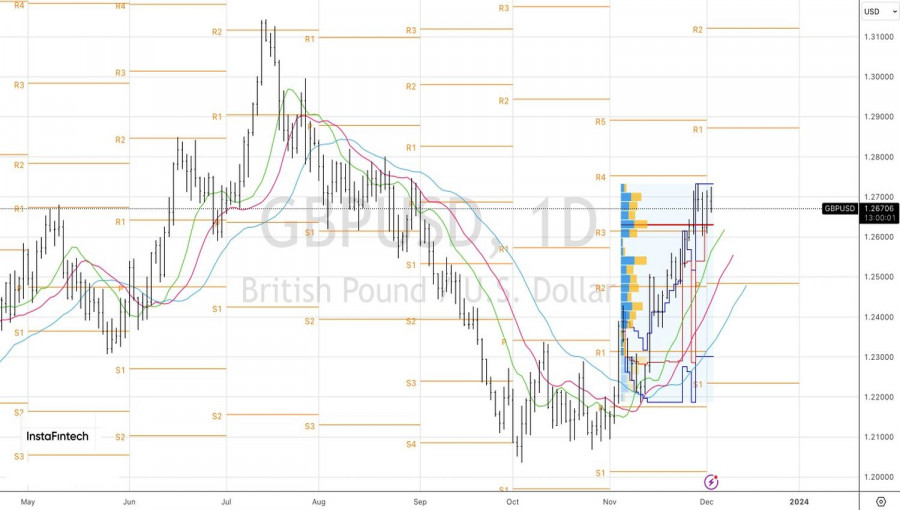

Technically, on the GBP/USD daily chart, the inability of the bulls to establish themselves above 1.27 became the first sign of their weakness. In the future, the dynamics of the pound will depend on whether the bears can storm the support at 1.2615-1.2630. A rebound will allow for long positions with a target at 1.29. Conversely, a breakdown will increase the risks of a pullback.

SZYBKIE LINKI