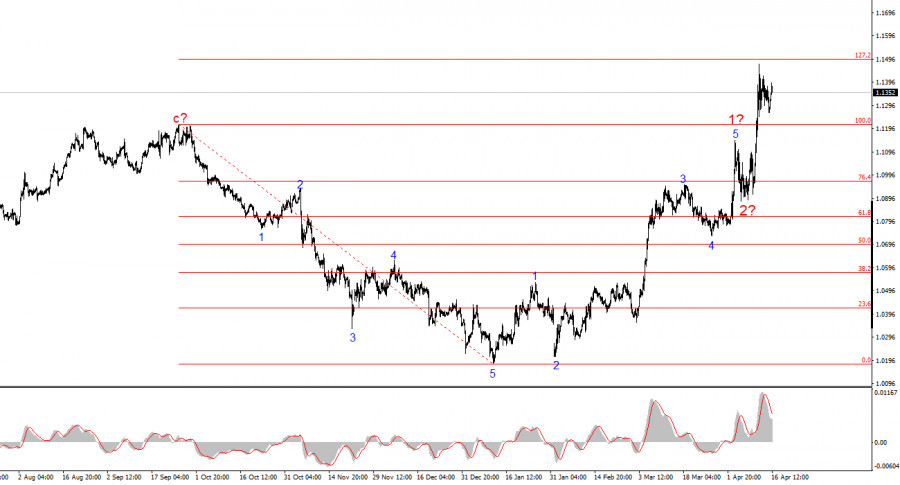

The wave structure on the 4-hour chart for the EUR/USD pair has shifted into a bullish formation. I think there's little doubt that this transformation was caused solely by the new U.S. trade policy. Until February 28 — when a sharp decline in the U.S. dollar began — the entire wave pattern looked like a solid downward trend. A corrective wave 2 was being formed. However, Trump's weekly announcements of various tariffs have had their effect. Demand for the U.S. dollar began to plummet, and the entire trend segment that started on January 13 has now taken on a five-wave impulsive shape.

Moreover, the market didn't even manage to form a convincing wave 2 within the new bullish trend. We only saw a minor pullback that was smaller in size than the corrective waves inside wave 1. However, the U.S. dollar could continue to decline — unless Donald Trump reverses his adopted trade policy. We've already seen how news flow can alter the wave structure, and it can happen again.

The EUR/USD pair gained a few dozen points on Wednesday, but we haven't seen strong price moves in recent days. The market has essentially frozen, showing little to no reaction to economic data, even though it continues to trickle in. For example, today the final March consumer price index (CPI) for the Eurozone was released. It confirmed that inflation slowed to 2.2%, as previously estimated. Therefore, there's no reason to expect the ECB to pause on Thursday.

As a reminder, the ECB will hold its third meeting of the year this Thursday, and there's a 90% chance that interest rates will be cut again. The European regulator has plenty of justification for doing so. The economy remains weak and could suffer further due to the trade war with the U.S. Inflation has already dropped to 2.2%, so there's little point in keeping rates in restrictive territory. In other words, the stars are aligning for further easing.

However, unlike before, I no longer expect the euro to fall with confidence. Over the past 2–3 months, the market has only been reacting to news about trade escalation between the U.S. and the rest of the world. Therefore, only such developments can now drive market movement up or down. Since there is currently no new news, the market remains in a state of waiting. Still, Trump could raise tariffs on China or introduce new broad tariffs on certain product categories this week. Thus, continued growth in the pair remains the primary working scenario.

Based on the analysis of EUR/USD, I conclude that the pair continues to build a new bullish trend segment. Donald Trump's actions have reversed the previous downtrend. Therefore, the wave structure will remain entirely dependent on the U.S. president's position and actions in the near future — something that must constantly be kept in mind. Based purely on wave structure, I had expected the formation of a three-wave correction within wave 2. However, wave 2 has already ended, having taken a single-wave form. As a result, wave 3 of the upward segment is now underway. Its targets could extend all the way to the 1.25 level, but reaching them will depend solely on Trump.

At a higher wave scale, the wave pattern has turned bullish. We are likely to see a long-term upward wave sequence. However, news flow — especially from Donald Trump himself — can still turn the situation upside down at any moment.

Core Principles of My Analysis:

فوری رابطے