The UK has announced tax hikes and spending cuts to help fight inflation. What is the pound more afraid of: Jeremy Hunt's budget effect or the advancing dollar?

The exchange rate fell after the UK government announced new tax increases and spending cuts. All of this, economists warn, could lead to a further slowdown in an already weakening economy.

In an autumn statement, it was announced that the UK dividend payout would be cut from £2,000 to £1,000 next year and then to £500 from April 2024.

This means that by 2025, anyone who receives dividends above this amount will be taxed on them at a rate based on how much other income they receive.

The annual capital gains tax exemption will be reduced from £12,300 to £6,000 in 2023 and then to £3,000 from April 2024.

"Entrepreneurs are punished with increased taxes on both capital gains and dividends. Those who have invested diligently over the long term to increase their financial strength will no doubt feel unfairly left out by this profit grab," commented analysts at Hargreaves Lansdown.

British Chancellor Jeremy Hunt has said the government is introducing measures to fill a £55bn financial black hole in the coming years.

The measures included a series of tax increases as well as spending cuts.

"There is a risk that the government may still end up with less taxes because investors accumulate assets. Changing capital gains tax credits will only penalize a minority of taxpayers, but still bring in significant amounts to the treasury, which is why such measures were taken," analysts say.

The main theses were:

Rent increases for public housing will be capped at a maximum of 7%.

The minimum wage will rise by 9.7%.

Benefits will rise in line with inflation.

The increase in benefits will cost £11bn.

The announcements appear to have calmed the markets a bit, despite a number of policy moves that may prove unpopular. One thing is clear: the economic background remains negative, at least in the short term. The economy is in recession and various new policies could affect revenues across the board.

Chancellor Jeremy Hunt sought to restore market confidence in the British government after the volatility experienced during his predecessor's government in September. It was important for the pound.

Hunt seems to have succeeded, convincing the markets that he has a sound plan. Gold bond yields are stable near their lowest levels since September 20th, which means they remain close to where they were before the ill-fated Liz Truss budget.

In general, there were few surprises. Almost everything was included in the value of the pound.

So, the confidence of the markets has been restored, but what to do with the complex fundamental picture and the specter of a recession?

The long-term outlook for the UK economy, and therefore the pound, looks bleak as the government raises taxes and cuts spending. Downturn ahead, years of "austerity and weak investment. High double deficit that needs funding. The housing market is on the edge of a knife," economists comment.

The recession could last just over a year, starting in the third quarter of 2022. GDP growth is projected at 4.2% in 2022, -1.4% in 2023, +1.3% in 2024, +2.6% in 2025, and +2.7% in 2026.

The unemployment rate is expected to rise from 3.5% to a peak of 4.9% in the third quarter of 2024.

Forecasts inflation growth of 7.4% in 2023. Price growth data shows that it is necessary to continue the fight for its reduction, including important commitments to restore public finances, Hunt concluded.

The new British government is showing concern, working to restore confidence in the budget. Against this background, the pound has stabilized, but economic issues do not give rest and will not give it in the near future.

"From the point of view of economic growth, it is difficult to rejoice at the prospects for sterling. We believe this is especially true for its crosses, as we expect the fate of the pound against the US dollar to be more determined by the direction of the dollar," wrote SocGen analysts.

"Selling the pound on a rally against the euro and the Australian dollar as the UK economy slows and politicians try to find a coherent vision for the UK's economic future could prove to be a profitable strategy in the coming months," they said.

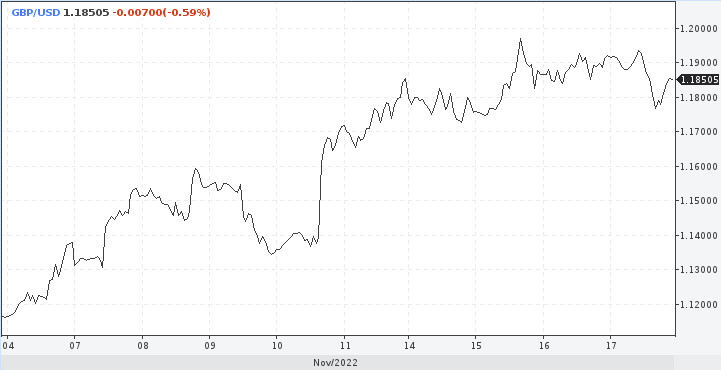

As for the GBP/USD pair, it has moved into a consolidation phase near 1.1900. It is possible that the quote will continue to rise to the target levels near 1.2070, then to the resistance area of 1.2250-1.2300.

Many authoritative analytical agencies believe that the dollar rollback has come to its logical conclusion. In the short term, the adjustment of long positions on the US currency index may be delayed a little more. However, the 105.00 area confirms the presence of a base in the fourth quarter of this year.

The dollar is trading in consolidation mode. In the short term, its positions will depend on a number of speeches by FOMC politicians. ING economists vote for further dollar consolidation.

The markets are laying on a 50 bps rate hike in December. Any further mention of this will not necessarily require a significant weakening of the dollar.

فوری رابطے