Hongkong (Reuters) – Čínská státní rada v neděli představila takzvaný „zvláštní akční plán“ na podporu domácí spotřeby, který zahrnuje opatření včetně zvýšení příjmů obyvatel a zavedení systému dotací na péči o děti.

Plán přichází v době, kdy úroveň spotřebitelské poptávky v Číně utrpěla v posledních letech různé potíže v důsledku faktorů, jako je narušení COVID-19 a dlouhodobý pokles trhu s nemovitostmi, což ochladilo sklon domácností utrácet a přispělo k deflačním trendům.

Plán byl vydán pro všechny regiony a resorty s cílem „energicky zvýšit spotřebu, rozšířit domácí poptávku ve všech směrech, zlepšit kapacitu spotřeby zvýšením příjmů a snížením zátěže“, uvádí se ve zprávě Rady.

Plán přichází týden po pracovní zprávě čínského premiéra Li Kianga pro Národní lidové shromáždění, která se zaměřila na zvýšení výdajů domácností s cílem zmírnit dopad slabé zahraniční poptávky.

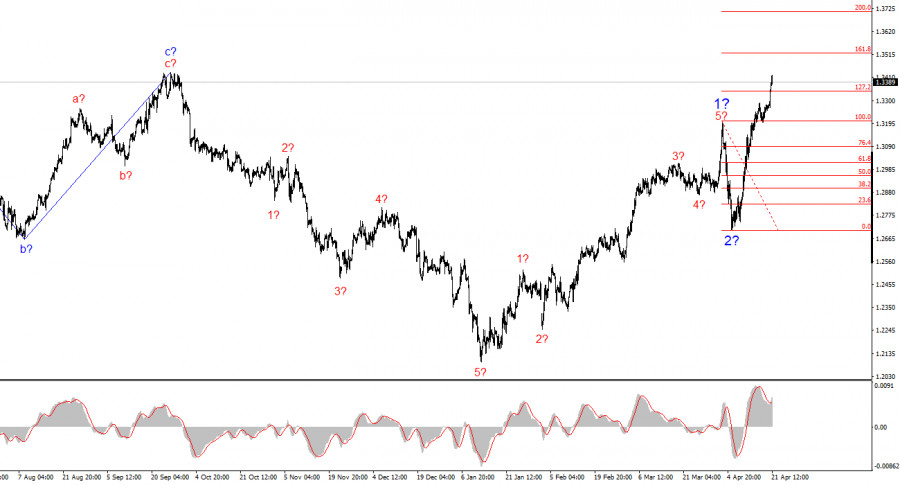

The wave structure for GBP/USD has also transformed into a bullish, impulsive formation—"thanks" to Donald Trump. The wave picture is nearly identical to that of EUR/USD. Up until February 28, we were observing the formation of a convincing corrective structure that caused no concern. However, demand for the U.S. dollar then began to plummet. As a result, a five-wave upward structure formed. Wave 2 took the shape of a single wave and is now complete. Consequently, we should expect strong upward movement from the pound within Wave 3, which has already been ongoing for more than a week.

Considering that recent news out of the UK has had no effect on the pound's sharp rise, one can conclude that Donald Trump alone is steering currency markets. If (theoretically) his trade policy direction changes, the trend could reverse—this time to the downside. Therefore, over the coming months (or even years), all actions from the White House should be closely monitored.

The GBP/USD pair rose by 120 basis points on Monday—another strong daily move. In the past nine trading days alone, the U.S. dollar has lost over 6 cents in value. And notably, during this time Trump hasn't introduced any new tariffs; he merely increased existing ones, and only against China. Moreover, he announced a 90-day grace period for all countries on his tariff list to allow time for negotiations. This was a step toward de-escalation, yet the market didn't believe him. And despite Trump's repeated claims of "lines forming at the White House," no such lines are visible.

Of course, negotiations with many countries are ongoing, but China isn't among them. As for the European Union, the situation remains murky. Few official statements have been made by EU leadership. Meanwhile, Washington continues to exaggerate its diplomatic achievements and make claims that don't reflect reality. EU officials have hinted that certain consultations are taking place, but there are no concrete details or interim results. For this reason, the market remains unimpressed by the "grace period" during which tariffs are still in effect—just at slightly lower rates than Trump originally intended.

Trump continues to position himself as a peacemaker offering the world a chance to sign trade deals with the U.S. What he doesn't say is that no real negotiations are happening. What exists is a list of Trump's ultimatums, and each country can either comply or face tariffs. To say this policy is unappealing to traders and investors is an understatement.

The wave pattern for GBP/USD has shifted. We are now dealing with a bullish, impulsive trend. Unfortunately, under Donald Trump, the markets are likely to face many more shocks and reversals that may not align with wave patterns or any form of technical analysis. The assumed Wave 2 is complete, as the price has broken above the peak of Wave 1. Therefore, we can expect the development of Wave 3, with near-term targets at 1.3345 and 1.3541, provided Trump's trade policy doesn't make a 180-degree turn—which currently seems unlikely.

On a higher time frame, the wave pattern has also transitioned into a bullish trend. Medium-term targets include 1.2782 and 1.2650.

Core Principles of My Analysis:

PAUTAN SEGERA