The EUR/USD pair experienced a minor correction on Tuesday; however, it remains weak and shows no signs of an end to the downtrend. This week, the price tested the 1.0200 level, which we identified as a target within the 1.00–1.02 range. While this target has been reached, there is no noticeable market interest in buying the euro. This lack of interest is not surprising, as we predicted throughout 2024 that the euro would decline. In fact, we specifically indicated a date—September 18—as a potential turning point for this decline.

Currently, the U.S. dollar continues to strengthen, prompting the market to search for reasons behind this trend. In our view, the explanation is quite straightforward. The market initially spent two years anticipating an easing of the Federal Reserve's monetary policy. However, it then became clear that the Fed might not even implement half of the expected rate cuts. Following this, Donald Trump's election victory reignited concerns about high inflation. Additionally, the Fed's outlook for 2025 suggests, at best, only two rate cuts of 0.25%. As a result, all key global factors continue to support the U.S. dollar.

Given the current situation, it is reasonable to expect that the euro may continue to decline. However, we are cautiously monitoring January 20, the date of Donald Trump's inauguration. It is possible that the recent rally of the dollar has been partly driven by anticipatory market moves. The market is expecting higher inflation under Trump, which would likely result in a much slower pace of rate cuts by the Fed. After January 20, these expectations will probably have been priced in, potentially leading to a reversal.

As of now, there are no signs that such a reversal has begun. Today, the market will also assess the U.S. inflation report, which will provide clarity on the Fed's potential actions in 2025. While the CCI indicator has consistently issued buy signals, these merely suggest possible corrections at most. Therefore, there is still no clear catalyst for euro growth. If today's inflation report shows higher-than-expected figures, the dollar could weaken. However, for the EUR/USD pair to suggest that the three-month downtrend is nearing an end, it would need to rise to at least the Murray "3/8" level of 1.0437. This achievement is not straightforward, given the ongoing selling pressure on the pair.

On the daily timeframe, an upward correction appears imminent, but merely appearing imminent is not enough. It could remain in this state for weeks. The market has already accepted that the Fed will not lower rates in January, so this factor can be considered priced in. As before, any consolidation above the moving average will signal a potential trend reversal.

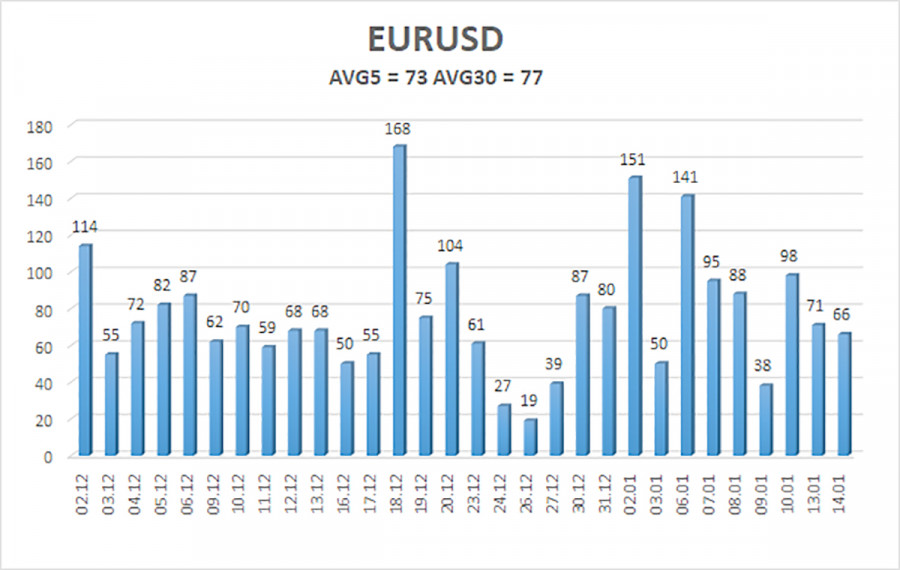

Over the last five trading days, as of January 15, the average volatility of the EUR/USD currency pair has been 73 pips, which is classified as "average." We anticipate that the pair will fluctuate between the levels of 1.0218 and 1.0364 on Wednesday. The higher linear regression channel continues to trend downward, indicating that the overall downtrend persists. The CCI indicator has recently dipped into the oversold zone twice, forming two bullish divergences. However, these signals once again suggest only a correction.

The EUR/USD pair is likely to continue its downtrend. For several months, we have anticipated a decline in the euro in the medium term, and we firmly support this overall bearish outlook, as we believe the trend is far from over. It is significant that the market has likely already factored in all potential rate cuts by the Fed. As a result, the U.S. dollar lacks fundamental reasons for a medium-term decline, aside from potential technical corrections.

Short positions remain relevant, targeting 1.0218 and 1.0193, as long as the price stays below the moving average. If you focus solely on technical analysis, consider long positions if the price rises above the moving average, with a target of 1.0437. However, any upward movement should be viewed as a correction at this time.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

PAUTAN SEGERA