The EUR/USD pair is showing intriguing behavior, especially given the current economic conditions—dropping to a weekly low during the Asian session before recovering later.

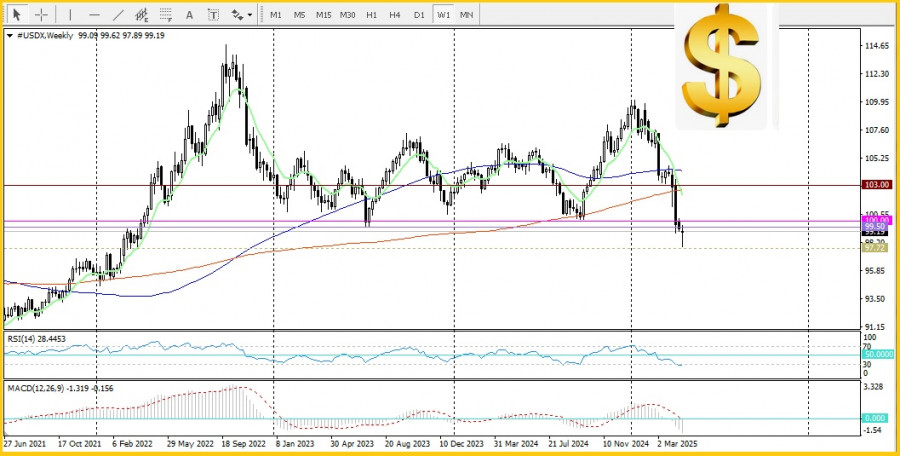

The primary factor weighing on EUR/USD is the U.S. dollar rebounding from a three-year low. Despite weakening confidence in the U.S. economy and expectations of more aggressive monetary easing by the Federal Reserve, the dollar is still holding its ground, exerting pressure on the pair. However, these same factors also limit the dollar's growth potential, helping to cap EUR/USD losses. From a technical standpoint, EUR/USD has shown resilience below the psychological level of 1.1300. Additionally, a bullish MACD divergence and the Relative Strength Index (RSI) exiting the overbought zone on the daily chart support the bulls. Therefore, it would be prudent to wait for a confirmed and sustained break below the 1.1300 level before concluding that the pair has topped around the 1.1575 area—levels last seen in November 2021. Such a break would pave the way toward the next targets around 1.1250 and the key psychological level of 1.1200.

From a technical standpoint, EUR/USD has shown resilience below the psychological level of 1.1300. Additionally, a bullish MACD divergence and the Relative Strength Index (RSI) exiting the overbought zone on the daily chart support the bulls. Therefore, it would be prudent to wait for a confirmed and sustained break below the 1.1300 level before concluding that the pair has topped around the 1.1575 area—levels last seen in November 2021. Such a break would pave the way toward the next targets around 1.1250 and the key psychological level of 1.1200.

On the other hand, if the pair manages to break above and hold above the 1.1400 level, this would open the path toward higher targets, including 1.1500 on the way to retesting the monthly high around 1.1575—and potentially even 1.1600.

QUICK LINKS