No macroeconomic events are scheduled for Monday. Last week, both the euro and the pound experienced significant growth, despite the absence of a strong macroeconomic or fundamental backdrop. While there were some positive reports for both currencies, there were also factors supporting dollar strength. Nonetheless, throughout the week, only the euro and the pound showed upward movement. Both currency pairs are maintaining an upward trend, as reflected in their respective trendlines.

On Monday, the notable fundamental events include a speech by Bundesbank President Joachim Nagel, along with remarks from Federal Reserve representatives Patrick Harker, Michelle Bowman, and Jonathan Waller. However, none of these speeches are anticipated to be particularly impactful. Last week, the market largely overlooked Chair Jerome Powell's more critical statements, suggesting that whatever the Fed policymakers say today is unlikely to sway market sentiment. Nagel's speech is expected to address Trump's tariff policies and the EU's necessary response. The monetary policy positions of both the European Central Bank (ECB) and the Fed are already well understood, so it is improbable that either central bank will introduce any new or significant information to the market at this time.

On the first trading day of the new week, market movements may be quite weak. Current market conditions remain volatile and erratic, so we should not expect logical price action. After five consecutive days of appreciation for the euro and pound, we may see a decline beginning today. Corrections in the market are typically complex structures that involve frequent pullbacks and internal retracements. It's unlikely that volatility will be high on Monday.

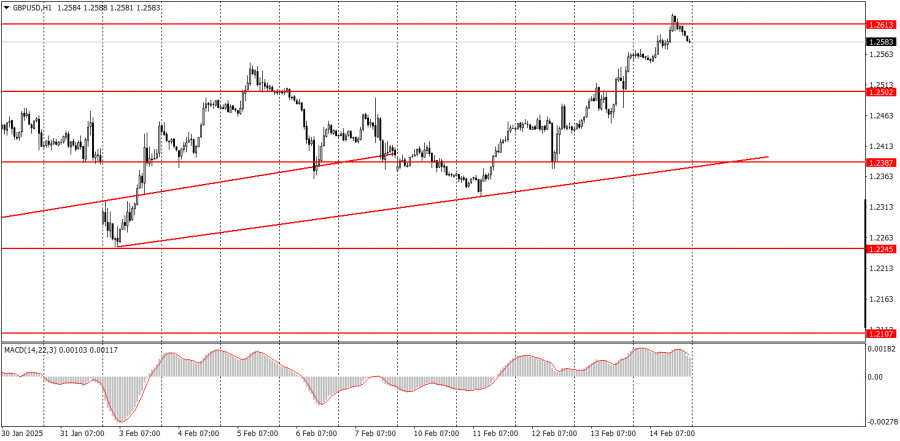

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

QUICK LINKS