The test of the 1.0245 level in the second half of the day coincided with the MACD indicator moving significantly below the zero line, which limited the pair's downside potential. For this reason, I chose not to sell the euro. Shortly after, the 1.0245 level was tested again when the MACD was in the oversold area, leading to the realization of Scenario #2 for buying the euro, resulting in a rise of more than 50 pips.

Traders are concentrating on possible changes in U.S. trade policy. The lack of clear statements from Trump regarding the gradual imposition of tariffs has created an atmosphere of uncertainty, which has strengthened the euro and weakened the dollar. Additionally, weaker-than-expected U.S. Producer Price Index (PPI) data has also undermined the dollar. Despite the overall volatility, the euro remains pressured by internal economic issues such as sluggish growth and low inflation. However, short-term factors related to trade policy may temporarily give the euro an advantage over the dollar. Traders are also awaiting comments from European Central Bank officials, which could lead to additional fluctuations in the exchange rate.

Today's reports include data on Italy's Consumer Price Index (CPI) and Germany's Wholesale Price Index, both of which are unlikely to provide significant support for euro buyers against the dollar. Italy's CPI will provide insight into consumer price trends and could indicate inflationary pressures. If the data exceeds expectations, it might increase pressure on the ECB to adjust its interest rate policies, indirectly supporting the euro. On the other hand, Germany's wholesale price index will shed light on supply and demand at the producer level. A decline in wholesale prices could signal slower economic growth, negatively impacting the euro. It's also important to note that the euro's value is influenced by U.S. economic policies, with actions from the Federal Reserve continuing to play a key role in currency movements.

For the intraday strategy, I will focus more on scenarios #1 and #2.

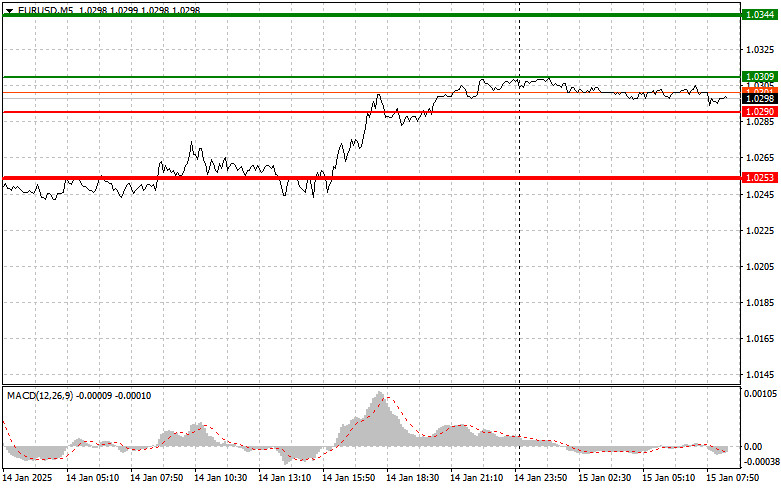

Scenario #1: Buy the euro upon reaching 1.0309 (green line on the chart) with a target of 1.0344. Exit the market at 1.0344 and open a short position, anticipating a 30-35 pip pullback from the entry point. Expect euro growth in the first half of the day only if supported by favorable data. Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: Consider buying the euro after two consecutive tests of the 1.0290 level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and could lead to an upward market reversal. Growth can be expected to opposing levels of 1.0309 and 1.0344.

Scenario #1: Sell the euro after it reaches 1.0290 (red line on the chart), targeting 1.0253. Exit the market at 1.0253 and immediately open a long position, anticipating a 20-25 pip pullback from the level. Downward pressure on the pair could return at any time. Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline.

Scenario #2: Consider selling the euro after two consecutive tests of the 1.0309 level when the MACD indicator is overbought. This will limit the pair's upward potential and could lead to a market reversal downward. A decline can be expected to opposing levels of 1.0290 and 1.0253.

QUICK LINKS