The test of the 1.0426 level occurred when the MACD indicator had just begun to move downward from the zero line, confirming the validity of the entry point. However, the pair declined by only 10 pips, and a larger sell-off did not materialize.

The euro showed a slight increase on Friday afternoon. Despite this positive momentum, the currency failed to consolidate at higher levels. Traders remain cautious at the end of the year, waiting for new data and benchmarks expected in 2025. Nevertheless, the low volatility in the forex market presents opportunities for more risk-tolerant investors. Speculators are trying to capture potential sharp market movements and benefit from price fluctuations. However, traders should exercise caution, as technical analysis becomes less reliable in such conditions, and there are few other indicators to rely on.

Today's release of Spain's Consumer Price Index is unlikely to draw much interest from traders, suggesting that it's better to anticipate sustained trading within the current horizontal channel.

Regarding intraday strategy, I will focus primarily on implementing Scenario #1 and Scenario #2.

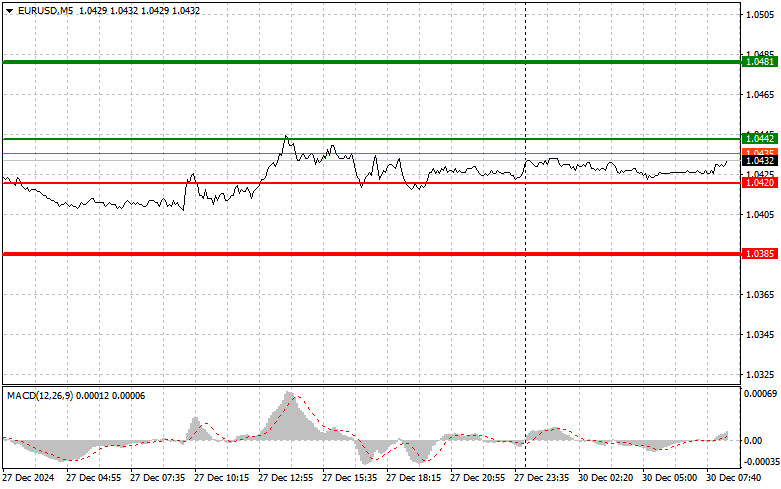

Scenario #1: Today, I plan to buy the euro when the price reaches 1.0442 (green line on the chart) with a target of 1.0481. At 1.0481, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. A strong upward movement of the euro in the first half of the day is unlikely. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the euro today if the price tests 1.0420 twice while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposing levels of 1.0442 and 1.0481 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.0420 (red line on the chart). The target will be 1.0385, where I plan to exit the market and immediately buy in the opposite direction, expecting a movement of 20-25 pips from this level. Pressure on the pair could return at any moment. Important: Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0442 twice while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposing levels of 1.0420 and 1.0385 can be expected.

QUICK LINKS