Throughout the past week, gold traded within a narrow range inside the daily Ichimoku cloud. The primary resistances limiting its movement were the weekly short-term trend at 2662.95 and the daily medium-term trend at 2662.83. Bullish players must surpass the weekly Tenkan level (2662.95) and neutralize the daily Ichimoku cross to extend the upward trend. The levels of the cross are currently at 2635.38, 2649.00, and 2675.60. Beyond that, it will be critical to exit the daily cloud at 2722.58. If the bulls overcome these resistances, their next objectives will include breaking the last significant high at 2789.61 and testing the critical psychological level of 2800.00.

Should the uncertainty of the past week resolve in favor of the bears, breaking into the bearish zone below the daily cloud (2630.50) will establish a downward target to breach the cloud. To achieve the daily target, bearish players must test and overcome weekly supports at 2598.24, 2537.92, and 2478.56, further reinforced by the monthly short-term trend at 2509.30.

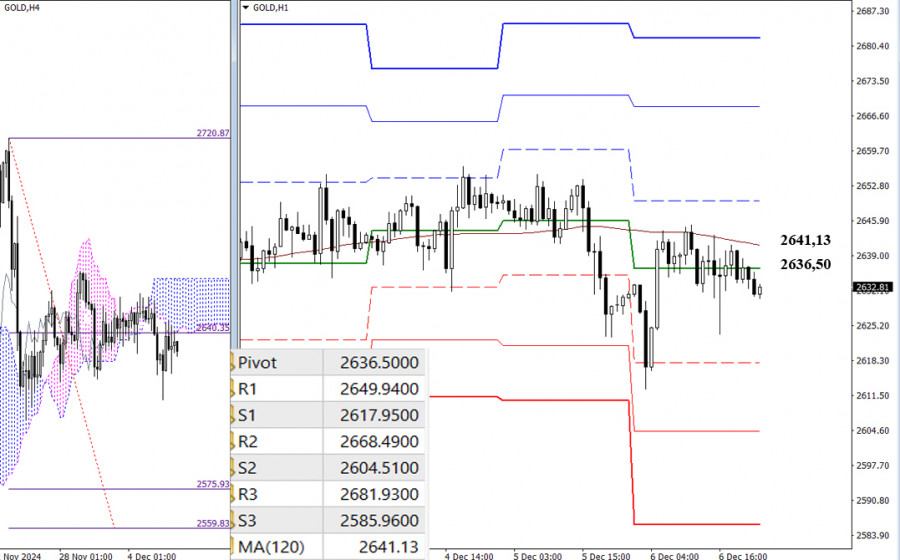

Uncertainty is also evident in the lower timeframes. The pair has been trading near the gravitational zone of key levels, which, on the last trading day of the week, were positioned at 2636.50 and 2641.13 (central Pivot level + weekly long-term trend).

If the current indecision ends with bearish activity, the downward targets will include the supports of the classic Pivot levels, complemented by the objective of breaking through the H4 cloud at 2575.93 – 2559.83. Conversely, if the bulls take the initiative, their intraday targets include classic Pivot levels. Additionally, solid consolidation in the bullish zone above the H4 cloud will establish an upward target to break the H4 cloud. The values of the classic Pivot levels are updated daily, with new data available at the start of trading.

***

QUICK LINKS